2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This alarming statistic highlights the significant HIBT risk associated with cross-chain interoperability. In our increasingly connected digital finance space, it is essential to address these risks promptly.

1. What is Cross-Chain Interoperability and Why Does it Matter?

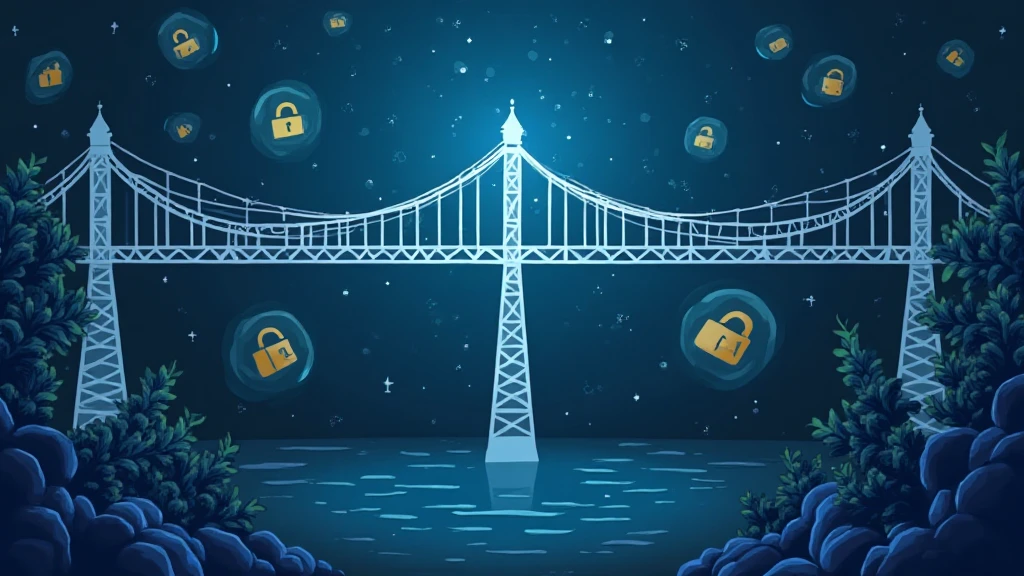

Think of cross-chain interoperability like currency exchange booths—just as you need to swap one currency for another when traveling, cross-chain bridges allow different blockchain networks to communicate and transact with each other. If these bridges aren’t secure, your funds can easily fall into the wrong hands, much like exchanging cash at a shady booth.

2. Identifying Security Vulnerabilities in Cross-Chain Bridges

Many users may not be aware that some cross-chain bridges have hidden vulnerabilities, making them susceptible to hacks. Just like checking a restaurant’s hygiene rating before dining, it’s crucial to check the security audits of these bridges before using them. Organizations can use Code Analysis tools to evaluate the safety of smart contracts.

3. The Role of Zero-Knowledge Proof Applications in Enhancing Security

Imagine playing a game of poker where you can prove you have a winning hand without revealing your cards. Zero-knowledge proofs (ZKPs) function in a similar manner, allowing secure transactions without exposing sensitive data. By integrating ZKPs into cross-chain bridges, we can significantly reduce HIBT risk and bolster overall network security.

4. Regulatory Trends to Watch in 2025

The future of DeFi regulations, especially in places like Singapore, is continuously evolving. As countries establish frameworks to govern decentralized finance, understanding the regulatory landscape is crucial. For instance, Singapore’s Monetary Authority has been increasingly focused on ensuring compliance, ensuring that user rights are protected while minimizing HIBT risks involved in cross-chain transactions.

In conclusion, addressing HIBT risk in cross-chain bridging requires a multi-faceted approach involving secure coding practices, the integration of technologies like zero-knowledge proofs, and insight into evolving regulations. To navigate these complexities, download our comprehensive tool kit now!

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult local regulatory bodies such as MAS or SEC before making investment decisions.

For more security insights, check our cross-chain security white paper and see how tools like Ledger Nano X can help you reduce private key leakage risk by 70%!