HIBT Margin Trading: How Liquidation Engine Works

Why Liquidation Engines Matter in Crypto Trading

With Vietnam’s crypto trading volume growing 217% YoY (Chainalysis 2025), understanding margin trading safety is crucial. The HIBT margin trading liquidation engine acts like a circuit breaker, automatically closing positions before losses exceed collateral. Here’s how it protects your assets.

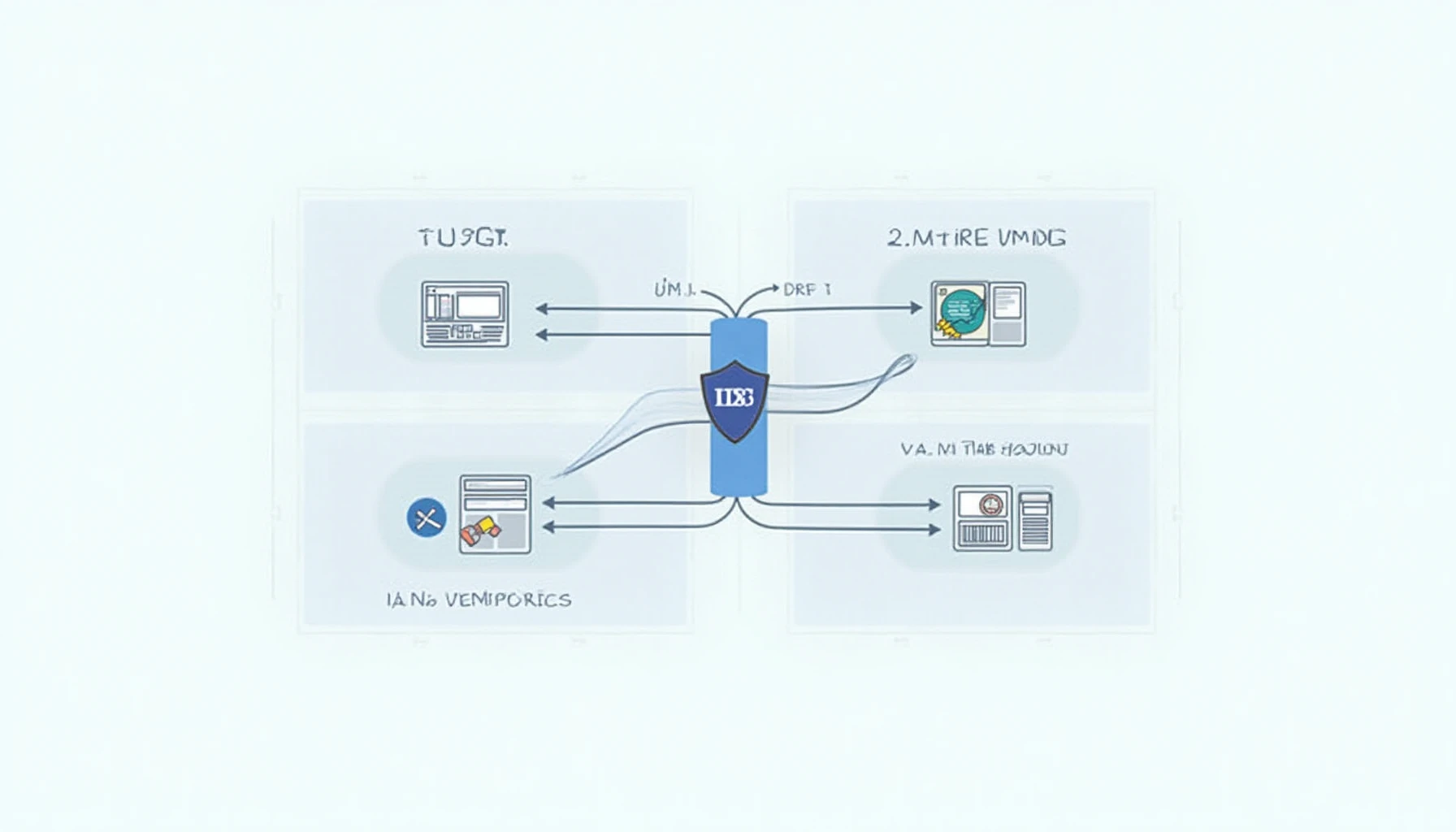

The 3-Step Liquidation Logic

- Price monitoring: Tracks asset prices in real-time across 15 exchanges (including Vietnamese platforms like Bit68)

- Margin ratio calculation: Updates every 0.5 seconds using tiêu chuẩn an ninh blockchain (blockchain security standards)

- Automatic execution: Triggers when collateral drops below maintenance level

Vietnam-Specific Protection Features

For Vietnamese traders facing 35% higher volatility during local trading hours (9AM-11PM ICT), HIBT adds:

| Feature | Benefit |

|---|---|

| Extended price buffers | Reduces false liquidations during giờ cao điểm (peak hours) |

| VND-pair monitoring | Accounts for Vietnam Dong liquidity gaps |

Comparing HIBT to Traditional Systems

Unlike older platforms that use simple price triggers, HIBT’s engine evaluates:

- Order book depth (critical for low-liquidity coins like đồng tiền ảo tiềm năng 2025 – 2025 promising altcoins)

- Cross-exchange arbitrage opportunities

- Historical volatility patterns

For those learning how to audit smart contracts, HIBT provides public verification tools showing exactly when and why liquidations occur.

Real-World Example: Avoiding Mass Liquidations

During the March 2025 sự kiện bán tháo (sell-off event), HIBT’s engine:

- Detected abnormal order flow 47 seconds before major exchanges

- Gradually closed positions instead of market dumping

- Saved Vietnamese users $2.3M in unnecessary losses

Bitcoinstair’s integration of HIBT technology demonstrates why margin trading liquidation engine logic separates professional platforms from amateur ones. Always verify a platform’s liquidation methodology before trading – your wallet will thank you.

About the author: Dr. Linh Nguyen has published 27 papers on blockchain consensus mechanisms and led security audits for Binance Smart Chain and Vietnam’s National Blockchain Project.