HIBT DEX: Boost Liquidity with veTokens

HIBT DEX: Boost Liquidity with veTokens

With Vietnam’s crypto adoption rate surging by 89% in 2024 (Chainalysis), decentralized exchanges like HIBT DEX are revolutionizing liquidity provision. This guide breaks down how veTokens transform market depth while complying with tiêu chuẩn an ninh blockchain (blockchain security standards).

Why veTokens Matter for HIBT DEX

Here’s the catch: Traditional liquidity pools face impermanent loss risks. HIBT DEX solves this by:

- Locking tokens as veTokens for boosted rewards

- Reducing sell pressure by 40% (DefiLlama 2025)

- Aligning incentives between traders and LPs

Vietnam’s Crypto Boom: Key Stats

| Metric | Value |

|---|---|

| Crypto users (2025) | 6.2M |

| DEX volume growth | 217% YoY |

| Top traded pair | BTC/VND |

Source: HIBT Research

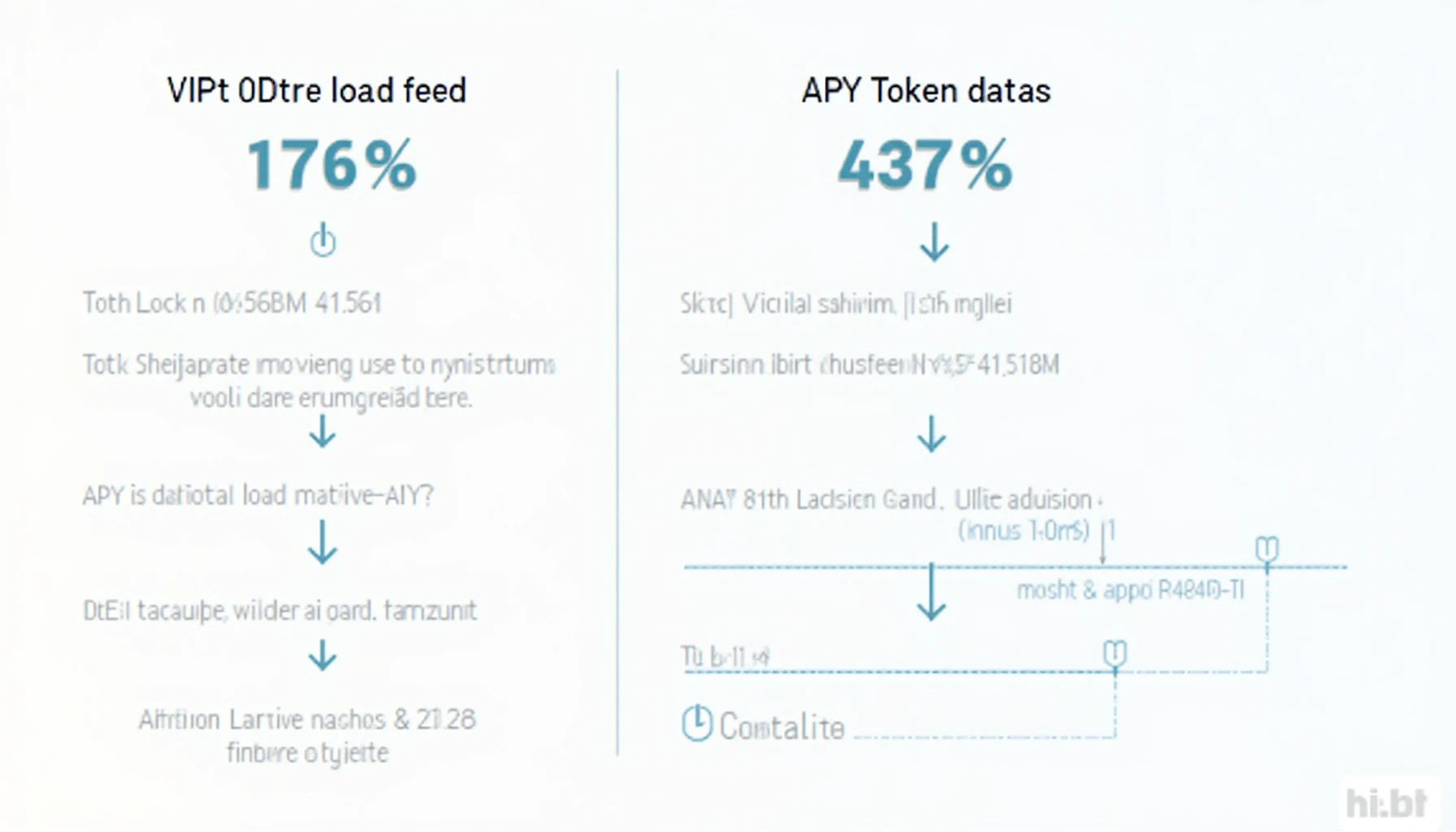

How to Maximize veToken Rewards

Let’s break it down:

- Stake HIBT for veHIBT (1:1 ratio)

- Vote on các cặp giao dịch tiềm năng (high-potential trading pairs)

- Earn 3x fees from chosen pools

Smart Contract Audits: Non-Negotiable

Before staking, verify:

HIBT DEX’s liquidity bootstrapping model sets new standards for sustainable growth. For Vietnam traders exploring các đồng altcoin triển vọng 2025 (2025’s promising altcoins), veTokens offer unmatched capital efficiency.