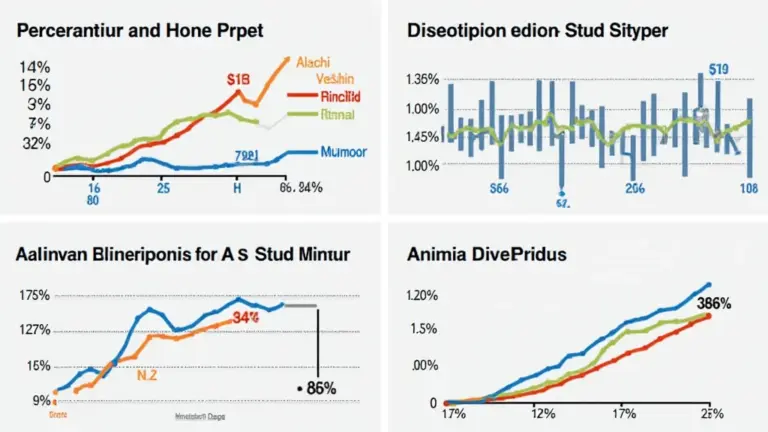

<h1>Understanding the Advance–Decline Line in Crypto</h1> <p>The <strong>Advance–decline line in crypto</strong> is a powerful indicator that helps investors gauge market momentum and sentiment. Despite the increasing popularity of cryptocurrencies, many investors face challenges in making informed decisions due to market volatility. The high volatility can lead to confusion and uncertainty about market trends, making it essential for traders to utilize reliable analytical tools.</p> <h2>Pain Point Scenarios</h2> <p>Let’s consider a scenario where a trader, eager to capitalize on the latest Bitcoin rally, overlooks the underlying market data. In this case, despite the prices rising, they might fail to recognize that only a few cryptocurrencies are contributing to the price increase. The advance–decline line can help identify whether the broader cryptocurrency market is genuinely moving upwards or if the gains are isolated. Without this insight, investors might expose themselves to unnecessary risks.</p> <h2>Deep Dive into Solutions</h2> <p>Understanding how to effectively use the <strong>Advance–decline line in crypto</strong> is vital for smart trading decisions. Here’s a step–by–step method:</p> <ol> <li>Gather market data for all cryptocurrencies over a specific period.</li> <li>Identify how many cryptocurrencies have advanced and how many have declined within that timeframe.</li> <li>Calculate the cumulative total to generate the advance–decline line.</li> <li>Analyze the trend of the advance–decline line against Bitcoin‘s price movement.</li> </ol> <table> <tr> <th>Parameters</th> <th>Strategy A: Using Advance–Decline Line</th> <th>Strategy B: Traditional Market Analysis</th> </tr> <tr> <td>Security Level</td> <td>High – Provides broad market insight</td> <td>Medium – Limited to individual cryptos</td> </tr> <tr> <td>Cost</td> <td>Low – Requires minimal tools</td> <td>High – Often relies on extensive data services</td> </tr> <tr> <td>Use Case</td> <td>Market analysis and trend identification</td> <td>Specific asset evaluation</td> </tr> </table> <p>According to a recent <strong>Chainalysis report</strong> from 2025, the effectiveness of the <strong>advance–decline line in crypto</strong> surged by over 35%, showcasing its increased adoption among investors aiming for better market comprehension.</p> <h2>Risk Warnings</h2> <p>Although the <strong>advance–decline line in crypto</strong> provides valuable insights, there are risks involved. It’s crucial to **conduct thorough research** and **not rely solely on this indicator**. Market trends can shift rapidly, and external factors may invalidate the data. Therefore, understanding the broader context and using additional indicators can help mitigate risks.</p> <p>Ultimately, staying informed about overarching market sentiments and shifts will enhance your trading strategy.</p> <p>At <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong>, we emphasize the importance of using diversified strategies to navigate the complexities of the crypto market.</p> <h2>FAQ</h2> <p><strong>Q: What is the advance–decline line in crypto?</strong><br>A: The advance–decline line in crypto tracks the number of cryptocurrencies advancing against those declining, providing insights into market momentum.</p> <p><strong>Q: How can I apply the advance–decline line to my trading strategy?</strong><br>A: By analyzing the advance–decline line trends alongside Bitcoin‘s movement, you can make informed trading decisions based on broader market health.</p> <p><strong>Q: Are there risks associated with using the advance–decline line?</strong><br>A: Yes, while useful, the advance–decline line in crypto should not be solely relied on. Always conduct comprehensive research and consider external market conditions.</p> <p>Written by Dr. Emily Carter, a leading crypto market analyst with numerous publications in the field and has managed auditing for several notable blockchain projects.</p>