HIBT Crypto Tax Software Compatibility

Introduction

As crypto enthusiasts dive deeper into the digital asset world, managing tax obligations has become a pressing concern. With approximately $4.1 billion lost to DeFi hacks in 2024, the importance of securing and reporting digital assets correctly cannot be overstated. In this article, we will explore the HIBT crypto tax software compatibility and its significant role in helping users adhere to tax regulations efficiently.

Why HIBT Software is Crucial

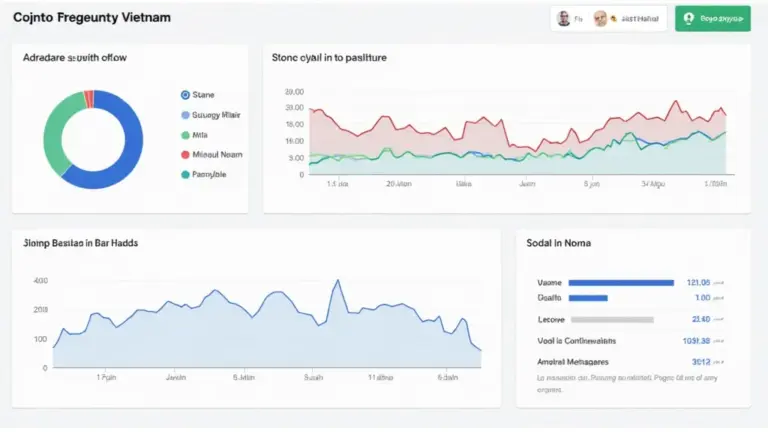

For crypto investors, compliance with regulations is paramount—especially in regions like Vietnam, where the crypto user growth rate is surging. According to recent studies, Vietnam’s crypto adoption rate has increased by over 75% in the past year. This means that more citizens will require reliable software like HIBT to ensure their digital transactions align with local tax laws.

Understanding Crypto Tax Software

Imagine trying to manage a huge investment without a financial advisor; that’s what navigating crypto taxes can feel like without specialized software. HIBT crypto tax software acts similarly to a trusted financial advisor, simplifying the process of tracking and reporting gains.

What Sets HIBT Apart?

The HIBT software is distinguished by its ability to:

- Automate transaction tracking—saving users time and reducing their workload.

- Generate tax reports—specifically tailored to meet compliance needs in various jurisdictions, including Vietnam.

- Provide insights—enabling users to understand their fiscal standing effectively.

Case Studies: HIBT in Action

Consider a case where an investor in Vietnam used HIBT to report their capital gains. By utilizing this software, they managed to accurately report their transactions, which improved their compliance standing while effectively managing their portfolio. This software’s compatibility with various exchanges ensures that users can pull their transaction data seamlessly.

Conclusion

In summary, HIBT crypto tax software compatibility is an essential tool for managing your crypto tax obligations. As we witness a rise in cryptocurrency transactions in Vietnam, utilizing such tools not only helps in compliance but also enhances the overall management of digital assets. Explore the HIBT offerings to streamline your crypto tax processes.

For more insights, visit HIBT’s website and check out our resources on managing crypto taxes effectively. Ensure you stay in compliance and maximize your investment potential with the right tools.

Author: Dr. Nguyễn Văn An, a renowned blockchain expert, has authored over 15 papers in the field and led the audit of various significant projects in Southeast Asia.