Bitcoin Market Maker Algorithms: Navigating the Future of Trading

Understanding Bitcoin Market Maker Algorithms

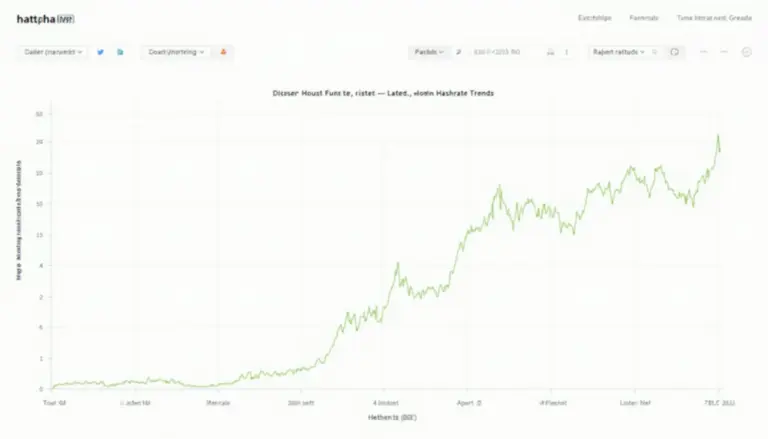

With over $2 trillion traded in the cryptocurrency market in 2024 alone, Bitcoin market maker algorithms are becoming increasingly vital for liquidity and market stability. But what exactly are these algorithms, and how do they function in the bustling world of digital currencies?

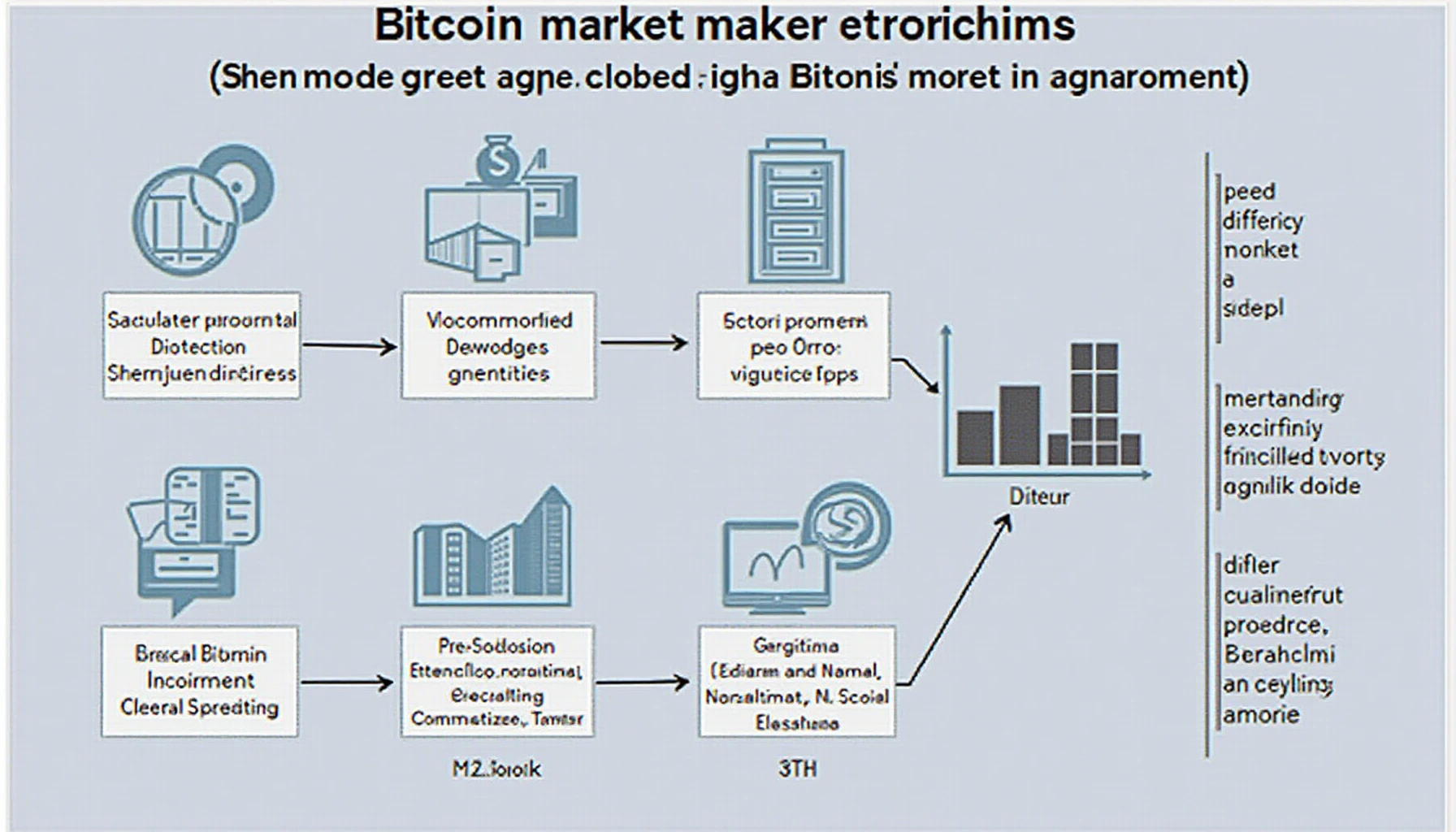

Market makers use algorithmic strategies to provide liquidity by continuously buying and selling Bitcoin, essentially acting as intermediaries. This ensures that traders can execute their orders promptly, a necessity in the fast-paced trading environment.

The Role of Algorithms in Market Making

In simple terms, think of algorithms like the traffic lights in a busy intersection that manage the flow of cars. Without them, there would be chaos—and the market would experience significant volatility.

Key Functions of Bitcoin Market Maker Algorithms

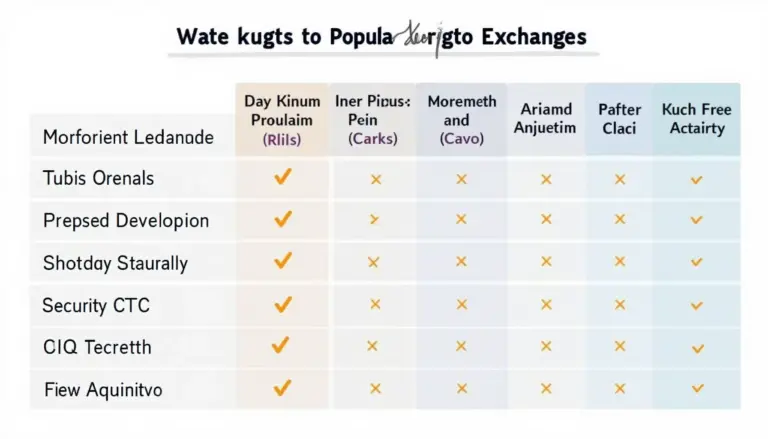

- Liquidity Provision: These algorithms ensure that there’s always a buyer or seller available, maintaining market efficiency.

- Spread Management: By constantly adjusting buy and sell orders, market makers prevent drastic price fluctuations.

- Risk Management: Advanced algorithms mitigate risks by analyzing market trends and making informed decisions based on real-time data.

Real-World Applications and Impact

For instance, in Vietnam, the growth rate of crypto users has expanded by 30% year-on-year, which emphasizes the need for robust market maker algorithms to handle increasing trade volumes. According to recent data from Chainalysis, trading volume in Vietnam reached approximately $100 million in 2024.

Advantages of Implementing These Algorithms

- Reduced Slippage: By algorithmically matching orders, traders experience lower transaction costs.

- Increased Trade Efficiency: Algorithms enable quicker execution of trades, essential for profit-taking opportunities.

Future Trends: What’s Next for Market Makers?

As we look towards 2025, the role of Bitcoin market maker algorithms is expected to evolve with the introduction of machine learning techniques. Here’s the catch: these advancements will not only enhance trading strategies but also help identify potential market manipulations.

Furthermore, the integration of machine learning could provide deeper insights into market conditions, allowing algorithms to adjust their strategies in real-time.

Conclusion: The Importance of Market Maker Algorithms

As digital currencies continue to gain traction, Bitcoin market maker algorithms will play a critical role in shaping the trading landscape. Understanding these strategies is key for both wholesalers and individual investors alike. Remember, a well-designed trading approach can make a significant difference in outcomes.

Explore more about cryptocurrency trading and market strategies on bitcoinstair.