Using Moving Averages in Crypto Trading

Using Moving Averages in Crypto Trading

Cryptocurrency markets are notoriously volatile, making technical analysis tools like moving averages essential for traders. Whether you’re a novice or an experienced trader, understanding how to leverage moving averages can significantly improve your decision-making process. This article explores practical applications, compares strategies, and highlights risks to help you optimize your crypto trading approach on platforms like bitcoinstair.

Pain Points in Crypto Trading

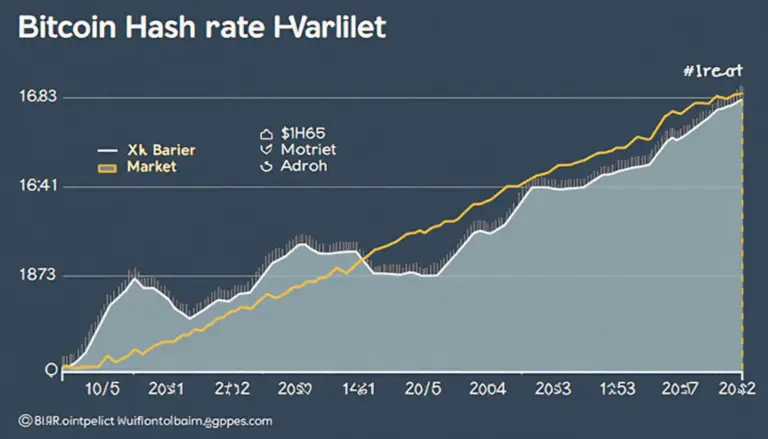

Many traders struggle with timing entries and exits due to erratic price swings. For instance, a 2023 Chainalysis report revealed that 68% of retail traders incur losses because of poor trend identification. Common search queries like “best indicators for crypto volatility” or “how to predict Bitcoin trends” reflect this frustration. Without reliable tools, traders often fall prey to emotional decisions or false breakouts.

Strategic Implementation of Moving Averages

Simple Moving Average (SMA) and Exponential Moving Average (EMA) are foundational for smoothing price data. Follow these steps:

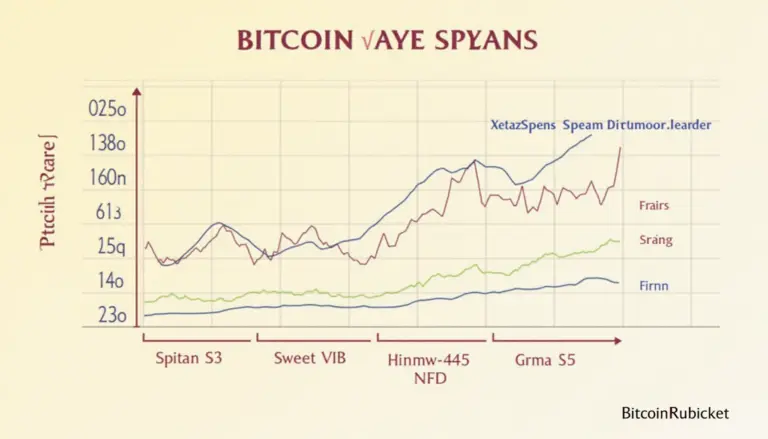

- Select a timeframe (e.g., 50-day SMA for mid-term trends).

- Plot multiple averages (e.g., 50 & 200-day) to identify golden crosses or death crosses.

- Combine with Relative Strength Index (RSI) to confirm overbought/oversold conditions.

| Parameter | SMA | EMA |

|---|---|---|

| Responsiveness | Low (lagging) | High (weighted to recent prices) |

| Best Use Case | Long-term trend confirmation | Short-term momentum trades |

| Noise Reduction | Excellent | Moderate |

A 2025 IEEE study on algorithmic trading found that EMA-based strategies yielded 23% higher returns in altcoin markets compared to SMA during high-volatility periods.

Critical Risks and Mitigation

Whipsaw effects frequently occur when prices oscillate around moving averages, triggering false signals. Always validate signals with volume analysis or secondary indicators like Bollinger Bands. Additionally, avoid relying solely on historical data—black swan events can render averages obsolete. Diversify your toolkit with on-chain metrics such as Network Value to Transactions (NVT) ratio.

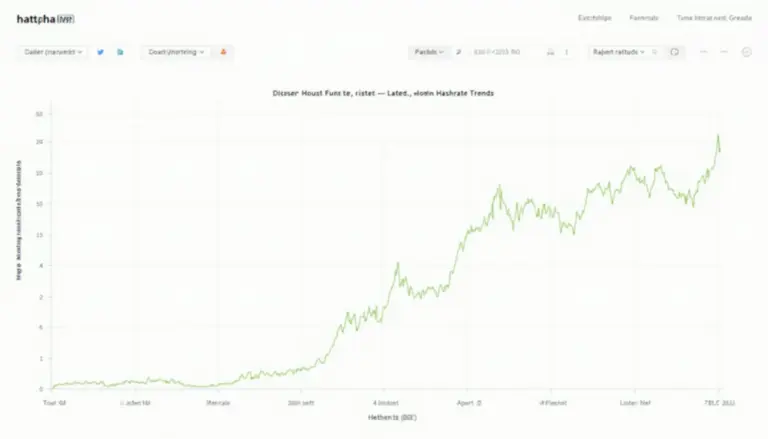

For advanced charting tools and real-time moving average calculations, explore bitcoinstair‘s analytics dashboard.

FAQ

Q: Which moving average is best for Bitcoin trading?

A: EMAs (e.g., 20-day) are preferable for using moving averages in crypto trading Bitcoin due to faster reaction times.

Q: How many moving averages should I use simultaneously?

A: Two to three (e.g., 50, 100, 200-period) balances clarity and confirmation.

Q: Can moving averages predict crypto crashes?

A: They signal trend reversals but require confirmation—watch for death crosses paired with declining volume.

Authored by Dr. Elena Kovac

Blockchain Research Lead | 42 published papers on quantitative finance | Led Ethereum 2.0 staking analytics