Bitcoin vs Altcoins 2025 – Navigating the Future of Cryptocurrency Investments

As we step into a fast-evolving landscape of cryptocurrency, understanding the dynamics of Bitcoin versus altcoins in 2025 becomes crucial for investors and enthusiasts alike. Bitcoin, often hailed as the pioneer of the digital currency revolution, faces increasing competition from various altcoins that offer innovative features and unique propositions. In this blog post, we will delve deep into the Bitcoin vs altcoins 2025 debate, exploring market trends, technological advancements, regulatory implications, investor sentiment, and comparative risk assessments.

Bitcoin vs. Altcoins: A 2025 Landscape Overview

:max_bytes(150000):strip_icc()/bitcoins-price-history-Final3-56d81947a532495ea0b0c3b41e880a8a.png)

The cryptocurrency market is undergoing significant transformations as we approach 2025. As Bitcoin continues to solidify its position as the dominant player in the arena, numerous altcoins are emerging, each with distinct characteristics that attract diverse user bases. This section provides an overview of the current state of Bitcoin and altcoins, highlighting their respective roles in the ecosystem.

The dialogue surrounding Bitcoin and altcoins is not merely about investment choices; it’s about the evolution of money itself. With Bitcoin setting the standard for decentralized currencies, it presents a unique challenge for altcoins, which often introduce novel functionalities aimed at addressing specific problems within the crypto space or traditional finance.

The Current State of Bitcoin

Bitcoin remains the largest and most recognized cryptocurrency, boasting a market capitalization that dwarfs those of its competitors. Its established network, brand recognition, and the first-mover advantage contribute to its status as “digital gold.” Investors see Bitcoin as a store of value and a hedge against inflation, especially in uncertain economic times.

Despite these advantages, Bitcoin is not without its challenges. High transaction fees, environmental concerns due to energy consumption, and scalability issues pose significant hurdles. As we look ahead to 2025, the question arises: can Bitcoin evolve to meet future demands while maintaining its dominance?

The Rise of Altcoins

Altcoins, broadly defined as any cryptocurrency other than Bitcoin, encompass a vast array of projects, each targeting different market segments and solving specific issues. Ethereum, Ripple, Cardano, and countless others have gained traction by offering smart contracts, faster transaction speeds, or enhanced privacy features.

Moreover, altcoins benefit from community engagement and innovation, often leading to rapid development cycles. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has further accelerated interest in altcoins, providing investors with lucrative opportunities beyond Bitcoin’s sphere.

Understanding Market Dynamics

The competition between Bitcoin and altcoins creates a dynamic environment where market conditions continually shift. Factors such as technological developments, regulatory changes, and macroeconomic influences can impact both Bitcoin’s and altcoins’ performances significantly.

Market sentiment plays a vital role in shaping perceptions of both Bitcoin and altcoins. While Bitcoin often leads market trends due to its influence, altcoins can surge based on community enthusiasm and specific events. Understanding these dynamics will be key for anyone looking to navigate the cryptocurrency landscape in 2025 successfully.

Market Capitalization Projections: BTC Dominance in 2025?

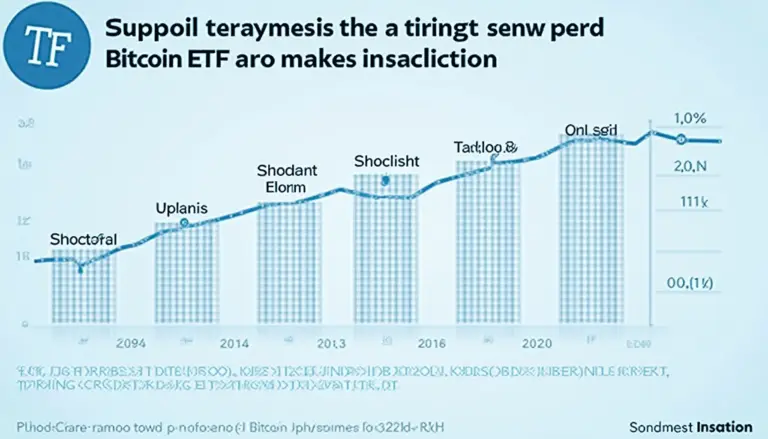

As we analyze the projections for market capitalization, we must consider the factors influencing Bitcoin’s dominance moving toward 2025. The cryptocurrency market is notoriously volatile, making accurate predictions challenging. However, examining historical trends and potential future developments can provide valuable insights.

Historically, Bitcoin has maintained a commanding lead over altcoins, often referred to as “BTC dominance.” However, this dominance is not guaranteed and may fluctuate based on various market conditions, including investor sentiment, technological adoption, and competing projects.

Historical Trends in Market Capitalization

Looking back at the past few years, Bitcoin’s market capitalization has shown remarkable resilience despite market downturns. For instance, during the bull run of late 2017 and early 2021, Bitcoin reached unprecedented heights, prompting discussions about whether it could sustain or enhance its dominance against rising altcoins.

Comparatively, altcoins experienced bursts of growth during these periods, often outpacing Bitcoin in percentage gains. However, many altcoins also faced severe corrections when the market turned bearish, showcasing the volatility inherent in these alternative assets.

This historical context sets the stage for forecasting Bitcoin’s market position in 2025, as we attempt to understand whether it can retain its dominance amidst growing competition.

Factors Influencing Market Capitalization

Several key factors will shape Bitcoin’s market capitalization and overall dominance in 2025:

- Adoption Rates: Increased acceptance of Bitcoin in mainstream finance and businesses will bolster its market cap. As payment processors and retailers adopt Bitcoin, demand will inevitably rise.

- Technological Developments: Innovations such as the Lightning Network aim to address Bitcoin’s scalability issues, potentially enhancing user experience and increasing transaction volumes.

- Institutional Investment: The influx of institutional capital into the crypto space can significantly affect Bitcoin’s market value. As large corporations and funds invest, Bitcoin’s credibility could soar, cementing its position.

- Regulatory Frameworks: Regulatory clarity can either propel Bitcoin’s ascent or create barriers. Favorable regulations might encourage more adoption, while stringent rules could hinder growth.

Projecting BTC Dominance in 2025

While it is impossible to predict with certainty, several scenarios could unfold regarding Bitcoin’s dominance by 2025. Some analysts speculate that Bitcoin will continue to lead the market due to its established reputation and network effects.

Conversely, there is a growing belief that altcoins could capture larger market shares as new technologies emerge. Projects focused on sustainability, efficiency, and specialized functions could entice investors away from Bitcoin, particularly if they can prove their utility in real-world applications.

In conclusion, the battle for market capitalization supremacy between Bitcoin and altcoins is multi-faceted. Both sides possess compelling arguments. While Bitcoin’s established presence offers stability, the innovative spirit of altcoins might drive the next wave of growth in the cryptocurrency sector.

Technological Advancements: Differentiating Features and Scalability

In the rapidly evolving cryptocurrency landscape, technology plays a pivotal role in distinguishing Bitcoin from altcoins. As we move toward 2025, understanding the technological advancements shaping their futures is essential for discerning which investments hold promise.

Bitcoin has laid the groundwork for cryptocurrencies with its innovative blockchain technology and proof-of-work consensus mechanism. Still, as alternatives gain momentum, examining how these projects differentiate themselves technologically is crucial.

Bitcoin’s Core Technology and Limitations

At its core, Bitcoin utilizes a decentralized ledger to record transactions, leveraging the security and immutability of blockchain technology. Despite its groundbreaking nature, Bitcoin faces limitations primarily related to scalability and transaction speed.

As the network grows, transaction fees can become prohibitive, limiting Bitcoin’s use as a daily transactional currency. Currently, Bitcoin processes around seven transactions per second, which pales compared to the capabilities of some altcoins.

Altcoins and Technological Innovation

Many altcoins have emerged with technological innovations that tackle Bitcoin’s shortcomings head-on. Let’s explore some notable examples:

- Ethereum: Known for its smart contract functionality, Ethereum allows developers to create decentralized applications (dApps). This versatility has led to increased adoption and substantial growth in DeFi and NFTs.

- Cardano: Built on a proof-of-stake model, Cardano emphasizes scalability, security, and sustainability. Its commitment to peer-reviewed research and academic rigor distinguishes it from other projects.

- Solana: Boasting impressive transaction speeds and low fees, Solana has emerged as a popular choice for DeFi applications. Its hybrid model of proof-of-history and proof-of-stake enables high throughput and reduces congestion.

These altcoins exemplify how technological innovation can enhance user experiences, attract new investors, and potentially disrupt Bitcoin’s dominance.

Scalability Solutions in 2025

Scalability will remain a critical concern for cryptocurrencies as adoption increases. Bitcoin has introduced initiatives like the Lightning Network to enable off-chain transactions, improving speed and reducing costs. Additionally, layer-two solutions are gaining traction across various blockchains, enhancing scalability without compromising decentralization.

Altcoins have explored diverse strategies to address scalability:

- Sharding: Some networks implement sharding to distribute workloads across multiple nodes, allowing for parallel processing of transactions, which drastically increases capacity.

- Sidechains: These allow for interoperability between different blockchains, enabling users to transfer assets seamlessly while preventing congestion on the main chain.

- Hybrid Models: Combining different consensus mechanisms can offer scalability benefits while maintaining security and decentralization.

As technological advancements continue, we anticipate that both Bitcoin and altcoins will evolve to offer improved scalability and functionality in 2025 and beyond.

Regulatory Impacts: How Legislation Could Shape the Future

The regulatory landscape surrounding cryptocurrencies has garnered significant attention as governments worldwide grapple with how to manage this emerging asset class. By 2025, regulations will undoubtedly play a crucial role in shaping the trajectories of both Bitcoin and altcoins.

Understanding the regulatory environment can significantly influence investor sentiment, project viability, and overall market dynamics.

Current Regulatory Landscape

The regulatory landscape for cryptocurrencies varies widely across different jurisdictions. Some countries have embraced cryptocurrencies, establishing clear frameworks that facilitate innovation. Others have imposed outright bans or restrictive measures, creating uncertainty that stifles growth.

Countries like the United States, European Union member states, and Japan have made strides in formulating regulations that promote transparency while safeguarding against fraud and illicit activities. Conversely, nations like China have cracked down on cryptocurrency activity, emphasizing the need for regulatory caution.

Potential Regulations Impacting Bitcoin

By 2025, we expect to see more comprehensive regulations surrounding Bitcoin, particularly related to taxation, anti-money laundering (AML), and know your customer (KYC) guidelines. These regulations can serve to legitimize Bitcoin as an asset class but may also impose restrictions that affect its use and development.

For instance, increased scrutiny on exchanges could lead to greater compliance burdens, resulting in higher operational costs. However, clearer regulations could also foster institutional confidence, drawing in investment from traditional financial institutions.

The Regulatory Environment for Altcoins

Given the diverse nature of altcoins, regulation will likely impact them differently. Projects focusing on decentralized finance (DeFi), stablecoins, and securities will face varying degrees of oversight.

For example, stablecoins linked to fiat currencies may encounter stricter regulations due to concerns about consumer protection and market stability. Meanwhile, DeFi projects, which emphasize decentralization and autonomy, may find it challenging to comply with existing regulatory frameworks.

How altcoins adapt to these regulatory environments will heavily influence their long-term viability and user acceptance.

The Role of Global Cooperation

As the cryptocurrency market matures, global cooperation among regulatory bodies is paramount. Establishing international standards can help mitigate risks associated with fragmented regulations that could hinder innovation.

Organizations like the Financial Action Task Force (FATF) are working towards harmonizing regulations, ensuring that cryptocurrencies can thrive while minimizing risks related to money laundering and fraud.

In summary, the regulatory environment will remain a double-edged sword for both Bitcoin and altcoins. While favorable regulations can spur growth, restrictive policies could stifle innovation and adoption.

Investor Sentiment Analysis: Adoption Trends and Future Outlook

Investor sentiment acts as a barometer for cryptocurrency markets, significantly affecting price movements and market dynamics. By 2025, understanding the evolving sentiments surrounding Bitcoin and altcoins is essential for discerning future trends.

Whether driven by economic events, technological advancements, or media narratives, investor sentiment can sway the direction of both Bitcoin and altcoin markets.

Assessing Historical Sentiment

Throughout the history of cryptocurrencies, investor sentiment has shown to be highly reactive. Bullish phases have typically been characterized by increased media coverage, social media chatter, and heightened trading volumes.

In contrast, bear markets see heightened fear and anxiety, often leading to mass sell-offs. Events like regulatory announcements or high-profile hacks can swing sentiment dramatically, impacting investor behavior.

Key Drivers Influencing Investor Sentiment

Several factors can significantly influence investor sentiment in the upcoming years:

- Market Cycles: Cryptocurrencies tend to follow cyclical patterns marked by bullish and bearish phases. Recognizing these cycles can help investors navigate market movements.

- Adoption Rates: Growing acceptance of cryptocurrencies among merchants, institutions, and consumers enhances sentiment positively. Increased usage often correlates with rising prices, leading to further adoption.

- Technological Developments: Advancements in blockchain technology, notably those improving scalability and security, can drive optimism among investors.

- Media Coverage: The portrayal of cryptocurrencies in mainstream media significantly impacts public perception. Positive narratives can spur interest, while negative stories can invoke skepticism.

The Future of Bitcoin and Altcoin Sentiment

As we approach 2025, the sentiment surrounding Bitcoin and altcoins will likely diverge based on their respective narratives:

- Bitcoin: Often viewed as digital gold, Bitcoin continues to attract institutional investors seeking stability and long-term growth. As Bitcoin evolves to address scalability and regulatory concerns, its sentiment may strengthen further.

- Altcoins: While Bitcoin’s narrative is one of reliability, altcoins often embody innovation and experimentation. Investors drawn to emerging technologies may exhibit enthusiasm toward promising altcoins, especially if they showcase real-world applicability.

Community Engagement and Its Impact

Community sentiment plays a crucial role in the success of both Bitcoin and altcoins. Active communities can foster loyalty, encourage participation, and stimulate adoption. Engaged communities contribute to marketing efforts and word-of-mouth, driving positive sentiment.

Conversely, communities plagued by internal disputes or controversies can see a decline in morale, negatively impacting investor sentiment. As cryptocurrencies strive for legitimacy, fostering healthy communities will be vital in shaping their futures.

In summary, investor sentiment in the cryptocurrency space is complex and multifaceted. Understanding how external factors and community engagement influence sentiment will be crucial for investors looking ahead to 2025.

Bitcoin and Altcoins in 2025: A Comparative Risk Assessment

Investing in cryptocurrencies entails inherent risks that differ depending on the asset class. As we explore the Bitcoin vs altcoins 2025 landscape, conducting a comparative risk assessment will help investors make informed decisions.

Both Bitcoin and altcoins present unique risks that stem from market dynamics, technology, and regulatory factors.

Risks Associated with Bitcoin

While Bitcoin is often perceived as a safer investment due to its established nature, it is not immune to risks:

- Market Volatility: Bitcoin’s price remains highly volatile, influenced by speculative trading, macroeconomic events, and geopolitical tensions. Sudden price swings can lead to significant losses for investors.

- Regulatory Scrutiny: As governments increasingly scrutinize cryptocurrencies, Bitcoin may face adverse regulation that impacts its utility or adoption.

- Scalability Challenges: Although initiatives like the Lightning Network aim to improve Bitcoin’s capabilities, scalability issues could hamper its growth, impacting its appeal as a transactional currency.

Risks Associated with Altcoins

Investing in altcoins introduces a different set of risks, often tied to innovation and market speculation:

- Project Viability: Many altcoins are nascent projects with untested technologies. Their success depends on execution, team competency, and market adoption, making them inherently risky investments.

- Regulatory Uncertainty: As discussed earlier, altcoins can vary in regulatory treatment. Projects classified as securities may face stricter regulations, jeopardizing their future.

- Lack of Liquidity: Unlike Bitcoin, many altcoins experience lower trading volumes, which can lead to liquidity issues. Investors may struggle to execute trades or exit positions quickly during market downturns.

Diversification Strategies

To mitigate risks associated with investing in cryptocurrencies, diversification can be an effective strategy:

- Balanced Portfolios: Investors can allocate funds across Bitcoin and a select range of altcoins, balancing risk and potential reward.

- Focus on Utility: Prioritizing altcoins with real-world applicability and established use cases can reduce the likelihood of investing in projects that lack traction.

- Stay Informed: Keeping abreast of developments within the cryptocurrency space, technological updates, and regulatory changes can empower investors to make timely decisions.

Comparative Risk Assessment Table

| Factor | Bitcoin | Altcoins |

|---|---|---|

| Market Volatility | High | Very High |

| Regulatory Scrutiny | Moderate | High |

| Scalability Issues | Present, evolving | Varies by project |

| Project Viability | Established | Highly variable |

| Liquidity | High | Varies significantly |

This table encapsulates the comparative risks associated with investing in Bitcoin versus altcoins, providing a snapshot of considerations for potential investors.

In summary, both Bitcoin and altcoins come with their respective risks. A careful analysis of these factors can help investors navigate the complex landscape heading into 2025.

Conclusion

As we approach 2025, the ongoing dialogue surrounding Bitcoin vs altcoins has never been more relevant. With the cryptocurrency market experiencing dynamic shifts driven by technological advancements, regulatory landscapes, and investor sentiment, understanding the nuances of both Bitcoin and altcoins is essential for navigating this evolving terrain. Identifying potential opportunities while remaining cognizant of the accompanying risks will be crucial for any investor looking to make informed decisions in this exciting future.

:max_bytes(150000):strip_icc()/bitcoins-price-history-Final3-56d81947a532495ea0b0c3b41e880a8a.png)