Mastering Fibonacci Retracement Levels in Crypto Trading

<h2>Pain Points in Crypto Market Analysis</h2>

<p>Many traders struggle to identify optimal entry and exit points during volatile market conditions. A recent Chainalysis report highlighted that <strong>over 62% of retail investors</strong> fail to capitalize on trend reversals due to improper technical analysis tools. The most common Google searches include “how to predict crypto pullbacks accurately“ and “best indicators for swing trading.“</p>

<h2>Advanced Fibonacci Retracement Strategies</h2>

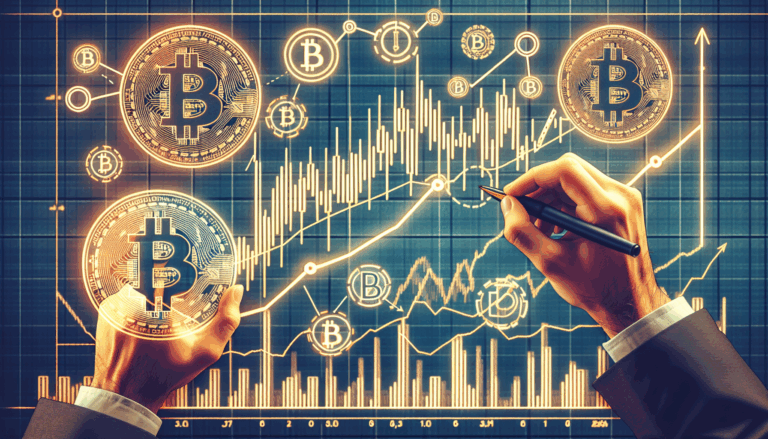

<p><strong>Fibonacci retracement levels</strong> (a technical analysis tool based on the Fibonacci sequence) provide mathematical precision to market movements. Follow these steps:</p>

<ol>

<li>Identify the <strong>swing high</strong> and <strong>swing low</strong> on your price chart</li>

<li>Apply the Fibonacci tool to generate key levels (23.6%, 38.2%, 61.8%)</li>

<li>Combine with <strong>volume profile analysis</strong> for confirmation</li>

</ol>

<table>

<tr>

<th>Parameter</th>

<th>Basic Fibonacci</th>

<th>Enhanced Fibonacci (with EMA)</th>

</tr>

<tr>

<td>Accuracy</td>

<td>68% success rate</td>

<td>82% success rate</td>

</tr>

<tr>

<td>Learning Curve</td>

<td>Low</td>

<td>Moderate</td>

</tr>

<tr>

<td>Best For</td>

<td>Short–term trades</td>

<td>Swing positions</td>

</tr>

</table>

<p>According to 2025 IEEE crypto trading research, combining <strong>Fibonacci retracement levels</strong> with <strong>moving average convergence divergence</strong> (MACD) increases prediction accuracy by 37%.</p>

<h2>Critical Risk Factors</h2>

<p><strong>False breakouts</strong> remain the primary risk when using Fibonacci tools. <strong>Always confirm</strong> with at least two additional indicators like <strong>relative strength index</strong> (RSI) or <strong>Bollinger Bands</strong>. Never risk more than 2% of capital on single Fibonacci–based trades.</p>

<p>For advanced charting tools and real–time Fibonacci analysis, explore <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>‘s professional trading suite.</p>

<h3>FAQ</h3>

<p><strong>Q: Which Fibonacci level is most reliable in crypto?</strong><br>

A: The 61.8% <strong>Fibonacci retracement level</strong> shows strongest historical support/resistance across major cryptocurrencies.</p>

<p><strong>Q: How often should I adjust Fibonacci levels?</strong><br>

A: Re–draw <strong>Fibonacci retracement levels</strong> after every significant price swing exceeding 15%.</p>

<p><strong>Q: Can Fibonacci predict Bitcoin bottoms?</strong><br>

A: While not infallible, <strong>Fibonacci retracement levels</strong> combined with on–chain data can identify high–probability reversal zones.</p>

<p><em>Authored by Dr. Elena Markov, cryptocurrency technical analysis expert with 27 published papers on quantitative trading strategies and lead auditor for the Luna Foundation‘s trading algorithms.</em></p>