Bitcoin Halving 2024 Explained – Understanding its Impact on the Future of Cryptocurrency

Bitcoin halving 2024 explained is crucial for anyone looking to understand the intricacies of cryptocurrency and its future. This event, which occurs approximately every four years, has profound implications not only for miners but also for investors and the overall market. As we delve into this topic, we’ll uncover the mechanics behind halving, its economic ramifications, and what we can expect from the upcoming 2024 event.

Bitcoin Halving 2024: A Comprehensive Overview

The concept of Bitcoin halving is rooted in the fundamental principles of how Bitcoin was designed by its mysterious creator, Satoshi Nakamoto. The halving event reduces the reward that miners receive for verifying transactions on the Bitcoin network, effectively controlling the supply of Bitcoin. As the supply decreases, the potential for an increase in value due to scarcity becomes intriguing.

Defining Bitcoin Halving

At its core, Bitcoin halving refers to the process of cutting the block reward for mining Bitcoin in half. Initially set at 50 BTC per block when Bitcoin was first launched in 2009, this reward has undergone several halvings. Each time a halving occurs, the amount of new Bitcoin being introduced into circulation decreases.

The most recent halving took place in May 2020, reducing the block reward from 12.5 BTC to 6.25 BTC. The next halving is anticipated to occur in 2024, further dropping the reward to 3.125 BTC per block. This systematic reduction is hardcoded into Bitcoin’s algorithm and ensures that there will only ever be 21 million Bitcoins in existence, making it deflationary in nature.

Historical Context

To truly grasp the implications of the upcoming halving, it is essential to look back at the history of past events. Bitcoin has undergone three halvings so far: in 2012, 2016, and 2020. Each of these events had significant consequences on the price of Bitcoin and the behavior of miners.

Historical data shows an upward trend in Bitcoin’s price following each halving, often leading to all-time highs. However, the effects are not immediate; typically, it takes time for the market to adjust to the new dynamics created by halving. This historical context serves as a foundation for understanding what might unfold during the 2024 halving.

The Importance of Timing

Timing plays a critical role in the impact of Bitcoin halving. Market sentiment, along with external factors such as regulatory news and technological advancements, can shape how the halving is perceived.

The lead-up to a halving often sees increased excitement among investors, driving demand and, consequently, prices up. Following the actual event, there may be a period of consolidation where the market stabilizes before potentially entering another bullish phase.

This anticipatory behavior among traders can create volatility, which both presents opportunities for profit and risks of significant losses.

Understanding the Mechanics: How Bitcoin Halving Works

To appreciate the nuances associated with Bitcoin halving, it’s imperative to understand its underlying mechanics. This section will explore how halving functions within the broader framework of blockchain technology and the significance of miners in this ecosystem.

The Role of Miners

Miners are the backbone of the Bitcoin network, tasked with verifying and confirming transactions. They achieve this through complex computational processes called proof-of-work, which requires substantial energy and resources. Upon successfully mining a block, miners receive newly minted Bitcoin as a reward.

As the reward decreases during halving events, miners must adapt their strategies. This can lead to consolidations within the mining industry as less efficient operations may struggle to remain profitable. Thus, understanding the balance between mining rewards and operational costs is vital for predicting the outcomes of future halvings.

The Blockchain Protocol

The Bitcoin blockchain operates on a decentralized ledger system that records all transactions made with Bitcoin. Each block contains a group of transactions, and once a block is mined, it is added to the chain in a linear sequence.

Every 210,000 blocks, or roughly every four years, the reward for mining is halved. This mechanism is part of Bitcoin’s coded protocol and reflects its foundational philosophy of scarcity, similar to precious metals like gold.

Supply and Demand Dynamics

The halving creates a unique interplay between supply and demand. With fewer new Bitcoins entering circulation post-halving, the total supply becomes more limited. If demand remains constant or increases amid this reduced supply, basic economic principles suggest that prices will rise.

It is this principle that draws many investors and speculators to Bitcoin, believing that scarcity will drive value over time. While this is not guaranteed, the correlation between past halvings and price surges lends credibility to this perspective.

The Economic Impact: Analyzing the Halving’s Effects on Bitcoin’s Price

The anticipated Bitcoin halving in 2024 will undoubtedly have significant economic implications, shaping market trends and investor behavior. This section will analyze the potential impacts on Bitcoin’s price and the broader cryptocurrency market.

Historical Price Trends Post-Halving

Analyzing historical price movements following previous halvings reveals patterns that can inform our expectations for 2024. After the 2012 halving, Bitcoin’s price surged from around $12 to over $1,200 within a year. Similarly, following the 2016 halving, Bitcoin reached an all-time high of approximately $20,000 in late 2017.

The 2020 halving also showcased this trend, with Bitcoin climbing to over $60,000 in 2021. These historical price surges following halvings invite speculation about the potential for similar outcomes in 2024.

Market Sentiment and Speculation

Market sentiment plays a pivotal role in determining price trajectories. Leading up to a halving, there is often a sense of optimism among traders and investors, driven by the belief that scarcity will enhance value.

However, sentiment can be volatile, influenced by external factors such as regulatory developments, macroeconomic conditions, and technological advancements. For example, negative news can swiftly alter perception and lead to sell-offs, countering the bullish tendencies typically observed around halving events.

External Influences

While Bitcoin halving stands as a significant catalyst for price movement, it is essential to acknowledge the multitude of external factors that can influence the market. These may include geopolitical tensions, inflation rates, changes in monetary policy, and technological disruptions.

For instance, rising inflation may prompt investors to seek alternative assets as a hedge against currency devaluation, increasing demand for Bitcoin. Similarly, favorable regulatory frameworks can encourage institutional investment, creating additional upward pressure on prices.

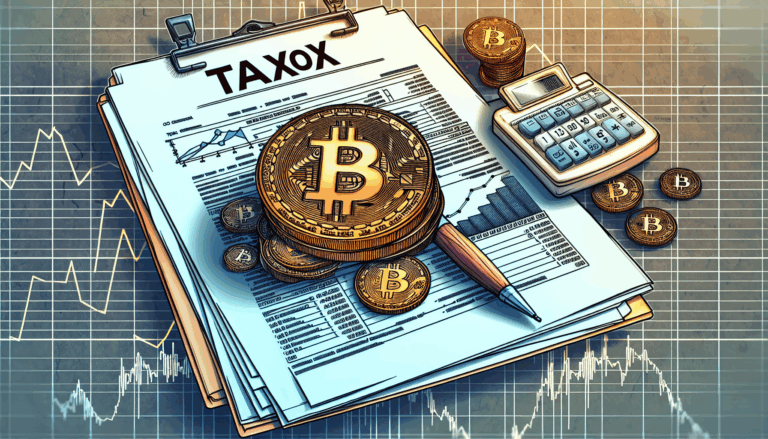

| Year | Block Reward | Price Pre-Halving | Price Post-Halving |

|---|---|---|---|

| 2012 | 50 BTC | $12 | $1,200 |

| 2016 | 25 BTC | $450 | $20,000 |

| 2020 | 12.5 BTC | $8,500 | $60,000 |

| 2024 | 6.25 BTC | TBD | TBD |

Note: Prices are approximations based on market conditions at the time.

Mining and the Halving: Implications for Bitcoin Miners in 2024

With the upcoming halving in 2024, miners will face a transformative shift in their operational dynamics. Understanding these implications is essential for those involved in Bitcoin mining or considering entering the space.

Profitability Challenges

As the block reward halves, miners who rely on the reward as their primary source of income face increasing profitability challenges. The fixed reward means that unless Bitcoin’s price rises significantly, miners could see their revenues decrease, especially if they operate with higher operational costs.

This scenario encourages miners to optimize their operations, employing more efficient hardware and exploring renewable energy sources to mitigate expenses.

The Rise of Mining Pools

Amidst decreasing rewards, many individual miners may find it more challenging to compete against larger mining operations. As a response, the trend towards forming mining pools is likely to gain momentum.

Mining pools allow smaller miners to combine their resources and share rewards, making it feasible for them to participate in the mining process. This collective approach helps level the playing field, ensuring that even smaller players can benefit from mining activities.

Technological Advancements

In preparation for the 2024 halving, miners are also expected to invest in advanced technology. Innovations in ASIC (Application-Specific Integrated Circuit) miners and improvements in energy efficiency will play a pivotal role in sustaining profitability.

Additionally, advancements in mining algorithms and cooling technologies will enhance performance while reducing costs. Staying ahead of the technological curve will be vital for miners seeking to thrive in the evolving landscape post-halving.

Historical Halving Events: Lessons from the Past

Reflecting on the lessons learned from historical halving events can provide valuable insights into what to expect in 2024. Understanding these trends and developments can help stakeholders navigate the complexities of the cryptocurrency market.

The 2012 Halving: A New Era Begins

The first-ever halving in 2012 marked a seismic shift for Bitcoin. It brought mainstream attention to the cryptocurrency, resulting in a surge of interest from both investors and the media.

The price increase following this halving established a precedent for future events, showcasing Bitcoin’s potential as a digital asset. For many, it served as the tipping point for recognizing Bitcoin as a serious financial instrument.

The 2016 Halving: Institutional Interest Grows

The 2016 halving reinforced the idea that Bitcoin was gaining traction as an investment vehicle. This period saw the emergence of institutional interest, with hedge funds and venture capital firms beginning to allocate funds to cryptocurrency.

The price trajectory leading up to and following the halving reflected this growing confidence, ultimately culminating in the monumental bull run of 2017. The enthusiasm generated during this period serves as a reminder of how halvings can catalyze broader acceptance and adoption.

The 2020 Halving: Resilience Amidst Uncertainty

The 2020 halving unfolded against the backdrop of unprecedented global uncertainty caused by the COVID-19 pandemic. Despite the challenges faced, Bitcoin demonstrated resilience, showcasing its potential as a store of value amidst economic turmoil.

This halving served as a testament to Bitcoin’s status as “digital gold,” attracting investors looking for alternatives to traditional assets. The lessons learned here underscore the importance of adaptability in the face of external challenges.

Looking Ahead: Predictions and Expectations for the 2024 Halving

As we approach the Bitcoin halving in 2024, speculation regarding its impact abounds. While predictions can be fraught with uncertainty, analyzing current trends and market sentiment can lend insight into what might unfold.

Bearish vs. Bullish Sentiment

Anticipation surrounding the halving is likely to elicit polarized views among traders. Some will adopt a bullish outlook, citing historical price patterns and the potential for increased demand amid reduced supply. Others may lean bearish, wary of potential market corrections or unfavorable economic conditions.

Understanding these contrasting perspectives can help investors formulate well-rounded strategies as they navigate the lead-up to the halving.

The Role of Institutional Investment

Institutional investment continues to play an increasingly important role in the cryptocurrency landscape. As more institutional players enter the market, their presence may amplify the impact of the halving on Bitcoin’s price.

Institutional investments tend to bring stability and legitimacy to the market, reinforcing confidence among individual investors. Observing how institutional participation evolves leading into the 2024 halving will be critical for predicting price movements.

Regulatory Developments

Regulatory clarity and frameworks are pivotal in shaping the future of cryptocurrency, including Bitcoin. Any significant legislative changes ahead of the halving could either bolster or dampen market sentiment.

As governments worldwide grapple with the implications of cryptocurrencies, their decisions will invariably impact investment strategies and market psychology. Keeping an eye on regulatory developments will be crucial as we approach the 2024 halving.

Conclusion

Bitcoin halving 2024 explained encapsulates a myriad of complexities ranging from mining dynamics to economic implications and historical precedents. As the next halving approaches, understanding the mechanics and potential impacts becomes paramount for individuals invested in or considering entering the cryptocurrency realm. The interplay of supply and demand, along with external influences and market sentiment, will shape the future of Bitcoin, ultimately defining its trajectory in the years ahead.