Navigating HIBT Crypto Tax Reporting

Understanding HIBT Crypto Tax Reporting

As cryptocurrency investments continue to surge, with Bitcoin reaching new heights, many investors in Vietnam and globally are grappling with the complexities of tax reporting. According to recent studies, around 63% of crypto users in Vietnam reported a lack of clarity about their tax obligations. Adapting to HIBT crypto tax reporting standards ensures compliance and helps avoid penalties.

What Is HIBT?

HIBT (High-Impact Blockchain Transactions) refers to significant transactions that require detailed reporting. Similar to traditional financial assets, HIBT focuses on the impact these transactions may have on the economy and taxation. Understanding the obligations tied to HIBT is crucial for investors and platforms alike.

The Importance of Crypto Tax Reporting

- Compliance: Adhering to HIBT standards helps avoid legal repercussions.

- Transparency: Accurate reporting fosters trust in the crypto market.

- Financial Health: Keeping track of transactions aids in assessing one’s financial growth.

Challenges in Crypto Tax Reporting

Many investors encounter challenges when navigating HIBT crypto tax reporting due to:

- Volatility: Rapid price changes complicate the calculation of gains and losses.

- Lack of Guidelines: Regulations continue to evolve, creating uncertainty.

- Complex Transactions: Decentralized finance (DeFi) introduces additional layers of complexity.

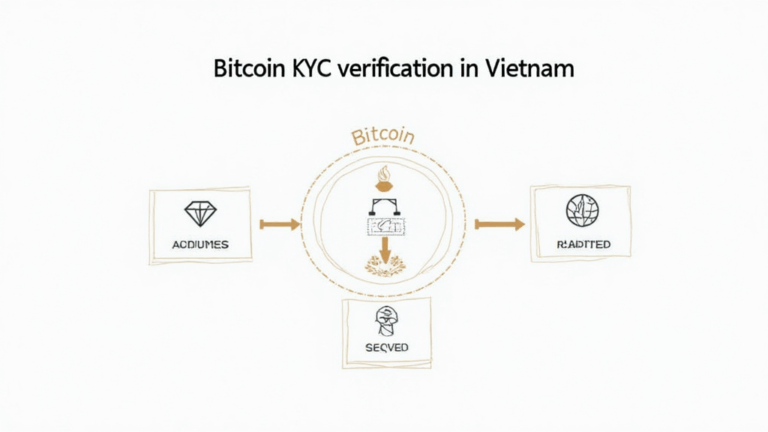

Simplifying Your Reporting Process

Investors can ease the HIBT crypto tax reporting process by utilizing reliable tools. For instance, platforms like HIBT.com offer resources and checklists designed to streamline the reporting process, ensuring you remain compliant.

Future Trends in Crypto Taxation

As the crypto landscape continues to evolve, so do tax regulations. Reports indicate that by 2025, countries like Vietnam are expected to implement clearer guidelines regarding cryptocurrency taxation, enhancing investor compliance and trust. In fact, the Vietnamese market is projected to see a growth rate of 15.3% in crypto user engagement.

Preparing for Changes

Investors should proactively stay informed about upcoming regulations. Referencing authoritative sources will guide your understanding of HIBT crypto tax reporting and its implications on your investments. The 2025 potential of altcoins suggests that understanding taxation can influence your investment strategies significantly.

Conclusion

Understanding HIBT crypto tax reporting is essential for any serious investor. By staying informed and utilizing available resources, you can navigate the complexities of taxation in the cryptocurrency space. For further insights, visit HIBT.com and download our comprehensive tax reporting checklist.

As blockchain technology continues to reshape the finance world, staying compliant not only protects you but also fosters a trustworthy digital economy. Remember, it’s wise to consult with local regulators to ensure you’re on the right path.