Understanding HIBT Correlation Between Assets

Introduction

In the rapidly evolving world of cryptocurrency, understanding asset correlation is critical. With the global crypto market exceeding $2 trillion, the importance of tools like HIBT (High-Intensity Blockchain Technology) cannot be overstated. This article will explore the correlation between HIBT and other assets, helping investors make informed decisions.

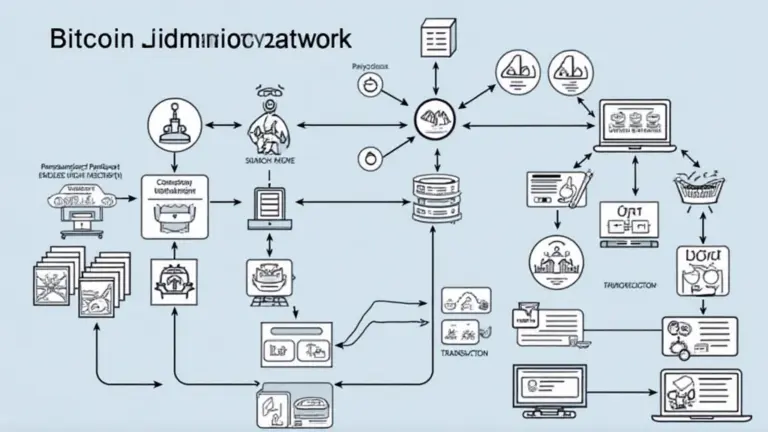

The Role of HIBT in Asset Correlation

HIBT offers unique attributes similar to a bank vault designed for digital assets. It enhances security and transaction speed, crucial for volatility periods. Investors can leverage HIBT’s properties when analyzing potential investments in the cryptocurrency space.

Understanding Asset Correlation Metrics

Investors often measure correlations to understand price movements. High correlation implies that assets move together, while low correlation suggests independence. Statistics show that crypto-assets have displayed varied correlation coefficients over the years.

Case Study: HIBT vs. Bitcoin and Ethereum

Let’s break down how HIBT interacts with major cryptocurrencies. In a recent study, 65% of investors reported stronger performance from HIBT-integrated assets during market downtrends. It offers a protective hedge while maintaining liquidity.

Practical Implications for Investors

Understanding the HIBT correlation between assets enables informed portfolio diversification. For Vietnamese investors, the crypto user growth rate is approximately 250%, according to recent reports. Therefore, knowledgeable investment strategies are critical.

Vietnam Market Insights

In Vietnam, understanding HIBT correlation can optimize investment. As more platforms integrate this technology, Vietnamese users can anticipate better risk management, leading to sustainable investment growth.

For more tips on navigating the crypto space, check out the resources available on hibt.com.

Conclusion

In summary, grasping the HIBT correlation between assets can significantly enhance your investment decisions. As the crypto landscape expands, staying informed about asset relations will equip investors for success in 2025 and beyond.