HIBT Price Chart Basics for New Traders

Introduction

In recent years, the cryptocurrency market has exploded, highlighted by a staggering $4.1 billion lost to DeFi hacks in 2024. This emphasizes the need for new traders to understand tools available to them, such as HIBT price charts. These charts provide vital insights into market trends and price movements, making them indispensable for any new investor wanting to make informed decisions. Let’s explore the basics of HIBT price charts for those just starting out in the crypto space.

Understanding HIBT Price Charts

Price charts are graphical representations of asset prices over time. For HIBT, the price chart displays the movement of its value in relation to other cryptocurrencies. Here’s what you should focus on:

- Time Frame: Analyze different time frames—daily, weekly, and monthly—to gauge the overall trend.

- Volume: Check trading volume alongside price changes; high volume often signifies strong interest.

- Market Cap: Monitor HIBT’s market cap to understand its ranking among cryptocurrencies.

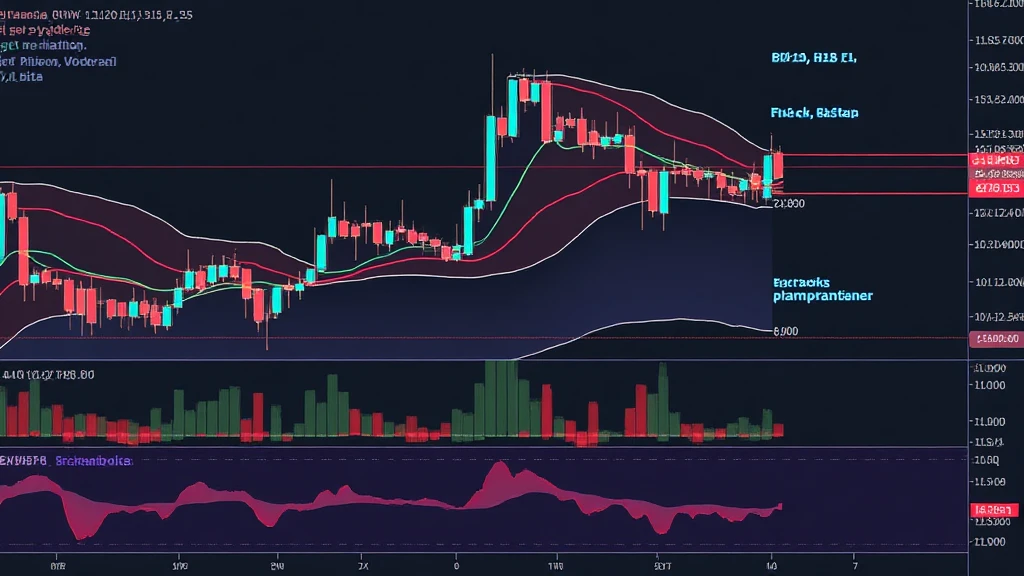

Key Chart Indicators

New traders should familiarize themselves with several essential indicators on HIBT price charts:

- Moving Averages: Both the simple moving average (SMA) and exponential moving average (EMA) can help investors identify price trends.

- Relative Strength Index (RSI): This indicator shows whether HIBT is overbought or oversold, guiding future trades.

- Support and Resistance Levels: Recognizing these levels helps in predicting price movements and setting entry or exit points.

Practical Strategies for Using HIBT Price Charts

Traders should adopt practical strategies while analyzing HIBT price charts:

- Chart Patterns: Look for familiar patterns such as Head and Shoulders or Double Tops to make predictions.

- Setting Alerts: Use trading platforms to set alerts for specific price points on HIBT so you don’t miss important trading opportunities.

Leveraging Real-World Data: Vietnam Market Insights

As Vietnam continues to embrace cryptocurrencies, understanding local market dynamics is crucial. In 2023, the growth rate of crypto users in Vietnam was reported at 60%, showcasing a robust interest in digital assets. By aligning your HIBT trading strategies with local trends, new traders can capitalize on emerging opportunities.

Conclusion

To effectively navigate HIBT price charts, new traders must familiarize themselves with various indicators, market sentiments, and practical strategies. The rapid growth in Vietnam’s crypto adoption makes this knowledge even more pertinent. For real-time trading insights and the latest updates, visit hibt.com. Consult with a financial advisor to tailor strategies specific to your investment goals.