Exploring Bitcoin Vulnerability Disclosures in Vietnam

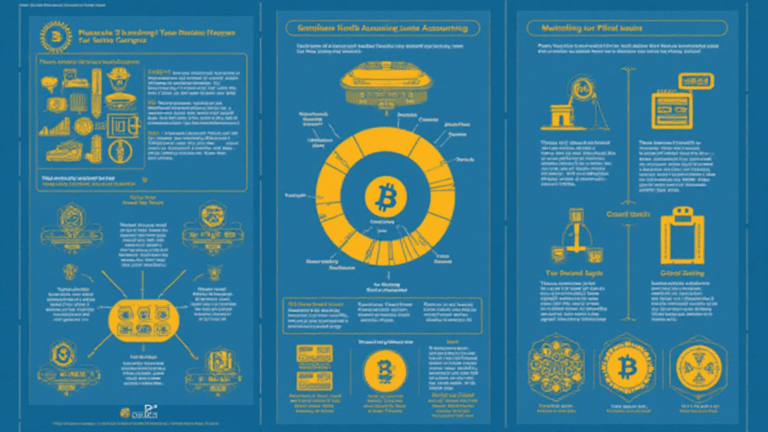

Understanding Bitcoin Vulnerabilities According to Chainalysis 2025 data, vulnerabilities in Bitcoin’s security can have serious implications for investors and users. Much like a crumbled wall in a livestock pen can let animals escape, vulnerabilities in cryptocurrency can lead to significant losses. Specific Challenges in Vietnam Vietnam’s crypto market is experiencing rapid growth, but it faces…