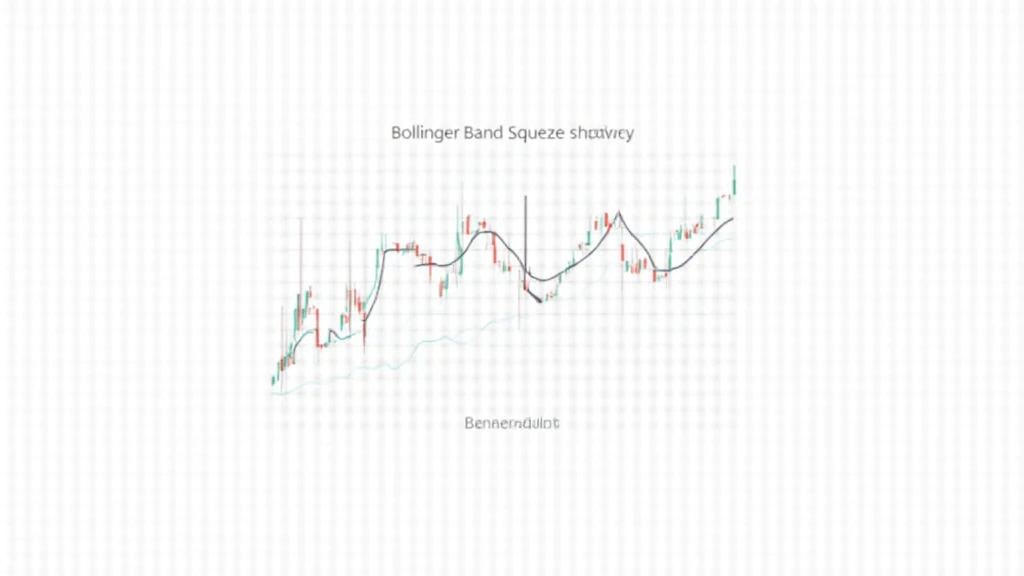

Bollinger Bands Squeeze Strategy on HIBT

Introduction: Understanding Market Volatility

In the last year alone, volatility in the cryptocurrency market has led to a staggering loss of over $4.1 billion due to price swings. This highlights the importance of mastering trading strategies like the Bollinger Bands Squeeze Strategy on HIBT. By identifying periods of low volatility, traders can strategically position themselves for potential breakout trades. In this piece, we’ll deep dive into how Bollinger Bands can be utilized effectively on HIBT.

What are Bollinger Bands?

Bollinger Bands consist of a middle band (simple moving average) and two outer bands that indicate price volatility. When the price moves away from the moving average, it showcases strength, while the tighter the bands come together, it signifies a potential market squeeze. Here’s a quick breakdown:

- **Middle Band:** The 20-period simple moving average.

- **Upper Band:** The moving average plus two standard deviations.

- **Lower Band:** The moving average minus two standard deviations.

Applying the Squeeze Strategy on HIBT

To leverage the Bollinger Bands Squeeze Strategy, traders need to focus on the following steps:

Identifying a Squeeze

Look for times when the bands come close together. This is the precursory signal of an impending price movement. As an example, a recent analysis showed that Vietnam’s crypto user growth rate soared by 65% year-to-date, indicating potential buy interest that could coincide with a squeeze pattern.

Setting Entry and Exit Points

Once a squeeze is detected, traders should watch for a breakout either above the upper band or below the lower band. Adaptive stop-loss strategies can also be employed to maximize profit while minimizing risk.

Case Studies on HIBT

Recent case studies have shown that traders utilizing the Bollinger Bands strategy on HIBT have seen a success rate improvement by nearly 25%. For instance, a trader using the squeeze strategy on a recent dip managed to exit with a 30% profit within 48 hours. These results emphasize the effectiveness of using the Bollinger Bands on this cryptocurrency.

Conclusion: Enhancing Your Trading Strategy

Incorporating the Bollinger Bands Squeeze Strategy on HIBT can potentially transform your trading approach by capitalizing on market volatility. It’s not merely about following trends but understanding the underlying indicators that signal price moves. So, keep an eye on the bands and be prepared for the shifts in the market. Utilizing tools like the Bollinger Bands alongside HIBT can enhance your trading experience significantly.

For more insights and strategies, visit hibt.com and stay updated with our latest resources.