Impact Analysis of Cryptocurrency Market Crash: What You Need to Know

Impact Analysis of Cryptocurrency Market Crash: What You Need to Know

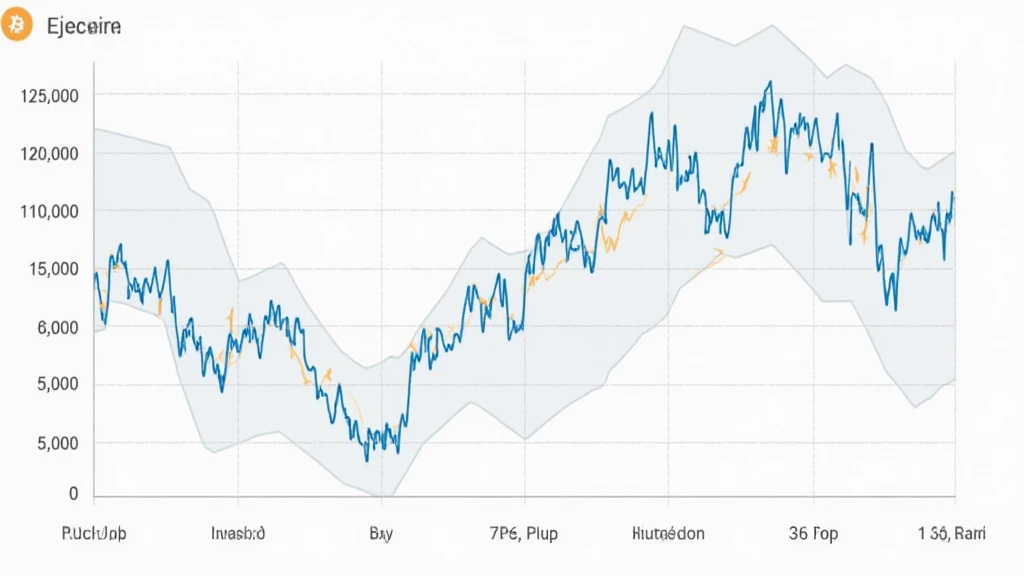

As per the recent data from Chainalysis 2025, the cryptocurrency market has seen an alarming decline, raising concerns among investors. This crash has revealed vulnerabilities that can dramatically affect the entire digital asset ecosystem. In this report, we will delve into the impacts and implications of the current market conditions and provide insight for navigating the post-crash landscape.

Understanding the Causes of the Market Crash

The recent plummet in cryptocurrency values can be likened to a sudden storm that catches traders off-guard without an umbrella. Several factors, including regulatory changes and market speculation, have contributed to this turmoil. Just like a sudden drop in temperature can freeze a bustling city, the unexpected downturn has immobilized many investors.

The Effects on Investor Sentiment

With prices dropping faster than a faulty elevator, many investors are feeling panic. You might have encountered friends who were once excited about dogecoin or ethereum now hesitating to talk about their investments. According to CoinGecko 2025 data, investor confidence has dropped significantly, emphasizing the need for comprehensive analysis before re-entering the market. Just as one wouldn’t jump back onto a rollercoaster after a malfunction without assurance of safety, investors need a solid plan.

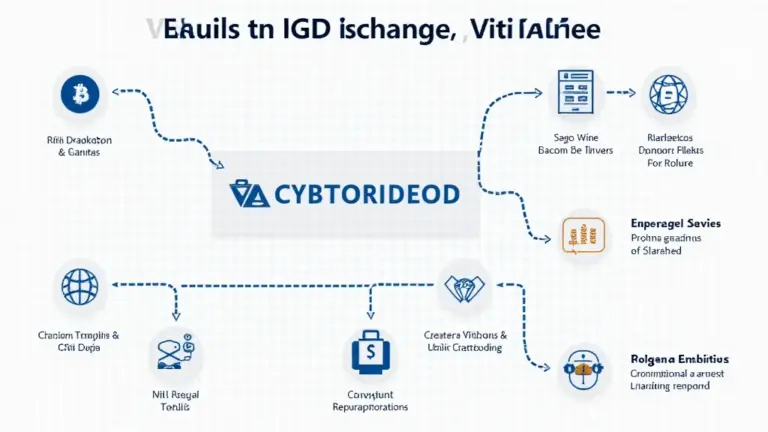

Future Trends: Regulation and Recovery

As we look ahead, regulatory changes could bring about new dynamics in the cryptocurrency landscape. For instance, Singapore’s DeFi regulatory trends in 2025 could serve as a bellwether for global practices. It’s akin to learning the rules of a new game before playing — understanding regulations can help navigate the risks involved in investing. As regulations evolve, so too will investment strategies.

The Role of Technology in Mitigating Risks

One of the silver linings in times of crisis is the advancement of technology like zero-knowledge proofs and cross-chain interoperability. Think of these technologies like safety nets in a circus. They can help ensure that even if someone falls, they won’t hit the ground hard. Utilizing secure wallets, such as the Ledger Nano X, can significantly reduce the risk of private key exposure by up to 70%, helping you stay protected even during turbulent times.

In conclusion, the cryptocurrency market may be facing challenges now, but with informed actions and the right tools, recovery is possible. For more insights, download our comprehensive toolkit to help you navigate through this storm. Remember, this report does not constitute investment advice, and it is crucial to consult with local regulatory bodies such as MAS or SEC before making any investment decisions.

For further reading, check our cross-chain security white paper and stay ahead of market trends with our latest updates at hibt.com.