2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

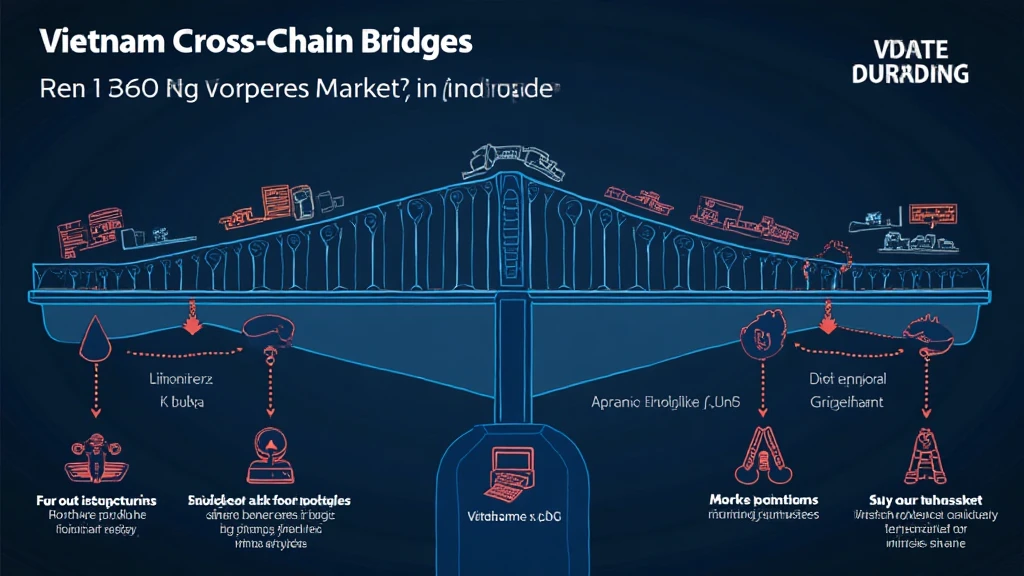

According to Chainalysis 2025 data, an alarming 73% of cross-chain bridges are found to have vulnerabilities, exposing traders and investors to significant risks. This raises critical questions about the safety and efficiency of the crypto market Vietnam as it evolves.

What Are Cross-Chain Bridges?

To understand this concept, think of cross-chain bridges as currency exchange booths. Just like how you swap your dollars for euros at an airport, cross-chain bridges facilitate the transfer of assets between different blockchain networks. This technology is crucial for enhancing interoperability in the crypto space, but it also comes with its own set of risks.

Identifying Key Vulnerabilities

In a world where assets are becoming increasingly digital, identifying vulnerabilities is essential. Your typical Vietnamese shopkeeper might not realize that just one unpatched vulnerability in a cross-chain bridge could lead to massive losses. Regular audits and updates, akin to checking your shop’s security, can significantly reduce these risks in the crypto market Vietnam.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs (ZKPs), much like a magician’s trick, allow one party to prove to another that they possess certain information without revealing the actual data. In the context of cross-chain bridges, ZKPs can help enhance privacy and security, ensuring that transactions carry reduced risk in the volatile crypto market Vietnam.

Future of Cross-Chain Security Audits

As we step into 2025, the future of cross-chain security audits looks promising. With trends in audits mirroring the growth of DeFi regulations in places like Singapore, crypto enthusiasts need to stay informed. Collaboration among industry stakeholders is essential, similar to how cafes and ice cream shops in Vietnam come together to create a vibrant market for food lovers.

In conclusion, understanding the strengths and weaknesses of cross-chain bridges is paramount to safeguarding investments. Download our comprehensive toolkit for best practices and audit checklists to ensure your assets remain secure in the evolving crypto market Vietnam.

For additional insights, visit our resources on cross-chain security whitepaper and please consult local regulatory authorities like the MAS or SEC before taking any action related to crypto investments.

Disclaimer: This article does not constitute investment advice. For your financial security, always verify with your local regulatory body.

Use tools like Ledger Nano X to mitigate risks; completing 70% of private key leak prevention is a step in the right direction.

Written by: Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standards Developer | Published 17 IEEE Blockchain Papers