HIBT Crypto Portfolio Strategies

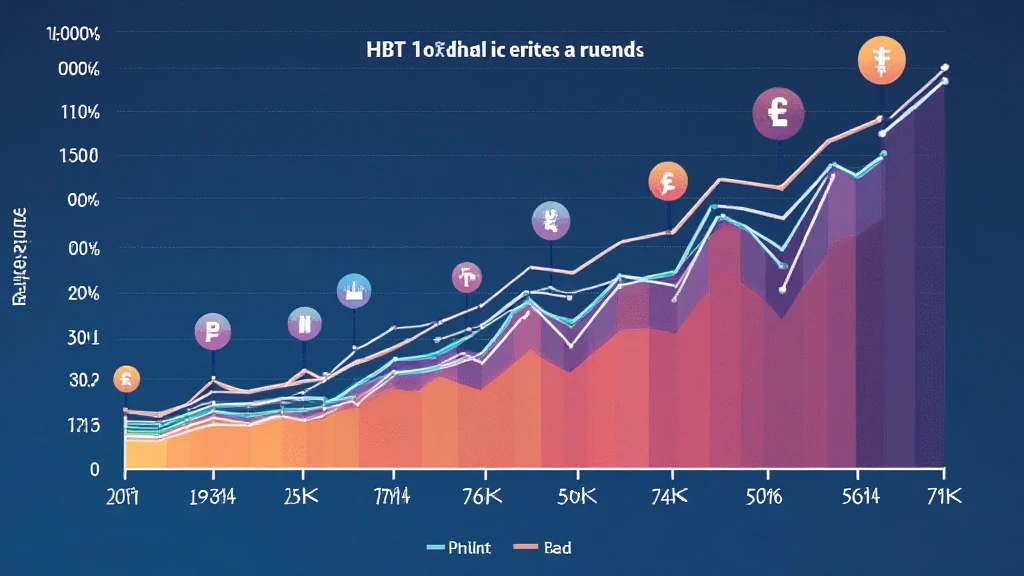

The Rise of HIBT Crypto Portfolio Strategies

In recent years, the crypto market has witnessed incredible growth, with over $4.5 trillion in total market cap as of 2023. This boom has prompted investors to seek effective strategies for managing their crypto portfolios, particularly in the emerging HIBT space. Understanding how to craft a robust crypto portfolio is crucial in this dynamic landscape.

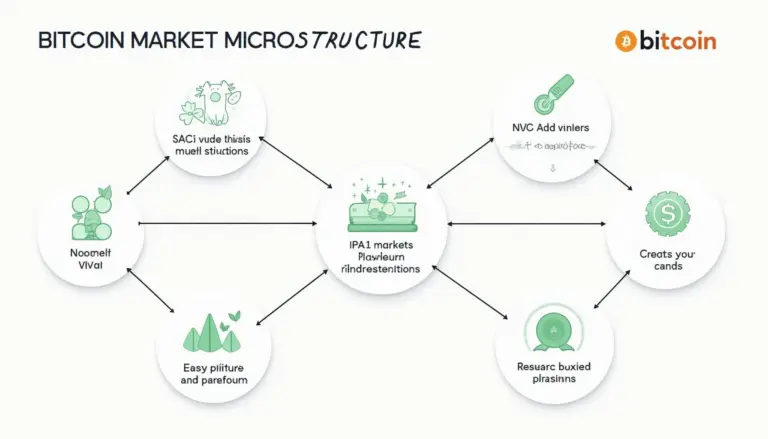

1. Diversification: Your Best Ally

Like a diversified fund manager, successful crypto investors know that spreading their investments is key. A well-rounded portfolio should contain a mix of established coins like Bitcoin and Ethereum, as well as promising altcoins. For instance, investing in 2025’s most potential altcoins such as Solana or Avalanche can enhance returns.

2. Risk Management: Staying Ahead of Volatility

The crypto market is highly volatile. Implementing risk management strategies, like setting stop-loss orders, helps protect your investments. For example, using tools like Ledger Nano X can reduce hacks by up to 70%, ensuring your assets remain secure.

3. Understanding Market Trends

Monitoring market trends is essential. Investors should analyze data from sources like Chainalysis to predict price movements. According to reports, in 2025, the Vietnamese user growth rate in the crypto market is projected to reach 30%, highlighting immense opportunities for savvy investors.

4. Regular Reevaluation of Your Portfolio

Just as a farmer rotates crops to maximize yield, regularly reevaluating your crypto holdings can optimize returns. Check your portfolio quarterly and align it with current market conditions and your investment goals.

5. Utilizing Decentralized Finance (DeFi)

DeFi is revolutionizing how investors manage liquidity. By providing liquidity on platforms like Uniswap, investors can earn interest on their idle assets. According to recent studies, 43% of investors now engage with DeFi products, significantly boosting their portfolio returns.

Embracing HIBT Crypto Portfolio Strategies

Adopting effective HIBT crypto portfolio strategies is essential for navigating the complexities of today’s market. By diversifying your assets, managing risk, and staying informed about trends, you position yourself for rewarding outcomes.

Curious about the latest in HIBT strategies? Visit HIBT for a comprehensive guide and stay ahead in the evolving world of cryptocurrencies.

A visual representation of diversified HIBT crypto portfolios and investment trends.