Understanding HIBT Institutional Trading Patterns in 2025

Introduction

With over $4.1 billion lost to DeFi hacks in 2024, the need for understanding trading patterns in the crypto market is imperative. Institutional investors are shaping the landscape, and HIBT (High-Volume Institutional Buying and Trading) patterns are particularly noteworthy. This article aims to decode these patterns and their implications for the future of digital assets.

What Are HIBT Patterns?

HIBT patterns refer to the strategies employed by institutional investors who significantly influence market trends. Like a well-coordinated team in sports, these investors analyze market data and execute trades that can sway prices. Understanding these patterns is essential for anyone engaged in the cryptocurrency market.

Key Characteristics of HIBT Trading

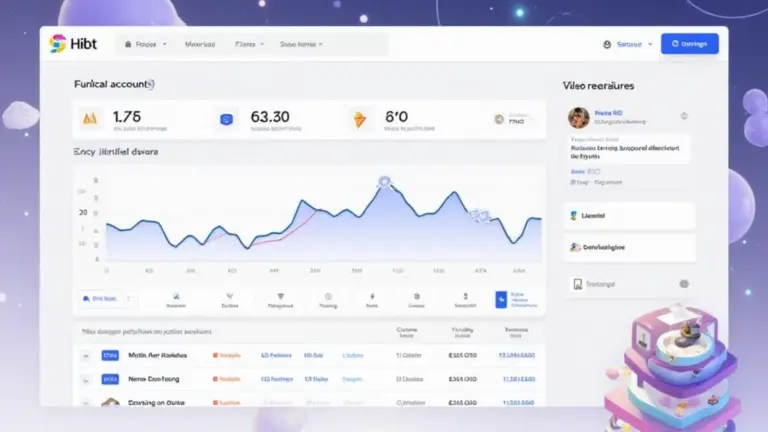

- Volume Surge: Institutional trading often leads to noticeable spikes in trading volumes, impacting liquidity.

- Tendency to Hold: Typically, institutions maintain their positions longer than retail investors, providing market stability.

- Data-Driven Decisions: Unlike individual traders, institutions rely heavily on data analytics, leading to informed decisions.

The Importance of HIBT in Vietnam’s Crypto Landscape

In Vietnam, the crypto market is witnessing a growth rate of over 70% annually, with institutions becoming increasingly involved. This development is vital as it leads to more robust market practices and the adoption of blockchain standards such as tiêu chuẩn an ninh blockchain.

Market Data Impact

According to a report by Statista, the Vietnamese crypto user base is expected to double by 2025. This growth will likely amplify HIBT patterns as investors leverage market fluctuations.

Recognizing HIBT Trading Signals

Being able to identify the signals for HIBT trading is crucial for both new and experienced investors. Here’s how:

- Price Movements: Sudden price shifts can suggest HIBT actions.

- Market Depth Analysis: High buy orders can indicate that an institutional player is entering the market.

- News Sentiment: Keep an eye on news that might trigger institutional interests.

Conclusion

As we look toward 2025, understanding HIBT institutional trading patterns will be essential for navigating the complexities of the crypto market. For traders and investors alike, staying informed about these dynamics can help in making strategic decisions. For further insights, download our comprehensive trading strategies checklist at HIBT.