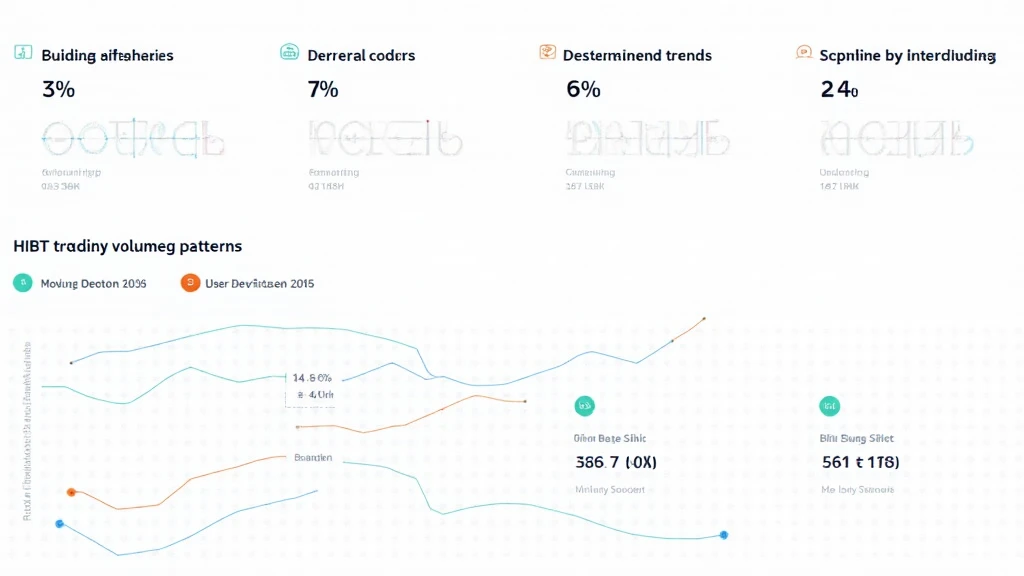

Understanding HIBT Trading Volume Explained

Understanding Trading Volume

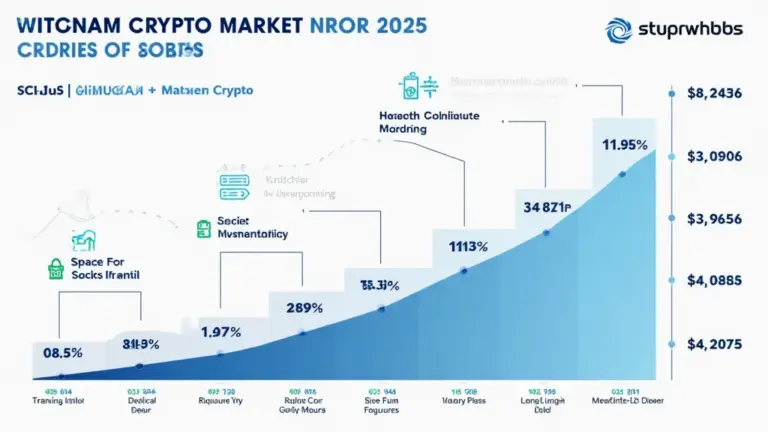

With an estimated $4.1B lost to DeFi hacks in 2024, investors are seeking safer cryptocurrency platforms. One critical aspect to consider is the trading volume of assets, particularly HIBT. Trading volume can be viewed as the pulse of the market, indicating liquidity, feasibility, and potential price movements.

What is HIBT Trading Volume?

HIBT trading volume refers to the total number of HIBT tokens that change hands over a specific period, usually measured within 24 hours. High trading volumes often suggest strong market interest, while low volumes may indicate a lack of demand.

Importance of Trading Volume

- Liquidity: High trading volume provides greater liquidity, allowing investors to enter and exit positions easily, much like a busy marketplace.

- Price Volatility: Rapid changes in trading volume can lead to price volatility, similar to how a sudden influx of buyers can drive up prices in any sales environment.

- Market Trends: Monitoring HIBT trading volume can help investors identify market trends. A spike, for example, might reflect upcoming announcements or developments.

Analyzing HIBT Trading Volume

To analyze HIBT trading volume effectively, investors should consider various metrics such as the average trading volume over time, trading volume spikes, and compare it to other cryptocurrencies. For instance, during Q1 2025, trading volumes for HIBT saw a increase of over 200% in comparison to previous quarters, indicating a rising interest among Vietnamese users, where cryptocurrency adoption is growing rapidly.

Real-World Application

Just as banks utilize trading volume data to assess liquidity, cryptocurrency exchanges like Bitcoinstair use HIBT trading volume metrics to inform traders. For example, if HIBT’s volume is significantly increasing, it may be a valid opportunity to invest or join trading activities.

The Vietnamese Market

Vietnam’s cryptocurrency market has seen a surge in user growth, with a reported increase of over 30% in active crypto users compared to last year. This trend directly influences HIBT trading volume, as more users drive demand and liquidity for HIBT tokens. As the adoption of blockchain technology increases, understanding these dynamics becomes crucial.

Staying Informed

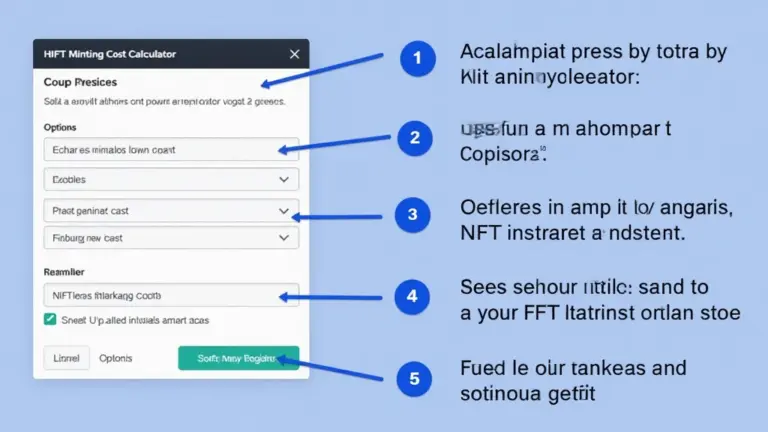

To stay updated on HIBT trading volume, consider utilizing tools such as trading volume indicators or market analysis platforms. For example, using HIBT’s trading volume chart on Bitcoinstair can simplify the monitoring process.

Conclusion

In summary, understanding HIBT trading volume is essential for anyone looking to navigate the crypto market effectively. With its rising prominence in Vietnam, trading volume will likely play a key role in shaping investment strategies. Whether you’re a seasoned trader or just starting, being aware of the trading trends will empower your investment decisions.

For more detailed insights into trading metrics, be sure to visit HIBT’s official trading dashboard.