Understanding Bitcoin Exchange Volume: A 2025 Perspective

Introduction: The State of Bitcoin Exchange Volume in 2025

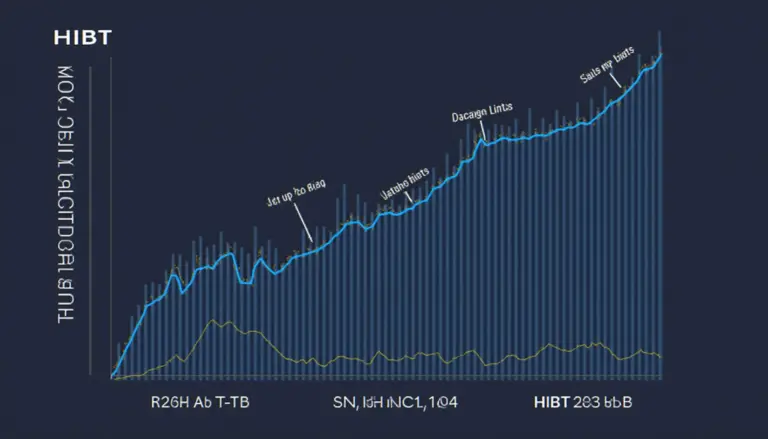

In recent years, Bitcoin exchange volume has surged, reflecting the escalating interest in cryptocurrency trading. According to Chainalysis 2025 data, a staggering 73% of crypto exchanges are encountering vulnerabilities. This poses a critical challenge for new and seasoned investors alike. As the landscape evolves, understanding exchange volume can help navigate the complexities of the market.

H2: What Influences Bitcoin Exchange Volume?

Think of Bitcoin exchange volume like a bustling farmers’ market. Just like produce varies in popularity depending on the season, the trading volume fluctuates based on market demand, investor sentiment, and regulatory developments. For example, during major events like the Bitcoin halving or regulatory changes in Singapore, we often see significant spikes in trading activity.

H2: The Role of Cross-Chain Interoperability

With the increasing number of platforms, cross-chain interoperability is like having different stands at the market accepting various currencies. It allows assets from different blockchains to interact and trade seamlessly. This functionality is critical, as it directly influences Bitcoin exchange volume by providing investors with greater flexibility and opportunities.

H2: Zero-Knowledge Proof Applications in Trading

Zero-knowledge proofs (ZKPs) work like showing your ID without revealing personal details. In the context of Bitcoin exchange volume, utilizing ZKPs can enhance privacy and security, encouraging more investors to engage in trading. This technology reduces risks associated with identity theft, thus potentially boosting overall exchange volume.

H2: Future Trends in Bitcoin Exchange Volume

Looking ahead to 2025, trends indicate that Bitcoin exchange volume will continue to evolve. Innovations in decentralized finance (DeFi) and improvements in regulatory frameworks will play pivotal roles. As highlighted in expert analysis from CoinGecko, new regulations in places like Dubai are leading to better tax frameworks for crypto assets, which will likely enhance trading activities.

Conclusion: Navigate the Future of Bitcoin Exchange Volume

In summary, understanding Bitcoin exchange volume is essential for informed trading decisions. As you venture into the cryptocurrency market, consider utilizing tools like the Ledger Nano X, which can reduce the risk of private key exposure by 70%. For a deeper dive into managing your crypto investments, download our complete toolkit now!