Bitcoin vs Ethereum Explained Simply – Understanding the Battle of Cryptocurrencies

In today’s digital age, cryptocurrencies have taken center stage, with Bitcoin and Ethereum being the most prominent players. This blog will provide a comprehensive breakdown of Bitcoin vs Ethereum explained simply, helping you grasp what sets these two cryptocurrencies apart, their purposes, and how they function within the financial ecosystem.

Bitcoin vs. Ethereum: A Simplified Introduction

Bitcoin and Ethereum are often compared, yet they serve distinct purposes in the world of blockchain technology. While Bitcoin was created primarily as a digital currency, designed to facilitate peer-to-peer transactions without the interference of central authorities, Ethereum introduces an innovative platform for decentralized applications (dApps) through smart contracts.

Understanding these differences is essential for anyone looking to invest or engage with cryptocurrency. In this section, we’ll explore the basic origins and functions of both Bitcoin and Ethereum to lay a solid foundation before diving deeper into their unique features.

Origins of Bitcoin and Ethereum

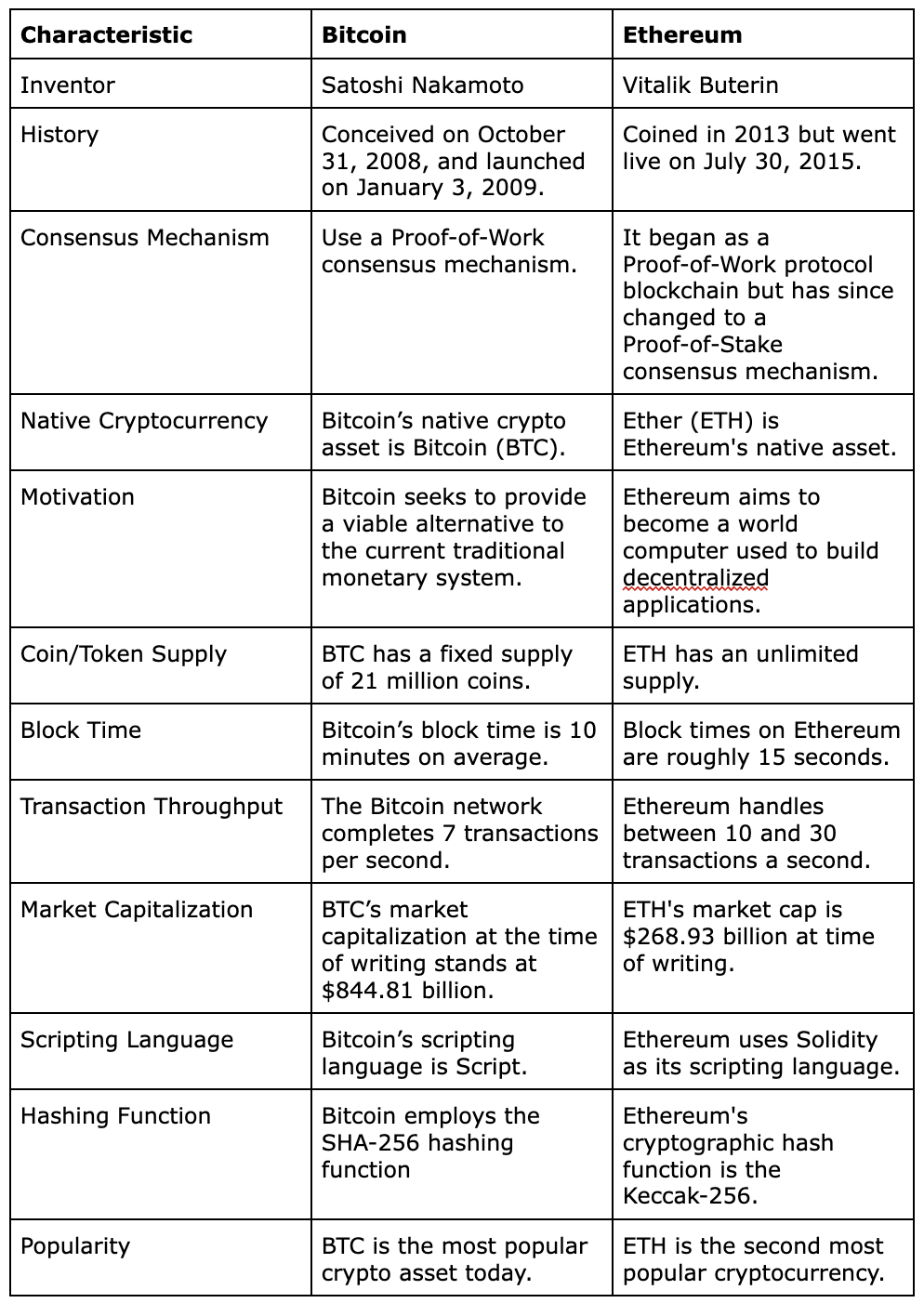

Bitcoin emerged in 2009, introduced by an anonymous entity known as Satoshi Nakamoto. It was designed as a response to traditional banking systems, emphasizing decentralization and user autonomy.

Ethereum followed in 2015, masterminded by Vitalik Buterin and other co-founders. The objective was not only to create a cryptocurrency but to build a platform that could host various decentralized applications and execute smart contracts.

The origins of these cryptocurrencies deeply influence their current functionalities and community support, shaping their evolution over the years.

Purpose and Use Cases

Bitcoin’s primary purpose is to be a digital alternative to traditional currencies, frequently termed “digital gold.” Its key use cases include:

- Peer-to-peer transactions

- Store of value

- Investment asset

Conversely, Ethereum serves multiple roles beyond just being a currency. Its notable use cases encompass:

- Hosting dApps (decentralized applications)

- Facilitating smart contracts

- Powering various tokens through ERC standards

Understanding the core purposes of each cryptocurrency can help users navigate their choices better when considering which to adopt or invest in.

Community and Ecosystem

Both Bitcoin and Ethereum boast strong communities that play significant roles in their development and adoption.

The Bitcoin community primarily revolves around discussions about its utility as a store of value and its potential to replace fiat currencies.

On the other hand, the Ethereum community is more diverse, encompassing developers, innovators, and entrepreneurs who leverage the platform’s capabilities for creating new applications and services. This diversity fosters innovation and drives Ethereum’s growth trajectory.

Key Differences: Bitcoin’s Focus vs. Ethereum’s Versatility

While Bitcoin and Ethereum may appear similar at first glance, their fundamental differences become apparent upon closer examination. Here, we will discuss the focus of each cryptocurrency, emphasizing Bitcoin’s role as digital money compared to Ethereum’s multifunctional platform.

Philosophy Behind Bitcoin

Bitcoin operates with a clear philosophical stance—creating a decentralized currency free from external control. The underlying ethos of Bitcoin advocates for financial empowerment and privacy.

- Decentralization: The absence of a central authority means users have complete control over their funds.

- Scarcity: With a capped supply of 21 million coins, Bitcoin is designed to create inherent value, distinguishing it from fiat currencies that can be printed endlessly.

- Security: Bitcoin’s proof-of-work consensus mechanism ensures that transactions are secure and irreversible.

These principles create a robust framework favoring security and trust among users, establishing Bitcoin as a safe haven asset akin to gold.

Ethereum’s Multifaceted Approach

Ethereum takes a broader approach, allowing developers to create complex applications and ecosystems on its blockchain.

- Smart Contracts: These self-executing contracts enable automated transactions without intermediaries, revolutionizing industries such as finance, real estate, and supply chain management.

- Versatile Ecosystem: With frameworks like ERC-20 and ERC-721, Ethereum supports a variety of tokens and applications, promoting an open-source environment for innovation.

- Community-Driven Development: Continuous upgrades (like Ethereum 2.0) and active community engagement foster a dynamic ecosystem that adapts to the needs of its users.

This versatility allows Ethereum to expand beyond mere currency to become a foundational layer for various technological advancements.

Market Position and Adoption Rates

Bitcoin has retained the title of the largest cryptocurrency by market capitalization since its inception, dominating headlines and attracting institutional investors. Its brand recognition and established network solidify its position as a leader in the cryptocurrency space.

Ethereum is catching up, demonstrating remarkable growth in DeFi (Decentralized Finance) and NFT (Non-Fungible Token) markets. Increased interest from developers and businesses indicates Ethereum’s potential to disrupt numerous sectors, despite its smaller market cap relative to Bitcoin.

By examining these differences, one can appreciate how each cryptocurrency caters to specific needs and goals within the overarching blockchain landscape.

Understanding Bitcoin: Digital Gold and Decentralized Payments

Bitcoin has been dubbed “digital gold” due to its scarcity and properties resembling precious metals. This section explores the intricacies of Bitcoin, its transaction mechanisms, and its role as a decentralized payment system.

The Mechanism of Bitcoin Transactions

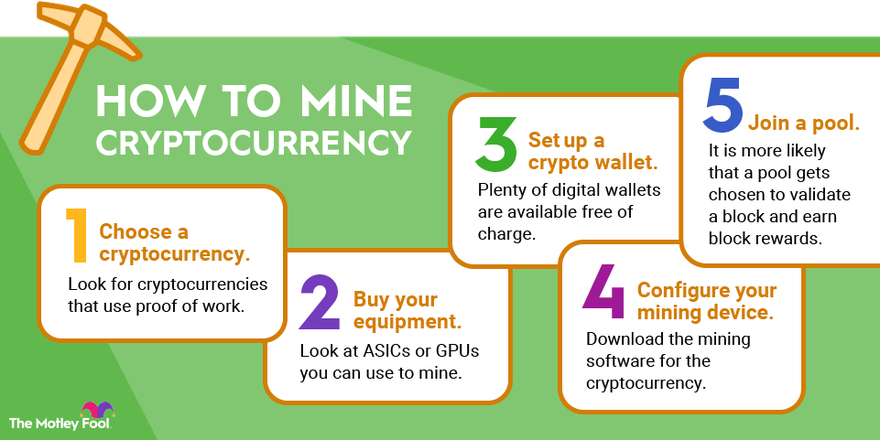

At the heart of Bitcoin lies the concept of cryptographic security. Every transaction is verified by a network of miners who solve complex mathematical puzzles via the proof-of-work consensus algorithm.

- Transaction Validation: The process involves validating transactions, bundling them into blocks, and securing them onto the blockchain.

- Mining Rewards: Miners receive rewards in the form of newly minted Bitcoin and transaction fees, incentivizing them to maintain the network’s integrity.

- Irreversibility: Once confirmed, a transaction cannot be reversed, ensuring transparency and accountability.

These mechanisms establish a trustworthy environment for users engaging in financial exchanges.

Bitcoin as a Store of Value

The notion of Bitcoin as “digital gold” hinges on its limited supply and increasing demand. Investors view Bitcoin as a hedge against inflation and economic instability.

- Safe Haven Asset: As economic conditions fluctuate, many individuals turn to Bitcoin for stability, driving up its value.

- Long-Term Investment: Institutional investors are increasingly adding Bitcoin to their portfolios, viewing it as a valuable long-term asset.

- Adoption by Corporations: Companies such as Tesla and MicroStrategy have begun incorporating Bitcoin into their treasury strategies, further legitimizing its role as a store of value.

Investors should keep in mind the cyclical nature of Bitcoin’s market behavior and be prepared for volatility.

Challenges Faced by Bitcoin

Despite its standing as a leading cryptocurrency, Bitcoin faces several challenges that could hinder its growth.

- Scalability Issues: Transaction speed and costs can become problematic during peak usage times, impacting user experience.

- Regulatory Scrutiny: Governments worldwide are scrutinizing cryptocurrencies, posing potential threats to Bitcoin’s operating environment.

- Energy Consumption: The energy required for mining operations raises concerns about sustainability and environmental impact.

Awareness of these challenges is crucial for understanding Bitcoin’s future trajectory.

Exploring Ethereum: Smart Contracts and Blockchain Applications

Ethereum transcends the limitations of a simple cryptocurrency by enabling a robust platform for decentralized applications and innovative solutions. In this section, we’ll delve into Ethereum’s defining features and how they contribute to its growing popularity.

Smart Contracts: Automating Agreements

One of Ethereum’s revolutionary aspects is its smart contract functionality, allowing for automated agreements executed directly on the blockchain.

- Self-Executing Code: Smart contracts eliminate the need for intermediaries by automatically executing predefined terms once certain conditions are met.

- Trustless Transactions: Parties can engage in transactions without trusting each other, relying instead on the code that governs the contract.

- Cost-Effective Solutions: By reducing reliance on middlemen, smart contracts can decrease costs in various industries, promoting efficiency.

This innovative capability positions Ethereum as a game-changer in not just cryptocurrency, but in how various sectors conduct business.

Decentralized Applications (dApps)

Ethereum acts as a breeding ground for decentralized applications (dApps), which operate without a single point of failure.

- Diverse Use Cases: From gaming platforms to financial services and social networks, dApps thrive on the Ethereum network, showcasing its versatility.

- Open Source Development: Ethereum encourages developers to create applications and contribute to its ecosystem, fostering innovation and collaboration.

- Interoperability: Many dApps can interact with each other, enhancing user experiences and creating synergies across different platforms.

As the dApp ecosystem continues to grow, Ethereum cements its reputation as a leading platform for blockchain applications.

The Future of Ethereum

With ongoing developments (such as the transition to Ethereum 2.0), Ethereum aims to address scalability issues and improve overall performance.

- Proof of Stake Transition: The upcoming shift from a proof-of-work to a proof-of-stake consensus mechanism promises reduced energy consumption and faster transaction speeds.

- Layer 2 Solutions: Initiatives like rollups aim to enhance transaction processing capabilities and reduce congestion on the main network.

- Growing Institutional Interest: As major corporations explore Ethereum’s capabilities, its presence in various industries is expected to expand significantly.

These factors suggest a bright future for Ethereum, with immense potential to shape the blockchain landscape further.

Transaction Mechanisms and Scalability: A Comparison

When comparing Bitcoin and Ethereum, transaction mechanisms and scalability are vital components to consider. Each cryptocurrency employs distinct methods, influencing their respective performance and applicability.

Bitcoin’s Transaction Mechanics

Bitcoin transactions follow a straightforward process, characterized by miners verifying transactions and adding them to the blockchain through proof of work.

- Block Size Limitations: Each block has a size limit (1MB), constraining the number of transactions per second, which leads to increased fees during high demand phases.

- Confirmation Times: Under optimal conditions, it typically takes ten minutes for a transaction to receive confirmation; however, this can vary based on network congestion.

- Fee Structure: Users pay fees to expedite transaction confirmations, which can fluctuate based on demand, resulting in varying costs.

This structure creates a reliable, albeit sometimes slow, transaction process, particularly during periods of heightened activity.

Ethereum’s Scalability Challenges

Ethereum’s flexibility comes with its own set of challenges regarding scalability.

- Gas Fees: Transactions on Ethereum require gas fees, which can increase dramatically during peak times, making dApps expensive to use.

- Network Congestion: High levels of activity often lead to congested networks, resulting in slower transaction times.

- Lack of Finality: Unlike Bitcoin’s irreversibility, Ethereum transactions can take longer to finalize, impacting the user experience negatively.

Addressing these challenges is essential for Ethereum to realize its full potential as a platform.

Current Solutions and Future Innovations

Both Bitcoin and Ethereum communities are actively working to enhance scalability and transaction efficiency.

- Layer 2 Solutions for Bitcoin: Technologies like the Lightning Network aim to facilitate instant micro-transactions off-chain, improving Bitcoin’s capacity.

- Ethereum 2.0 Enhancements: The upgrade plans to introduce sharding and a move to a proof-of-stake model, aiming to boost transaction throughput drastically.

- Cross-Chain Interoperability: Emerging technologies intend to create bridges between different blockchains, enhancing user experiences and resource allocation.

Exploring these innovations allows us to envision more seamless and efficient blockchain transactions in the future.

Investing in Bitcoin and Ethereum: Risks and Potentials

Investment considerations are crucial when evaluating Bitcoin and Ethereum. Both offer unique opportunities, yet they come with inherent risks that every investor must acknowledge.

Bitcoin Investment Insights

Investing in Bitcoin is often seen as a stable choice due to its established history and market dominance.

- Potential for Growth: Bitcoin’s finite supply creates a scarcity that can drive demand and subsequently price appreciation over time.

- Institutional Adoption: Increasing acceptance among institutions reinforces its legitimacy as a viable asset class, contributing to Bitcoin’s long-term prospects.

- Market Volatility: Despite its reputation for stability, Bitcoin remains susceptible to market fluctuations, requiring investors to be prepared for potential downturns.

Understanding these dynamics helps investors gauge Bitcoin’s potential benefits and accompanying risks.

Ethereum Investment Considerations

Investing in Ethereum offers exposure to the rapidly evolving world of decentralized applications and smart contracts.

- Expanding Use Cases: As more businesses recognize Ethereum’s utility, the demand for its native currency (ETH) may increase significantly.

- Technological Advancements: Ongoing improvements, including Ethereum 2.0, promise enhanced scalability and performance, appealing to forward-thinking investors.

- Market Competition: Ethereum faces competition from alternative smart contract platforms, which could affect its market share and future growth.

Evaluating these factors equips investors with insights into navigating Ethereum’s investment landscape successfully.

Risk Management Strategies

Regardless of the cryptocurrency chosen, effective risk management is paramount.

- Diversification: Allocating investments across multiple cryptocurrencies can mitigate risks associated with market volatility.

- Research and Education: Understanding the nuances of each asset is critical for making informed investment decisions.

- Portfolio Rebalancing: Regularly assessing and adjusting your portfolio based on market trends can protect against losses while maximizing returns.

Implementing these strategies can lead to a more balanced approach to cryptocurrency investing.

Conclusion

Bitcoin and Ethereum represent two distinct yet significant facets of the cryptocurrency landscape. Bitcoin stands out as a decentralized digital currency and a store of value, while Ethereum paves the way for innovative applications through smart contracts and dApps. By understanding their key differences, transaction mechanisms, and investment potentials, individuals can make informed decisions in their cryptocurrency journeys. As the digital currency space evolves, both Bitcoin and Ethereum are likely to play pivotal roles, shaping the future of finance and technology.