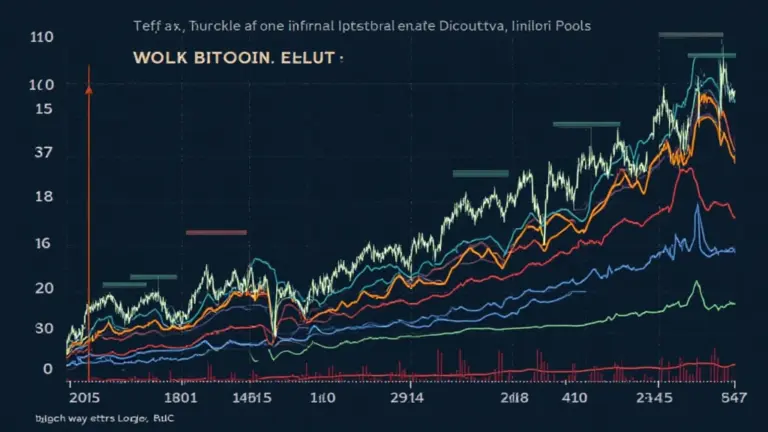

Bitcoin Network Hash Rate Trends

Bitcoin Network Hash Rate Trends

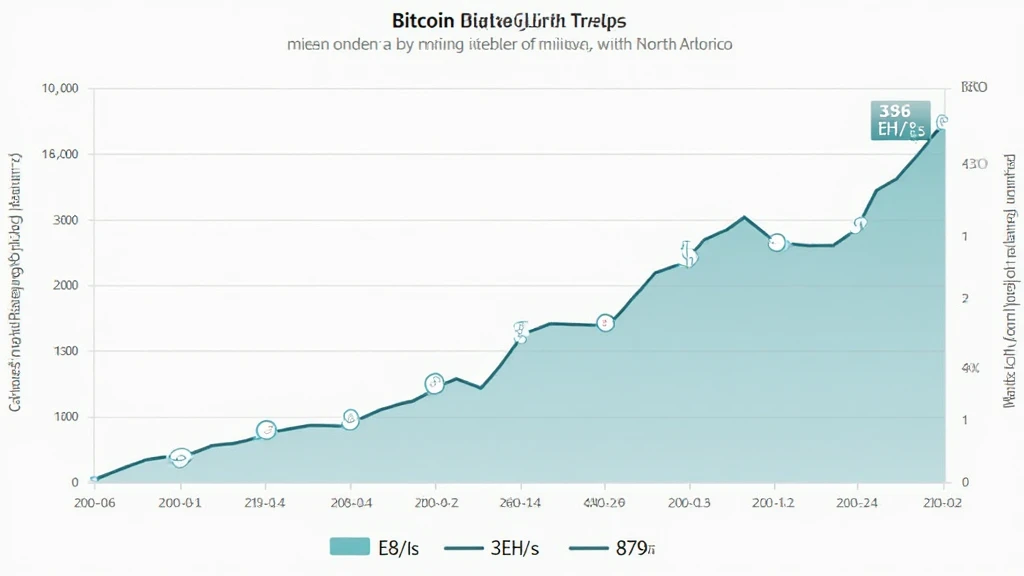

As of early 2025, the Bitcoin network hash rate has surged to unprecedented levels, reaching 358 EH/s in January. This dramatic rise can be attributed to increased investments in mining technology and the growing adoption of decentralized finance (DeFi). With an estimated 82% of the hash power coming from North America, the global Bitcoin mining landscape is evolving rapidly. So, what do these trends mean for miners and investors?

Understanding Hash Rate Dynamics

A hash rate essentially measures the computing power of miners participating in the Bitcoin network. Like a bank vault protecting significant assets, a higher hash rate enhances network security and reduces the risk of 51% attacks. Moreover, fluctuations in hash rate can have significant implications for mining profitability and transaction speeds.

Factors Influencing Hash Rate Trends

- Advancements in Mining Technology: Innovative hardware like ASIC miners has driven efficiency.

- Energy Costs: The cost of electricity significantly impacts mining operations; many miners are relocating to regions with low energy prices.

- Market Sentiment: Anti-crypto regulations or pro-mining policies in countries can influence local hash rates.

Impact on Miners and Investors

With the anti-money laundering regulations becoming stricter worldwide, miners must stay compliant to avoid repercussions. The trends indicate that miners in regions like Vietnam are experiencing a growth rate of around 40% in user engagement as more people become interested in Bitcoin.

Future Projections

As we look ahead to the rest of 2025, several scenarios could unfold based on current trends:

- Increased Difficulty Levels: With rising hash rates, mining difficulty will likely continue to escalate.

- Consolidation in the Mining Sector: Smaller miners may struggle to compete, leading to potential mergers and acquisitions.

- Regulatory Pressures: Expect more compliance requirements which could impact operational models.

Stay Updated

For miners and investors, understanding the Bitcoin network hash rate trends is vital for making informed decisions. Regularly monitoring the market trends and technological developments will empower users to optimize their strategies.

In conclusion, the Bitcoin network hash rate trends are vital indicators of market health and security. With the increasing complexity of the mining landscape, it’s essential to stay informed to navigate potential challenges effectively.