2025 Cross-Chain Bridge Security Audit Guide

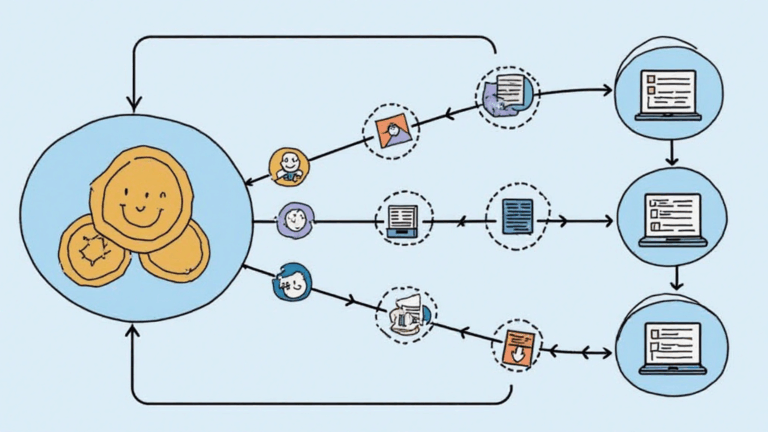

2025 Cross-Chain Bridge Security Audit Guide According to Chainalysis, a staggering 73% of cross-chain bridges globally have vulnerabilities. With challenges ranging from regulatory compliance to technical security, understanding how to navigate these pitfalls is crucial for crypto traders. That’s where HIBT’s guide to crypto regulatory compliance for traders comes into play. What are Cross-Chain Bridges?…