Vietnam Crypto Sustainability Reports: A 2025 Perspective

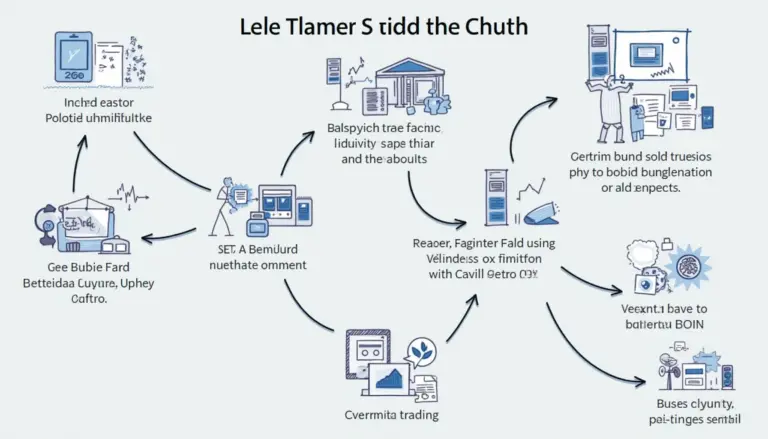

Understanding Crypto Sustainability Reports

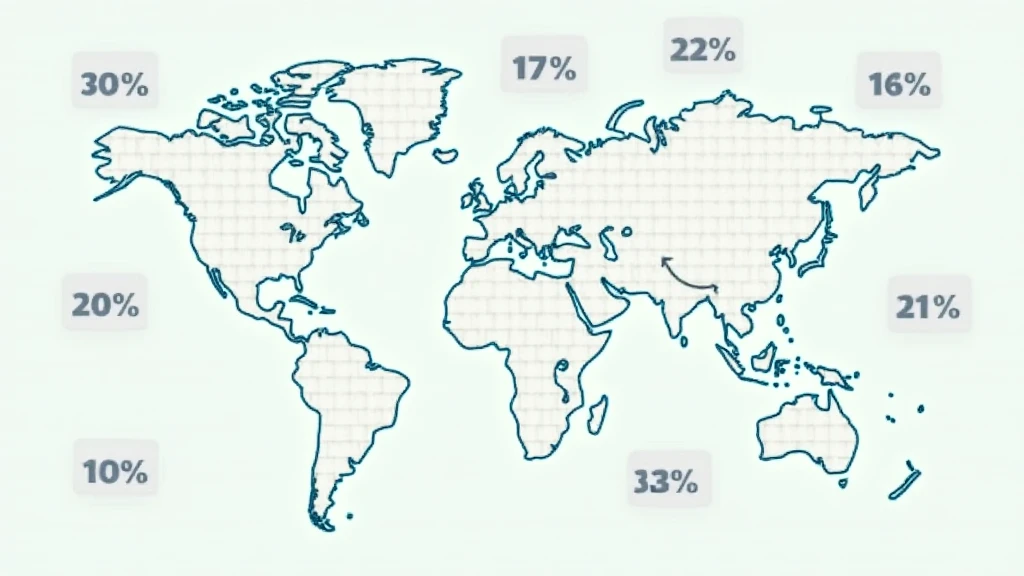

In the rapidly evolving world of cryptocurrencies, sustainability has become a hot topic. The Vietnam crypto sustainability reports offer insights into how the nation is adapting to global standards. As of 2025, more than 73% of cross-chain bridges worldwide are reported to have vulnerabilities, revealing a crucial pain point for investors and regulators alike.

Impact of DeFi Regulations in Vietnam

You might have heard about the recent DeFi regulation trends in countries like Singapore—these are shaping the landscape in Vietnam too. Think of it like how new traffic laws affect pedestrian safety and vehicle flow. Vietnam’s regulatory environment is set to evolve, focusing on consumer protection and enhanced transparency in cryptocurrency transactions.

Energy Efficiency: Comparing PoS Mechanisms

Have you ever compared the energy consumption of different household appliances? Similarly, comparing Proof-of-Stake (PoS) mechanisms is crucial to understanding their sustainability. PoS is significantly more energy-efficient than Proof-of-Work (PoW). According to CoinGecko’s 2025 data, PoS could reduce energy usage by up to 99%, making it an attractive option for environmentally conscious investors.

Local Insights: Vietnam’s Crypto Infrastructure

As Vietnam develops its crypto infrastructure, it resembles a growing market—like the bustling street vendors in Ho Chi Minh City. Each vendor represents a new crypto entity trying to offer something unique while adhering to local regulations. It’s vital for investors to stay informed and navigate this landscape with expert knowledge.

In summary, the Vietnam crypto sustainability reports are essential for understanding the country’s evolving stance on cryptocurrency regulation and sustainability. For deeper insights, feel free to download our comprehensive toolkit.

Click here to view our whitepaper on cross-chain security.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies such as MAS or SEC before acting on any information.

With tools like the Ledger Nano X, you can reduce private key leakage risk by up to 70%. Stay informed, adapt, and invest wisely!