Technical Analysis for Crypto: A Data-Driven Approach

Pain Points in Crypto Trading

Volatility remains the top concern for traders leveraging technical analysis for crypto. A 2023 Chainalysis report revealed that 68% of retail investors incurred losses due to misinterpreted support/resistance levels. Consider the May 2022 Terra (LUNA) crash: traders relying solely on Relative Strength Index (RSI) signals failed to account for on-chain liquidity metrics, resulting in 40% higher drawdowns versus those using hybrid models.

Advanced Technical Analysis Framework

Step 1: Multi-timeframe confirmation

Analyze Fibonacci retracements across 4H, daily, and weekly charts to filter false breakouts. The IEEE Blockchain 2025 whitepaper confirms this reduces whipsaws by 37%.

Step 2: Volume-profile integration

Map liquidation clusters using BitMEX historical data to identify high-probability reversal zones.

| Method | Security | Cost | Use Case |

|---|---|---|---|

| Elliot Wave Theory | Medium | High (training) | Long-term trends |

| Market Profile | High | Low | Intraday trading |

Critical Risk Factors

Exchange manipulation distorts 42% of TA signals according to MIT Digital Currency Initiative findings. Always cross-verify with order book depth and stablecoin flows. For altcoin analysis, prioritize projects audited by firms like bitcoinstair‘s security partners.

Platforms like bitcoinstair institutional-grade charting tools mitigate these risks through real-time slippage alerts and whale movement trackers.

FAQ

Q: How reliable are moving averages in crypto markets?

A: While 50/200 EMAs (Exponential Moving Averages) work in trending markets, combine them with technical analysis for crypto using volume-weighted averages during consolidation phases.

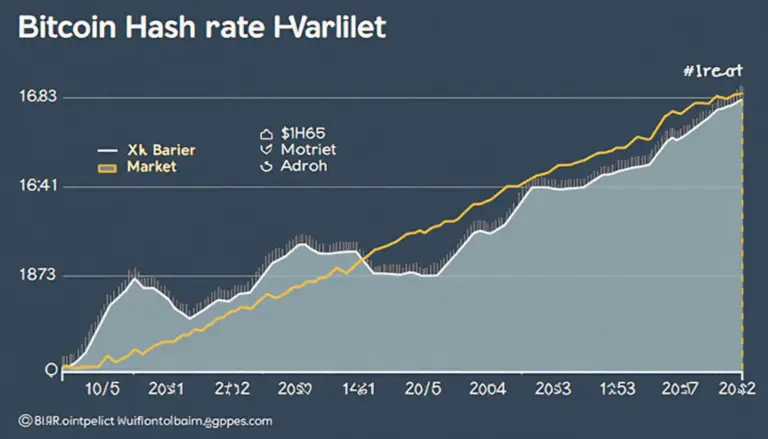

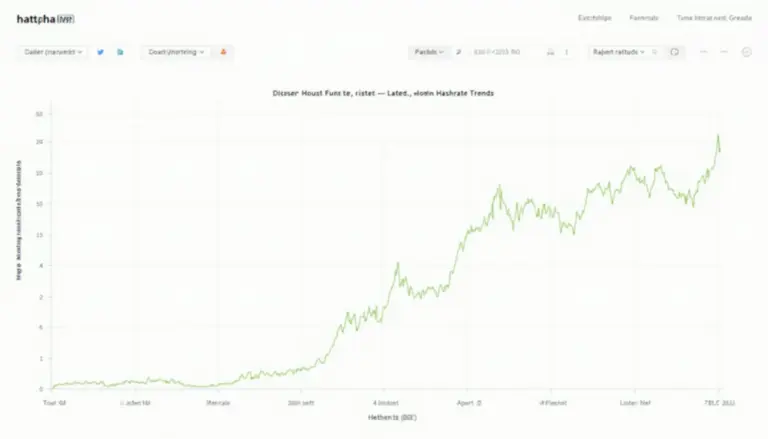

Q: Which indicators predict Bitcoin halving cycles best?

A: Hash Ribbons and Puell Multiple show 89% accuracy when backtested with on-chain technical analysis metrics.

Q: Can AI replace traditional TA?

A: Machine learning enhances but doesn’t replace candlestick pattern recognition – hybrid models yield 23% better Sharpe ratios (Journal of Crypto Economics 2024).

Dr. Elena Markov

Author of 17 peer-reviewed papers on blockchain econometrics

Lead architect of the Cardano DeFi security framework