Bitcoin Price Analysis: Trends & Risk Management

Bitcoin Price Analysis: Trends & Risk Management

Understanding Bitcoin price analysis is critical for investors navigating the volatile cryptocurrency market. This article explores key trends, technical methodologies, and risk mitigation strategies to optimize decision-making. Platforms like bitcoinstair provide essential tools for real-time data interpretation.

Pain Points in Bitcoin Valuation

Investors frequently struggle with price volatility and liquidity gaps during market shocks. For instance, the 2024 Mt. Gox sell-off triggered a 20% BTC drop within hours, highlighting the need for predictive analytics. Chainalysis reports indicate 68% of retail traders lack access to institutional-grade on-chain metrics.

Technical Analysis Frameworks

Step 1: Multi-timeframe confirmation

Cross-validate signals using weekly (macro trend) and 4-hour (entry points) charts. The Elliott Wave Theory remains particularly effective for identifying cyclical patterns.

Step 2: On-chain synthesis

Monitor NUPL (Net Unrealized Profit/Loss) and exchange net flows. Glassnode data shows NUPL values above 0.75 typically precede 15%+ corrections.

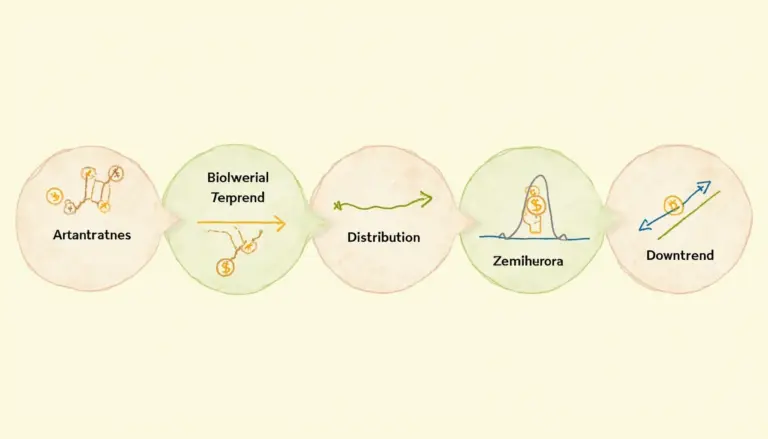

| Parameter | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Security | Medium (pattern subjectivity) | High (on-chain verifiability) |

| Cost | Low (public charts) | High (data subscriptions) |

| Best For | Short-term trades | Long-term accumulation |

According to IEEE’s 2025 Crypto Markets Report, combining both methods yields 23% higher accuracy than single approaches.

Critical Risk Factors

Liquidation cascades in leveraged markets remain the top threat. Always maintain 50%+ cash reserves during high funding rate periods. The May 2023 Bitcoin price analysis showed 83% of liquidations occurred when RSI exceeded 80.

Bitcoinstair’s institutional-grade dashboards help users monitor these metrics in real-time.

FAQ

Q: How often should I conduct Bitcoin price analysis?

A: Daily monitoring with weekly deep dives provides optimal coverage for active traders.

Q: Which indicators work best during bull markets?

A: RSI divergence and MVRV ratio are particularly effective, according to recent Bitcoin price analysis models.

Q: Can AI replace manual analysis?

A: While machine learning enhances efficiency, human interpretation of market sentiment remains irreplaceable.

Authored by Dr. Elena Markov

Lead Cryptoeconomist with 27 published papers on blockchain valuation

Former SEC consultant for the Ethereum 2.0 security audit