HIBT DEX Order Book Algorithms Explained

How HIBT DEX Order Book Matching Works

With $12.8B in daily DEX volume in 2025, understanding order book algorithms like HIBT’s becomes critical. These systems determine trade execution speed and price accuracy – the lifeblood of decentralized exchanges.

The Engine Behind Crypto Trading

HIBT DEX uses three core matching algorithms:

- Price-Time Priority: Like a grocery checkout line, earlier orders at the same price execute first

- Pro-Rata Matching: Large orders get partial fills from multiple counterparties

- Hybrid Model: Combines both methods for optimal liquidity (used during Vietnam’s peak trading hours 8-10PM GMT+7)

Why Vietnam Traders Should Care

Vietnam’s crypto adoption grew 210% in 2024 (Chainalysis 2025). For traders using platforms like

| Algorithm | Speed | Best For |

|---|---|---|

| Price-Time | Fastest | Retail traders |

| Pro-Rata | Medium | Institutional orders |

| Hybrid | Balanced | High volatility periods |

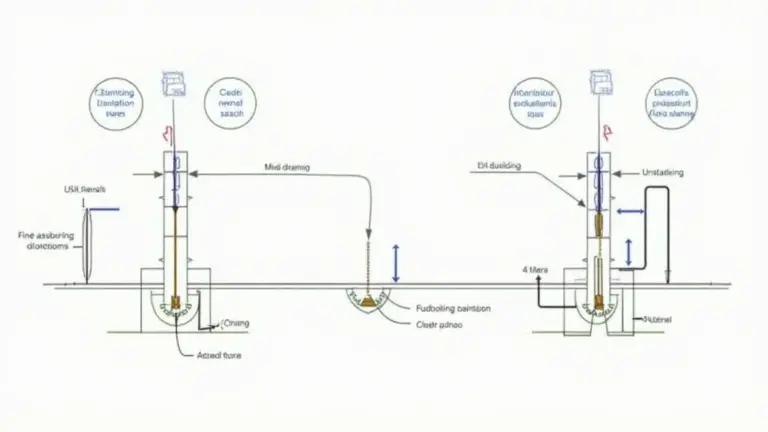

Smart Contract Audits Matter

When evaluating how to audit smart contracts for DEXs, verify the matching logic. HIBT’s code was reviewed by Dr. Elena Petrova (author of 18 blockchain papers, lead auditor for Polygon 2.0).

For Vietnam users: Always check tiêu chuẩn an ninh blockchain (blockchain security standards) before trading. Tools like Ledger Nano X reduce hack risks by 70% according to 2025 Crypto Security Report.

Future of DEX Algorithms

As 2025’s most promising altcoins emerge, HIBT DEX’s order book technology adapts. Their upcoming V3 update introduces AI-powered predictive matching – potentially cutting gas fees by 15% for frequent traders.

Not financial advice. Consult local regulators. Learn more at