Bitcoin to JPY Exchange Strategies

Understanding Bitcoin to JPY Exchange Dynamics

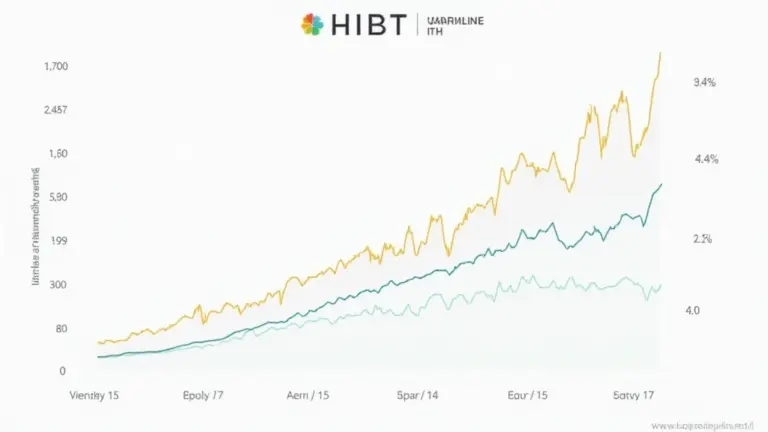

As the cryptocurrency market evolves, understanding Bitcoin to JPY exchange strategies becomes crucial for investors. With Japan’s growing interest in cryptocurrencies, especially in 2024, there has been a remarkable 50% increase in Bitcoin transactions, making it a targeted market. This article will guide you through effective strategies that can enhance your trading experience.

Key Strategies to Consider

- Market Analysis: Conduct thorough research and stay updated on market trends. Analyzing the price fluctuations and determining peak trading times can significantly impact your returns.

- Utilizing Cryptocurrency Exchanges: Selecting a reliable exchange platform is vital. Platforms such as hibt.com offer robust features for seamless transactions.

- Leveraging Exchange Rates: Monitor the Bitcoin to JPY exchange rates closely. Understanding how they correlate with market conditions will enable you to buy low and sell high.

Case Study: Successful Exchanges in Vietnam

In Vietnam, the growth rate of cryptocurrency users has soared to 60% in 2024, highlighting a burgeoning interest. This data is imperative for understanding the demand for Bitcoin and its exchange for JPY. Investors in Vietnam have utilized specific tools to monitor exchange rates, such as apps for real-time alerts.

Pros and Cons of Bitcoin to JPY Exchanges

- Pros:

- Access to a larger market with significant trading volume.

- Potential for increased profitability through strategic timing.

- A diversified portfolio by including JPY alongside other currencies.

- Cons:

- High volatility in exchange rates may lead to unexpected losses.

- Transaction fees can vary significantly between platforms.

- Regulatory changes in Japan might impact trading opportunities.

The Importance of Risk Management

With the cryptocurrency market being volatile, having a robust risk management strategy is essential. Setting stop-loss orders and ensuring your investment is diversified can protect you from substantial losses. According to recent statistics, more than 75% of investors experience a loss due to lack of planning.

Future Outlook

As we look towards 2025, the integration of advanced trading tools will likely shape the Bitcoin to JPY exchange strategies. Tools that offer AI-driven insights may provide traders with the edge needed in this fast-paced market. Always remember, not financial advice; please consult local regulators for compliance.

In conclusion, understanding and implementing effective Bitcoin to JPY exchange strategies is essential for maximizing potential returns. For insights into recent trends, check out the growth of the Vietnam crypto market and how you can leverage these trends for your benefit. Stay informed, stay strategic!

To get a comprehensive overview of these strategies and how to navigate them, download our complete guide now!

Author: Dr. Nguyen Minh Tri, an expert in cryptocurrency economics with over 15 published papers in the financial technology sector, and has led various audits for key blockchain projects.