Enhancing Cryptocurrency Market Liquidity

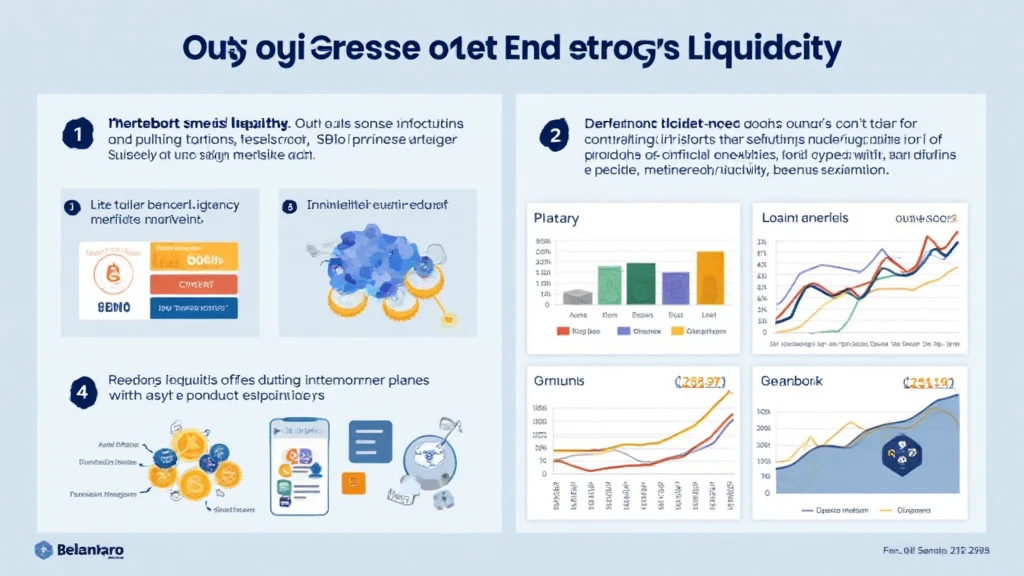

Understanding Cryptocurrency Market Liquidity

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding cryptocurrency market liquidity has never been more critical for traders and investors alike. Market liquidity reflects the ease with which digital assets can be bought and sold without drastically affecting their price. High liquidity typically attracts more participants, ultimately leading to a more robust market.

The Importance of Market Liquidity

Market liquidity is vital for ensuring efficient price discovery and low transaction costs. Balancing supply and demand helps stabilize the market, akin to having a well-stocked bank vault for digital assets. Unlike traditional markets, the cryptocurrency market can be more volatile, making liquidity a key element for new investors navigating this landscape.

Liquidity Providers and Their Role

Liquidity providers are essential in maintaining market liquidity. They facilitate trades by placing buy and sell orders, offering rewards in return for their services. In the Vietnamese context, the user growth rate has seen a significant increase of 30% annually, making it crucial for liquidity providers to adapt quickly. Download our security checklist to better engage with local investors.

Strategies to Enhance Liquidity

- Utilizing Automated Market Makers (AMMs): These decentralized exchanges enable seamless trading experiences without a central authority.

- Incentivizing Traders: Platforms could offer rewards like up to 5% on transactions to increase trading activity.

- Integrating Stablecoins: The introduction of stablecoins can help attract more users, providing price stability in volatile conditions.

Examining the Vietnamese Market

As Vietnam’s crypto market continues to grow, understanding local trends is essential. For example, the implementation of new regulations has resulted in higher trust from users. Additionally, many investors are looking for the most promising altcoins for 2025, indicating a pivot towards investing in innovative projects.

Future Outlook on Market Liquidity

By leveraging improved technology and adapting to regulatory changes, the cryptocurrency market can enhance liquidity. As we move into 2025, expect to see increased collaboration between platforms and users, which will further amplify market stability. For those asking how to audit smart contracts, exploring decentralized tools will become essential in evaluating the integrity of transactions.

Conclusion

In conclusion, maintaining high cryptocurrency market liquidity is integral for sustaining growth and attracting new users, especially in emerging markets like Vietnam. As more people engage with digital assets, implementing strategies that enhance liquidity will be vital for a successful trading experience. Visit bitcoinstair.com”>bitcoinstair for more resources and insights into improving your trading strategy.