Understanding HIBT Crypto Tax Strategies for 2025

Understanding HIBT Crypto Tax Strategies for 2025

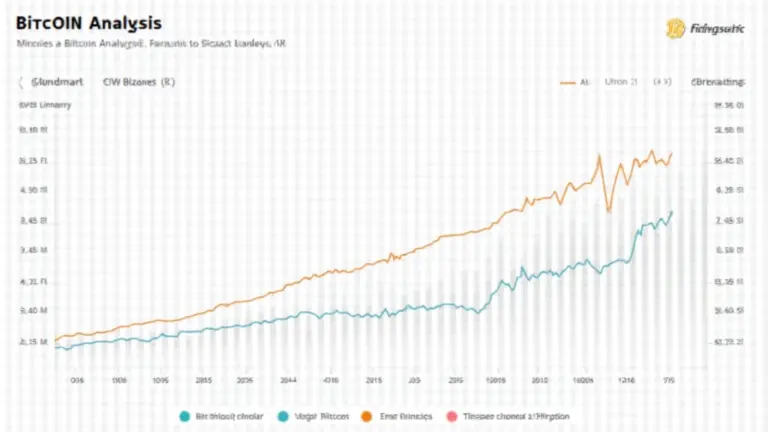

According to Chainalysis data for 2025, a staggering 73% of crypto users remain unaware of essential tax obligations related to their holdings. As the crypto landscape evolves, understanding HIBT crypto tax strategies becomes imperative for investors and traders alike.

What is HIBT in Crypto Taxation?

HIBT, or How Individuals Benefit from Taxation, encapsulates the myriad of strategies that crypto investors can employ to optimize their tax obligations. Think of it as having a well-thought-out plan when doing your grocery shopping. Just like how you wouldn’t buy everything that looks good on the shelf without checking your budget, you shouldn’t navigate crypto taxes without a strategy.

Key Considerations for Tax Reporting

One important aspect of HIBT crypto tax strategies is accurate reporting. For example, if you have ever filled out your tax forms, you know how every little detail matters. It’s similar in the crypto world; each transaction needs careful documentation, especially with the rise of DeFi platforms. By 2025, experts anticipate significant regulatory changes in Singapore that could further complicate this landscape.

Cross-Chain Interoperability and Tax Implications

Cross-chain interoperability allows users to move assets between different blockchain networks easily. Imagine it as a currency exchange booth where you can easily swap dollars for euros. While this capability is beneficial, it also complicates tax reporting. You may find yourself needing to document your transactions across different platforms, which can lead to potential tax liabilities you hadn’t considered.

Zero-Knowledge Proofs and Their Tax Landscape

Zero-knowledge proofs (ZKP) offer a way to prove ownership of assets without revealing transaction details. It’s like saying you have an item in your shopping cart without letting others see your entire list. As these technologies advance, utilizing ZKP can become a part of HIBT crypto tax strategies by potentially helping to minimize the reported income you need to declare.

Conclusion

In summary, navigating the evolving landscape of HIBT crypto tax strategies in 2025 requires awareness and preparation. Investors should stay informed about local regulations, especially in regions like Dubai, where cryptocurrency taxation is still taking shape. To assist in this endeavor, download our comprehensive toolkit to ensure you’re ready for the upcoming tax season.

Remember, this article does not constitute investment advice, and you should always consult with your local regulatory authorities like MAS or SEC before making any financial decisions.

For more detailed strategies, check out our crypto tax strategy page and view our security white paper for further insights.

Invest in a Ledger Nano X to reduce your risk of private key exposure by up to 70%.

Written by Dr. Elena Thorne, former IMF Blockchain Advisor and ISO/TC 307 Standard Developer.