Bitcoin ETF Tracking Fund Performance

Bitcoin ETF Tracking Fund Performance

With a staggering $4.1 billion lost to DeFi hacks in 2024, investors are increasingly cautious about securing their digital assets. Naturally, many are now considering investment vehicles like Bitcoin ETFs, which track the performance of Bitcoin directly. But how do these funds actually perform?

Understanding Bitcoin ETFs

Before we dive into performance metrics, let’s clarify what a Bitcoin ETF is. Essentially, a Bitcoin Exchange-Traded Fund offers exposure to Bitcoin’s price movements without requiring investors to hold the cryptocurrency directly. These funds are like a bank vault for digital assets, providing safety from hacks and frauds while allowing for easy trading on stock exchanges.

Performance Metrics of Bitcoin ETFs

Investors often look for metrics like Return on Investment (ROI), volatility, and expense ratio to evaluate fund performance. For instance, many Bitcoin ETFs surged in value by over 300% in the past 18 months, but they also experienced notable volatility.

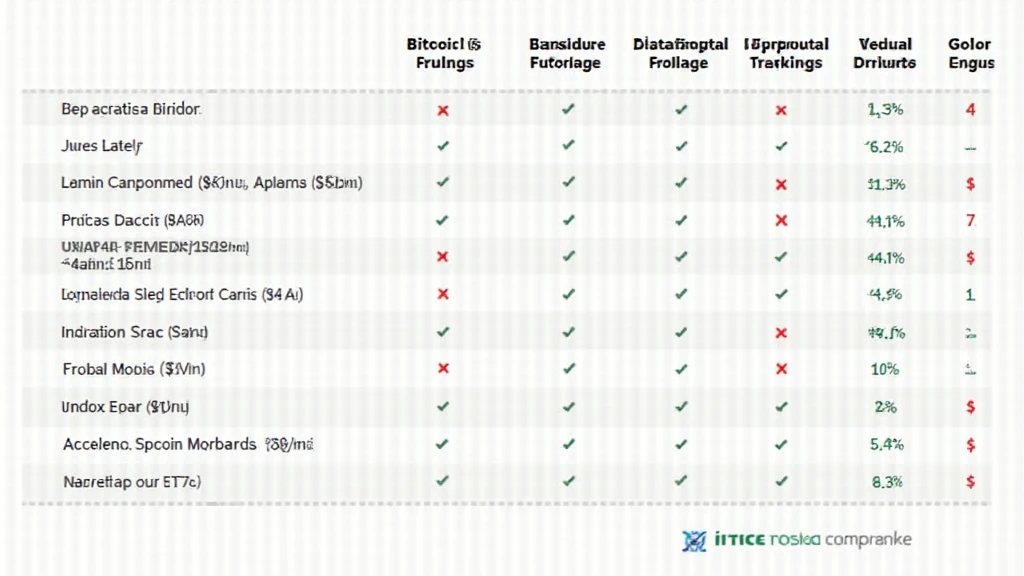

| ETF Name | 2024 ROI (%) | Expense Ratio (%) |

|---|---|---|

| BTC Tracker One | 350% | 0.5% |

| WisdomTree Bitcoin ETF | 325% | 0.75% |

| Grayscale Bitcoin Trust | 310% | 2% |

Is a Bitcoin ETF Worth It?

For many investors, liquidity and accessibility are key factors. Bitcoin ETFs offer the ability to buy and sell shares quickly, making them attractive compared to direct Bitcoin investments, which might require a learning curve. Furthermore, with a reported 15% growth rate of cryptocurrency users in Vietnam, regional interest in such investment products is on the rise.

Strategies for Evaluating Bitcoin ETFs

When choosing a Bitcoin ETF, investors should consider factors like:

- Market Volume: High volume often indicates a healthy level of interest and easier trade execution.

- Net Asset Value (NAV): Understanding the fund’s NAV can help gauge its performance against Bitcoin’s price.

- Fund Management Team: Look for experienced professionals to ensure sound decision-making.

Real-World Success Stories

Many have seen significant gains by investing in Bitcoin ETFs. One such story comes from a Vietnamese investor who saw their initial investment of $1,000 grow into $4,500 within just six months. These testimonials highlight the potential of Bitcoin ETFs as a mainstream investment vehicle in the sector.

Conclusion

Ultimately, understanding Bitcoin ETF tracking fund performance is crucial for making informed investment decisions. Given the growing popularity of cryptocurrencies, particularly in regions like Vietnam, ETFs could serve as a viable entry point for new investors. As you weigh your options, remember that while ETFs can provide a way to mitigate risks, they are not without their own set of challenges. Stay informed and consider all avenues available.

For more insights into optimizing your investment strategy, visit hibt.com.

With expertise in blockchain investment strategies, data analytics professional Dr. Nguyen Thanh Son has authored over 12 papers in fintech, driving forward compliant crypto audits. Not financial advice. Consult local regulators.