2025跨链桥安全审计指南

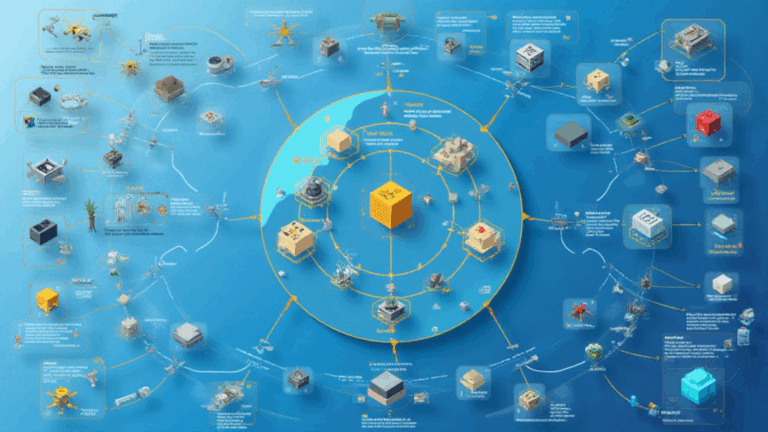

2025跨链桥安全审计指南 根据Chainalysis 2025数据,全球73%的跨链桥存在漏洞,这让投资者在进行数字资产交易时感到不安。在这样的背景下,了解HIBT’s crypto regulation FAQs显得尤为重要,帮助投资者识别风险并做出明智决策。 什么是跨链桥,为什么它们重要? 你可能遇到过这种情况:你在某个平台上拥有比特币,但想在另一个平台上使用它来进行DeFi交易。跨链桥就像货币兑换亭,帮助你在不同的区块链之间转移资产。了解其功能和潜在风险,才能在2025年迎接合规的未来。 2025年跨链桥安全性风险 根据CoinGecko的2025数据,大多数跨链桥的安全机制并不完善。想象一下,街边的汽车修理店如果没有足够的工具和认证,顾客自然不敢将车留给他们。这就是为什么投资者需要仔细审查每个跨链桥的安全性。在HIBT’s crypto regulation FAQs中,有关安全性检查的指引,可以帮助你做出选择。 零知识证明的应用如何提升安全性? 零知识证明就像是一位不愿意透露身份的证人,只提供必要的信息。通过这种方式,跨链桥可以在不泄露用户隐私的情况下,验证交易的合法性。2025年,我们期望看到更多跨链桥运用这种技术,提高整个系统的安全性。 如何进行跨链桥的安全审计? 进行跨链桥安全审计,就像给房屋做检修。需要定期检查房顶是否漏水、管道是否通畅。投资者可以查看HIBT’s crypto regulation FAQs,获取审计方法和最佳实践的信息,从而确保资产安全。当你决定进行审计时,使用像Ledger Nano X这样的设备可以降低70%私钥泄露的风险。 总结:在2025年,跨链桥的安全和合规性将成为数字货币交易的重要方面。了解HIBT’s crypto regulation FAQs,可以帮助你认清风险并保护资产。立即下载我们的工具包,获取更多实用信息! 风险声明:本文不构成投资建议,操作前请咨询当地监管机构(如MAS/SEC)。查看跨链安全白皮书以获得深入信息。