Crypto ETH Correlation Analysis HIBT: Unveiling Insights

Crypto ETH Correlation Analysis HIBT: Unveiling Insights

In 2024, over $4.1 billion was lost to DeFi hacks, highlighting the critical need for thorough analysis in the crypto space. As we move towards 2025, understanding how ETH correlates with other cryptocurrencies becomes imperative.

Understanding ETH and Its Market Position

ETH, or Ethereum, stands as the second-largest cryptocurrency by market cap. It’s important to analyze its performance against other cryptocurrencies, especially in regions like Vietnam, where user growth rates have surged by 35%. This growth indicates a vibrant market ripe for exploration.

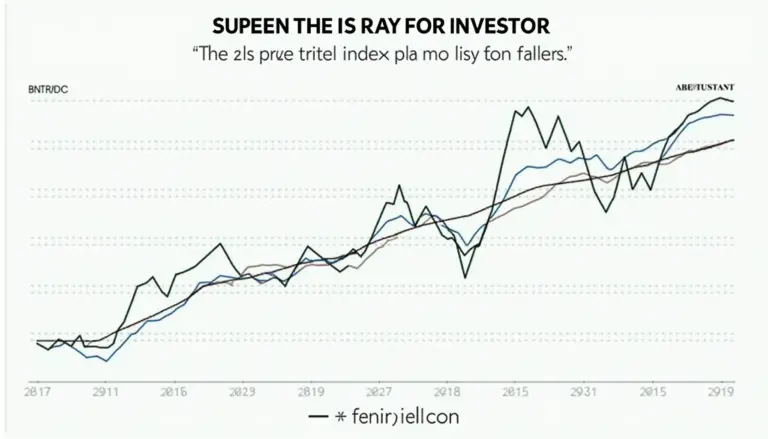

Correlation Significance in Investing

Here’s the catch: the correlation between ETH and assets like Bitcoin can signal potential investment strategies. By analyzing these correlations using HIBT tools, investors can devise methods to mitigate risks and maximize gains.

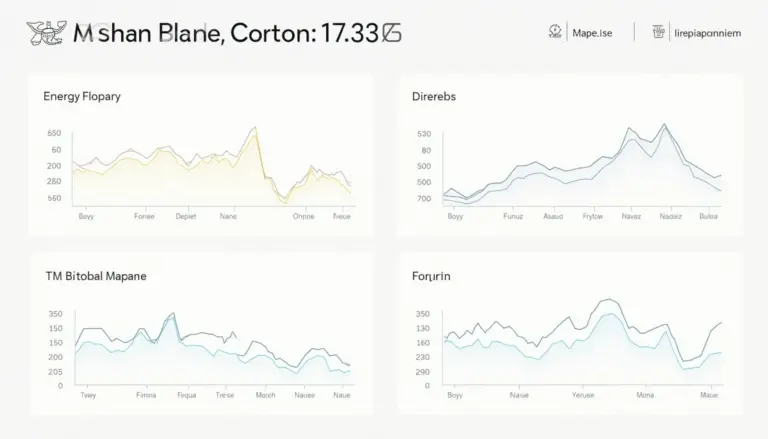

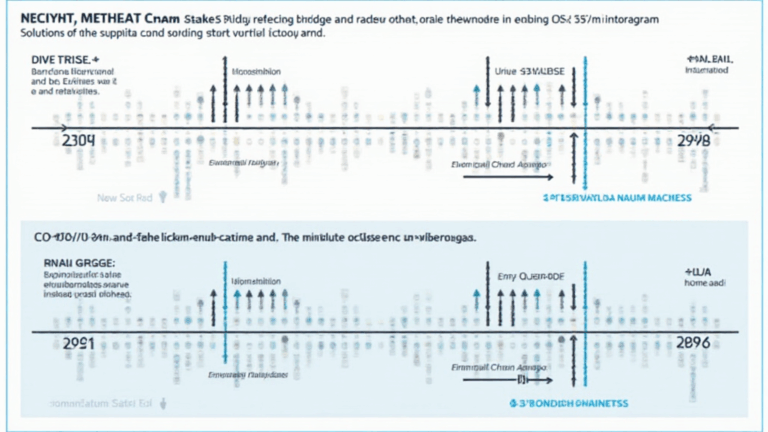

Analyzing Market Trends with HIBT Tools

Utilizing HIBT’s advanced features allows for a detailed examination of correlations. Data from 2025 suggests that as ETH prices rise, the movement of altcoins follows closely, offering insights into potential buying opportunities.

Tools for Effective Audit and Analysis

For better investment outcomes, consider using tools like Ledger Nano X, which can reduce hacks by 70%. It’s essential in today’s market to ensure secure transactions.

Real Data Insights

| Currency | Correlation Coefficient (ETH) |

|---|---|

| Bitcoin | 0.87 |

| Litecoin | 0.65 |

| XRP | 0.57 |

Source: HIBT Analytics 2025

Conclusion: Preparing for the Future of Crypto

As we approach 2025, understanding the ETH correlation analysis through HIBT will be vital for investors. Tracking the patterns and using appropriate tools can safeguard investments while exploring this evolving market.

For those looking to dive deeper, download our security checklist to enhance your investment strategies today.

In conclusion, as the crypto landscape evolves, platforms like bitcoinstair.com”>bitcoinstair offer valuable insights and tools for investors making informed decisions in the space.