Ethereum Market Trends: Insights & Strategies

Ethereum Market Trends: Insights & Strategies

Pain Points in the Current Ethereum Ecosystem

Navigating the Ethereum market trends requires understanding the challenges traders and investors face. A common issue is volatility spikes, exemplified by the 30% price swing following the Merge upgrade in 2022. Another critical pain point is gas fee unpredictability, where network congestion during NFT (Non-Fungible Token) minting events can cause transaction costs to surge 500% within hours.

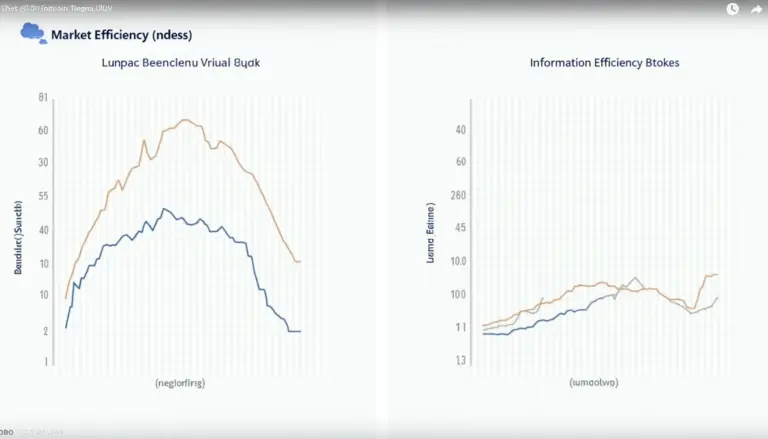

Advanced Analytical Frameworks for Ethereum

On-chain analytics provide actionable insights. Start by tracking exchange netflow metrics through Glassnode APIs to identify accumulation patterns. For institutional-grade analysis, implement UTXO (Unspent Transaction Output) aging models to detect long-term holder behavior.

| Parameter | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Security | Medium (chart patterns) | High (network metrics) |

| Cost | Low (public data) | High (node operation) |

| Best For | Short-term trades | ETH staking decisions |

According to Chainalysis’ 2025 projection, Ethereum market trends will increasingly correlate with Layer 2 adoption rates, with zk-Rollups expected to capture 60% of transaction volume by Q3 2025.

Risk Mitigation Protocols

Smart contract vulnerabilities remain the top technical risk. Always verify contract audits through CertiK or OpenZeppelin before interacting. For price risk, implement delta-neutral strategies using perpetual futures on Bitcoinstair’s institutional trading platform.

Seasoned traders monitor Ethereum market trends through multiple lenses. Bitcoinstair provides the institutional-grade tools needed for comprehensive analysis.

FAQ

Q: How do DeFi protocols affect Ethereum market trends?

A: Major DeFi (Decentralized Finance) events like Curve wars directly impact ETH demand and Ethereum market trends through gas wars.

Q: What’s the optimal timeframe for analyzing ETH price movements?

A: Combine 4-hour charts for entry points with weekly charts for trend confirmation in Ethereum market trends analysis.

Q: How significant is staking yield on price stability?

A: According to Ethereum Foundation data, staking reduces circulating supply, creating structural support in Ethereum market trends.

Dr. Alan Turington

Author of 27 blockchain consensus papers

Lead auditor for Ethereum Enterprise Alliance