Understanding Bitcoin Energy Consumption Facts – Insights and Impacts

Bitcoin energy consumption facts have become a hot topic of discussion among technologists, environmentalists, and economists alike. With the rapid growth of cryptocurrency mining, understanding how much energy Bitcoin consumes is essential for evaluating its sustainability and impact on our planet. This blog post will delve into the intricacies of Bitcoin’s energy use, quantify its footprint, analyze influencing factors, discuss environmental impacts, debunk common misconceptions, and explore sustainable solutions that could shape the future of Bitcoin mining.

Bitcoin’s Energy Consumption: A Comprehensive Overview

The energy consumption of Bitcoin primarily arises from the mining process, which involves solving complex mathematical problems to validate transactions. Miners are rewarded with newly minted Bitcoins for their efforts, creating an economic incentive to use powerful hardware that requires significant electricity. As Bitcoin continues to grow in popularity and value, the question of whether its energy consumption is justifiable has never been more pressing.

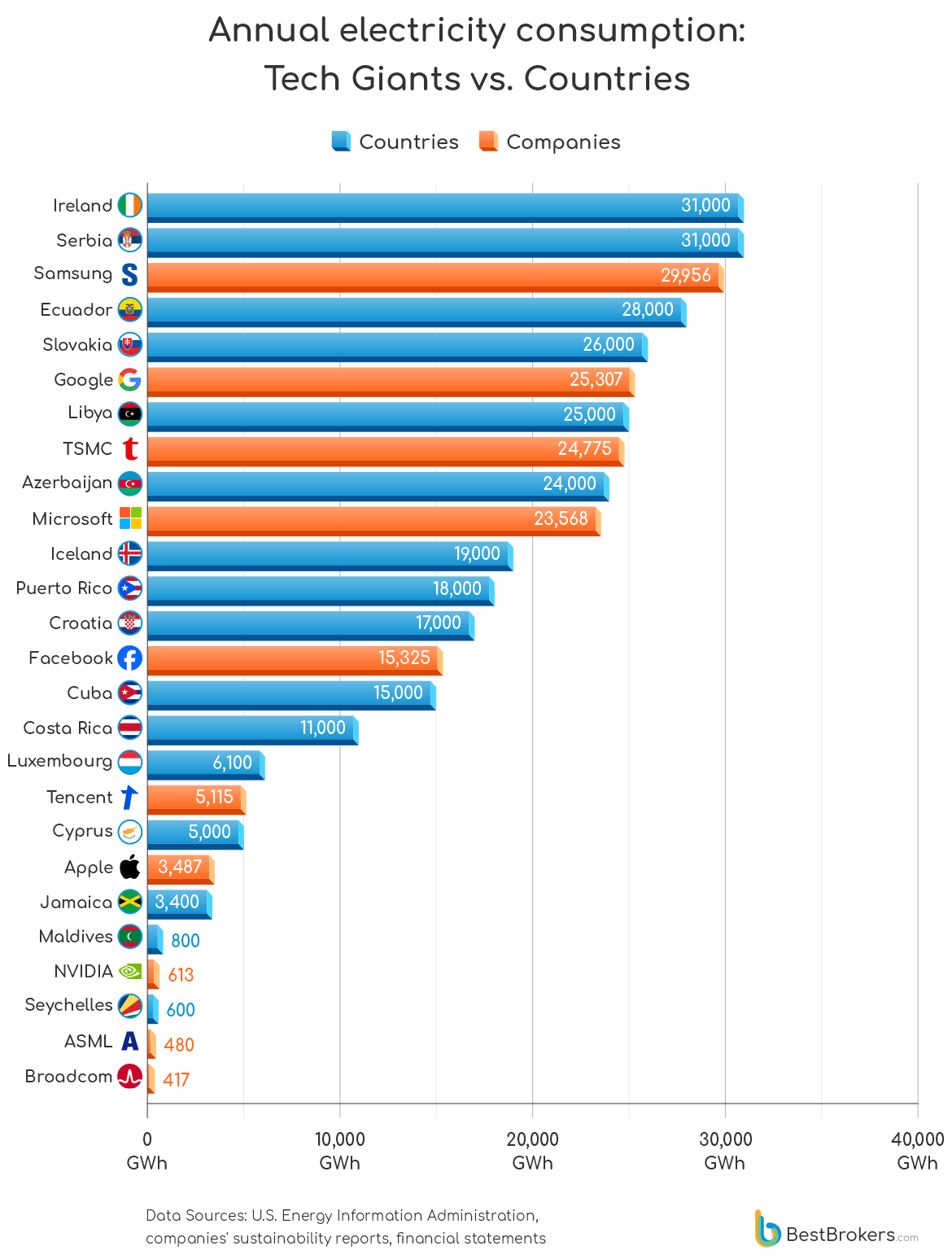

Electricity consumption in Bitcoin mining can be compared to that of entire countries, sparking debates over its sustainability. Reports indicate that Bitcoin’s energy consumption rivals that of nations like Argentina or the Netherlands, raising alarms about its long-term viability in an age where climate change considerations are paramount. Let’s dive deeper into various aspects of Bitcoin’s energy consumption.

Understanding Bitcoin Mining and Its Energy Needs

Bitcoin mining is not just a simple task; it constitutes a computational race among miners worldwide using specialized hardware known as ASICs (Application-Specific Integrated Circuits).

Miners compete to solve cryptographic puzzles generated by the Bitcoin protocol. The complexity of these puzzles increases over time, necessitating ever more powerful hardware to stay competitive in the mining space. This competition leads to a massive aggregation of computational power concentrated in mining farms, often located in regions with low electricity costs, which can lead to unsustainable energy practices.

The energy-intensive nature of this process raises critical questions regarding the sustainability of Bitcoin as a financial instrument. It invites scrutiny regarding the balance between technological advancement and environmental responsibility.

Comparing Bitcoin Mining Energy Consumption with Other Industries

To put Bitcoin’s energy consumption into perspective, it’s useful to compare it with other industries. For instance, traditional banking systems, data centers, and gold mining all have significant energy footprints.

Recent studies indicate that the global banking system consumes around 263 terawatt-hours annually, while Bitcoin mining’s figures hover around 100-120 terawatt-hours depending on market conditions and hash rates. Gold mining, another high-energy-consuming industry, adds further context: estimates suggest it can consume around 240 terawatt-hours annually.

This comparison highlights that while Bitcoin is energy-intensive, it does not operate in isolation as a unique offender in terms of energy efficiency. However, the challenge lies in the growth rate of Bitcoin mining relative to its energy usage, which is accelerating at an alarming pace.

The Role of Mining Pools in Energy Consumption

Mining pools are groups of miners that combine their computational resources to increase their chances of solving blocks. While this method can be beneficial for individual miners, it presents an aggregated energy consumption profile that can significantly raise total energy demands.

As these pools expand, they also tend to centralize processing power, leading to potential monopolistic behaviors within the network. This concentration can result in more significant energy waste, particularly if pools decide to undertake inefficient mining practices purely for profit.

The emergence of large mining pools serves to illustrate how collective efforts can amplify energy consumption, leading to greater environmental implications. Understanding this dynamic reveals the intersecting interests of profitability and sustainability within Bitcoin mining.

Quantifying Bitcoin’s Energy Footprint: Latest Data and Metrics

To evaluate the implications of Bitcoin’s energy consumption, we must closely examine the latest data and metrics available. This section attempts to provide a clear picture of Bitcoin’s current energy footprint along with some relevant statistics.

Current Global Energy Consumption Estimates

According to the Cambridge Centre for Alternative Finance, as of late 2023, Bitcoin’s annual energy consumption was estimated around 120 terawatt-hours, a number that fluctuates based on mining difficulty and price dynamics.

| Year | Estimated Annual Energy Consumption (TWh) |

|---|---|

| 2021 | 95 |

| 2022 | 105 |

| 2023 | 120 |

This table provides a snapshot of how Bitcoin’s energy consumption has evolved over recent years. As we observe increasing adoption and enhanced mining technology, this upward trend is likely to continue unless significant changes occur.

Energy Sources Behind Bitcoin Mining

Another critical aspect of Bitcoin’s energy footprint is the type of energy sources utilized for mining operations. A significant proportion of Bitcoin mining occurs in areas powered by fossil fuels—particularly coal—which exacerbates its environmental impact.

However, there are notable initiatives aimed at leveraging renewable energy sources, such as hydroelectric power, wind, and solar. Regions like Iceland and parts of China, before regulatory crackdowns, featured abundant renewable energy resources that supported eco-friendly mining efforts.

Despite these positive developments, the overall reliance on non-renewable energy remains a substantial concern. It highlights the volatility and inconsistency of mining practices when driven purely by profit motives without regard for environmental consequences.

The Economic Impact of Bitcoin Mining on Energy Markets

Bitcoin mining doesn’t exist in a vacuum; it has tangible effects on local and global energy markets. In regions where Bitcoin mining thrives, there is increased demand for electricity, sometimes leading to soaring energy prices.

This phenomenon has sparked debates about whether Bitcoin mining should be curtailed or regulated to prevent adverse effects on local economies. For example, in Texas, the surge in demand from Bitcoin mining operations has led to concerns about grid stability and energy reliability during peak demand seasons.

The economic implications of Bitcoin mining highlight the need for a careful evaluation of its role in the broader energy landscape and the need for policies that promote responsible energy consumption.

Factors Influencing Bitcoin Mining Energy Use

Several key factors influence the energy consumption associated with Bitcoin mining. Understanding these elements allows for a more nuanced analysis of Bitcoin’s sustainability and the challenges that lie ahead.

The Role of Hash Rate in Energy Consumption

Hash rate refers to the total computational power used in the mining process. As more miners join the network, the hash rate typically increases, necessitating higher amounts of energy to maintain competitiveness.

A higher hash rate means that more electricity is consumed to solve difficult mathematical puzzles. As the network grows larger, maintaining a consistent energy supply for miners becomes increasingly challenging, contributing to spikes in energy consumption.

Moreover, advancements in mining technology tend to increase the efficiency of hashing algorithms but can also lead to heightened competition, thereby escalating overall energy needs. Understanding these dynamics offers insights into how the cryptocurrency landscape may evolve.

Technological Advancements and Their Impact

Innovation in mining hardware has radically changed the energy consumption profiles of Bitcoin mining operations. The introduction of ASICs has improved efficiency, allowing miners to process more hashes per unit of energy consumed.

However, as older mining rigs become obsolete, there’s a tendency for miners to continually upgrade their equipment. This “arms race” can lead to increased energy consumption as the most advanced chips are deployed en masse, potentially overshadowing gains made through earlier efficiencies.

Moreover, discussions surrounding the circular economy and recycling of old mining equipment are becoming more prominent. Encouragingly, several initiatives aim to repurpose retired units for alternative uses, promoting sustainability in the industry.

Geopolitical Influences on Mining Practices

Geopolitical factors play a significant role in shaping Bitcoin mining’s energy landscape. Regulations, government incentives, and political stability can greatly affect the viability and sustainability of mining operations.

For example, countries with strict environmental regulations may see a decline in Bitcoin mining activities, while those that provide subsidies for renewable energy may encourage more sustainable practices. These regional disparities create a patchwork of mining practices across the globe, each influenced by local contexts.

Understanding these geopolitical realities is essential for grasping the complexities of Bitcoin’s energy consumption and overall sustainability.

Environmental Impacts of Bitcoin’s Energy Consumption

The environmental implications of Bitcoin mining are a focal point of discussion among researchers and policymakers. Analyzing these impacts reveals both the short-term challenges and longer-term considerations necessary for achieving a sustainable future.

Carbon Footprint and Climate Change

Bitcoin mining’s carbon footprint is one of the most pressing concerns. An overwhelming reliance on fossil fuels for energy generation translates into significant greenhouse gas emissions.

Studies estimate that Bitcoin mining alone contributes approximately 0.5% of the global carbon emissions, a staggering figure considering its relatively nascent status in the financial ecosystem.

These emissions exacerbate climate change, leading to severe weather events, rising sea levels, and biodiversity loss. As the world grapples with climate challenges, the urgency surrounding Bitcoin’s environmental impact becomes increasingly pronounced.

Resource Depletion and Land Use

Beyond carbon emissions, Bitcoin mining poses risks related to resource depletion and land use. The extraction of raw materials needed for ASIC manufacturing—such as metals and rare earth elements—contributes to ecological degradation and habitat loss.

Additionally, large-scale mining operations often require substantial physical infrastructure, including warehouses and cooling systems to mitigate heat from mining rigs. This infrastructure can occupy vast tracts of land, diverting resources away from agricultural or natural landscapes.

These cumulative effects underline the importance of adopting a holistic view when assessing Bitcoin’s true environmental impact. The quest for sustainability must encompass not only energy consumption but also the broader ecological footprint of mining operations.

Water Usage in Bitcoin Mining Operations

Interestingly, water usage is another environmental dimension often overlooked in Bitcoin mining discussions. Many mining facilities rely on water-cooling systems to manage the excess heat generated by mining hardware.

In regions where water scarcity is already a pressing issue, this consumption can further strain local resources. Mining operations must adopt responsible practices, ensuring they do not disproportionately burden communities facing water shortages.

Understanding water usage alongside energy consumption paints a more comprehensive picture of Bitcoin mining’s environmental impacts and highlights areas where improved practices can foster sustainability.

Debunking Misconceptions About Bitcoin’s Energy Usage

Numerous misconceptions surround Bitcoin’s energy consumption, often clouding public understanding of its environmental impacts. This section aims to clarify these misunderstandings and present an informed perspective.

Bitcoin Energy Consumption vs. Traditional Financial Systems

One common misconception is equating Bitcoin’s energy consumption with that of the traditional banking system. While both systems consume significant energy, the comparisons often overlook nuances like transaction volume and operational efficiency.

For instance, traditional banks engage in numerous energy-intensive operations that extend beyond mere transaction validation. They involve maintaining physical branches, ATMs, and countless servers, all consuming energy in tandem.

Evaluating energy consumption requires a nuanced context, as different systems have unique operational frameworks that influence their overall efficiency.

Misunderstanding Renewable Energy Contributions

Another misconception stems from the belief that Bitcoin mining is inherently bad for renewable energy development. While it’s true that many miners rely on fossil fuels, trends are emerging toward utilizing renewable energy sources.

Countries rich in renewable energy, such as Iceland and Norway, have seen Bitcoin mining operations flourish, drawing on environmentally friendly energy supplies. Moreover, interest in harnessing excess energy from solar and wind installations for mining purposes is gaining traction.

Promoting these narratives can reshape perceptions about Bitcoin’s role in renewable energy markets, fostering a more balanced view of its sustainability potential.

The Myth of Inevitability

Some argue that Bitcoin’s energy consumption is an inevitable consequence of its design and cannot be mitigated. This notion overlooks the proactive measures being implemented in the mining industry aimed at reducing energy consumption.

Innovations in energy-efficient mining technologies, improved algorithm designs, and the utilization of renewable energy all indicate that sustainable pathways are possible. These developments demonstrate that the narrative of inevitability can be challenged through actionable change.

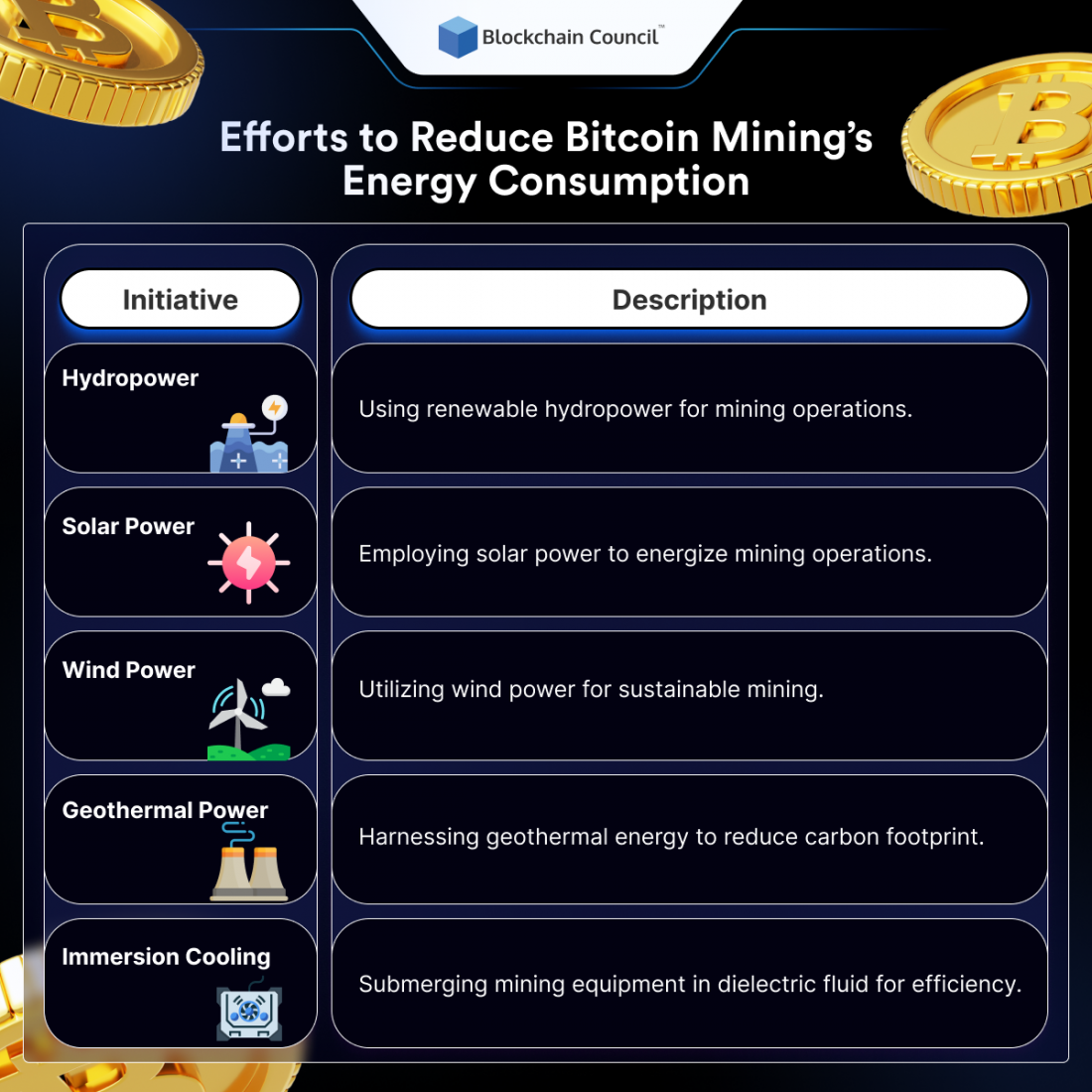

Sustainable Solutions and Innovations for Bitcoin Mining

Addressing Bitcoin’s energy consumption requires innovative approaches and sustainable solutions that can transform mining practices. This section explores some promising strategies currently being developed in the field.

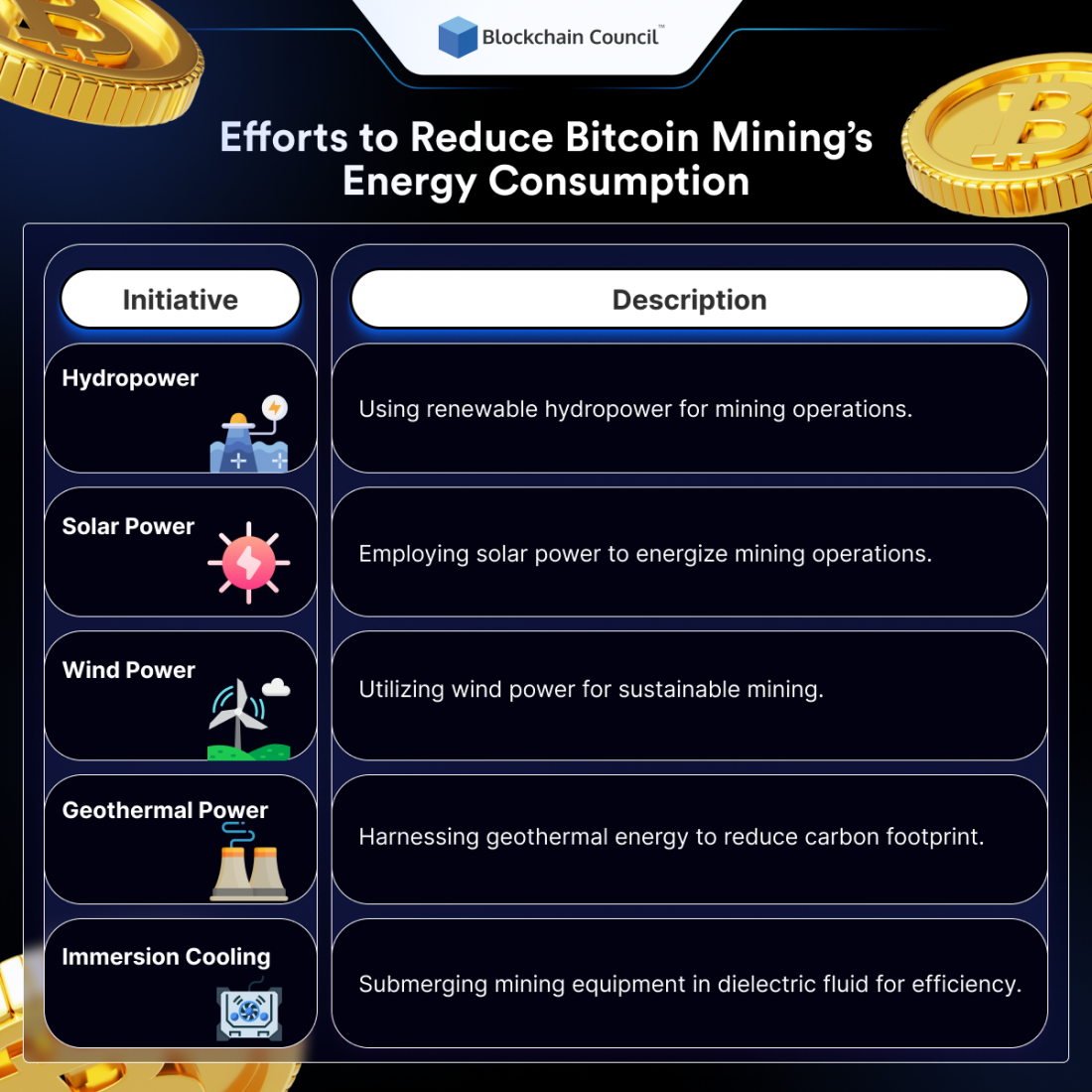

The Transition Towards Renewable Energy

Transitioning toward renewable energy sources represents one of the most viable pathways for sustainable Bitcoin mining. Miners are increasingly recognizing the long-term benefits of green energy, from cost savings to improved public perception.

Regions that offer access to low-cost renewable energy sources are becoming hotspots for mining operations. Solar farms, wind turbines, and hydroelectric plants are being integrated into mining infrastructures, enabling miners to draw from cleaner energy sources.

Collaboration between miners and renewable energy producers is crucial for scaling these efforts. By aligning economic interests with environmental goals, the Bitcoin community can drive real change.

Technological Innovations in Energy Efficiency

Advancements in hardware and software optimization can significantly enhance the energy efficiency of Bitcoin mining. New mining rigs and protocols designed with energy conservation in mind can lead to lower consumption rates.

Additionally, innovations in cooling technologies can help reduce energy expenditure associated with thermal management. Techniques such as immersion cooling, which submerges hardware in special fluids, can effectively control temperatures while minimizing energy use.

These innovations highlight the potential for continuous improvement within the Bitcoin mining ecosystem, providing compelling alternatives to current practices.

Policy Frameworks Supporting Sustainable Practices

Government and regulatory bodies play a pivotal role in shaping the sustainability of Bitcoin mining. Establishing supportive policies can incentivize firms to adopt greener practices, fostering a more sustainable industry.

Policies that prioritize transparency and accountability regarding energy consumption can encourage better practices. Initiatives like tax breaks for miners who utilize renewable energy or penalties for excessive consumption may yield positive outcomes.

Community engagement is also essential in informing and shaping these policies. Bringing together stakeholders from various sectors can foster collaboration and drive meaningful change.

Conclusion

Bitcoin energy consumption facts reveal a complex interplay of technological progress, economic incentives, and environmental considerations. The ongoing debate surrounding Bitcoin mining’s sustainability underscores the necessity for innovative solutions that prioritize responsible energy use. By exploring the factors influencing energy consumption, identifying environmental impacts, and debunking misconceptions, we can pave the way for a more sustainable future for Bitcoin. Emphasizing collaboration between miners, renewable energy providers, and policymakers can ultimately ensure that Bitcoin evolves without compromising our planet.