Understanding HIBT Transaction History: A Comprehensive Guide

Introduction

In the fast-evolving world of cryptocurrency, keeping track of your transactions is essential. With losses amounting to $4.1B from DeFi hacks in 2024 alone, knowing how to analyze your HIBT transaction history is critical for your investment strategy. This guide aims to empower you with the knowledge to navigate your transaction history effectively.

What is HIBT?

HIBT, standing for High Integrity Blockchain Transactions, represents a framework focusing on secure and transparent transactions within blockchain networks. For those utilizing HIBT, understanding your transaction history is crucial for maintaining security and compliance.

How to Access Your HIBT Transaction History

Accessing your transaction history on HIBT is straightforward. Here’s how:

- Visit the HIBT platform: Go to the official website of HIBT.

- Log in: Use your credentials to access your account.

- Navigate to the History section: This is usually located in your account dashboard.

- Filter transactions: You can filter by date, type, or amount to find specific transactions.

For detailed steps, check the support page on hibt.com.

Understanding Your Transaction Details

Your transaction history will typically include the following details:

- Date and Time: When the transaction occurred.

- Transaction ID: A unique identifier for the transaction.

- Amount: The amount of HIBT involved in the transaction.

- Status: Whether the transaction is pending or completed.

Let’s compare the HIBT transaction history to a bank statement, where each entry represents a transaction that can be audited for accuracy.

Importance of Regularly Checking Your Transaction History

Regularly reviewing your HIBT transaction history can provide insights into your trading patterns and help you identify any discrepancies. By analyzing trends, you can:

- Make informed decisions about future trades.

- Ensure compliance with tiêu chuẩn an ninh blockchain regulations.

- Identify potential fraudulent activities promptly.

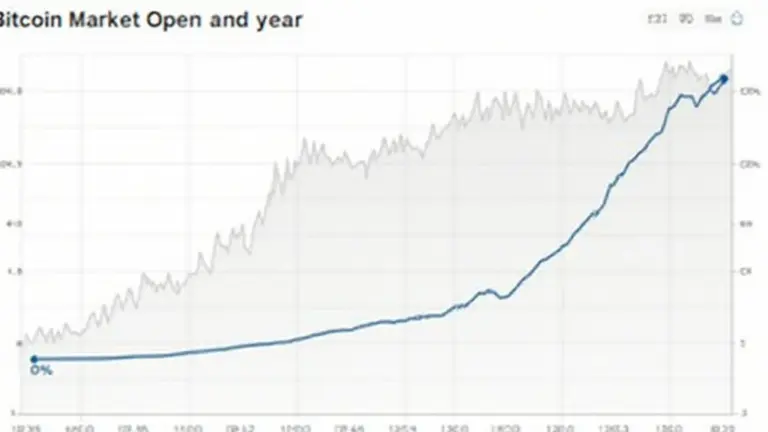

According to recent data, the growth of crypto users in Vietnam has reached 130% in 2023, emphasizing the need for robust transaction management.

Tools to Enhance Your Analysis

Utilizing analytics tools can significantly improve how you interpret your HIBT transaction history. Consider tools like:

- CoinTracking: Offers comprehensive insights into your performance and tax obligations.

- TokenTax: Helpful in preparing your returns by organizing your crypto transactions.

Remember, while these tools add valuable context, they cannot replace your due diligence.

Conclusion

In conclusion, effectively managing your HIBT transaction history is vital for maintaining security and optimizing your investment strategies. By understanding the components of your transaction history, and utilizing recommended tools, you can make better decisions in your crypto journey. Stay informed, secure your investments, and explore the ever-growing potential of HIBT transactions with bitcoinstair.com” target=”_blank”>bitcoinstair.

For further insights, consult with experts and check out our resources to enhance your cryptocurrency experience.

About the Author

Alex Nguyen is a blockchain technology specialist with over 15 publications in the field and has led audits for several high-profile projects. He focuses on enhancing the security and efficiency of digital financial systems.