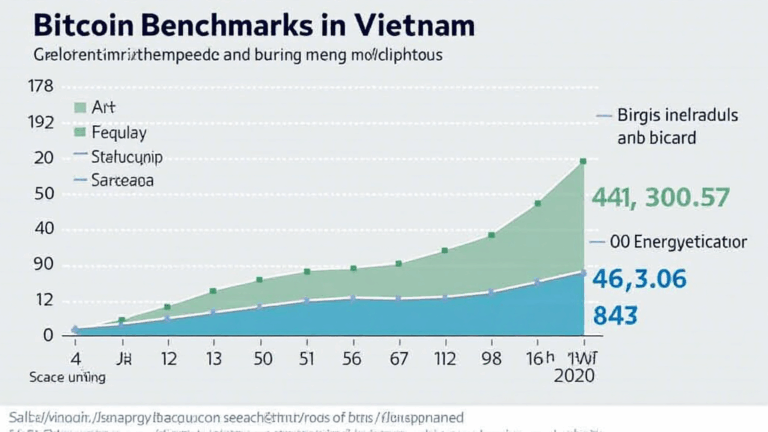

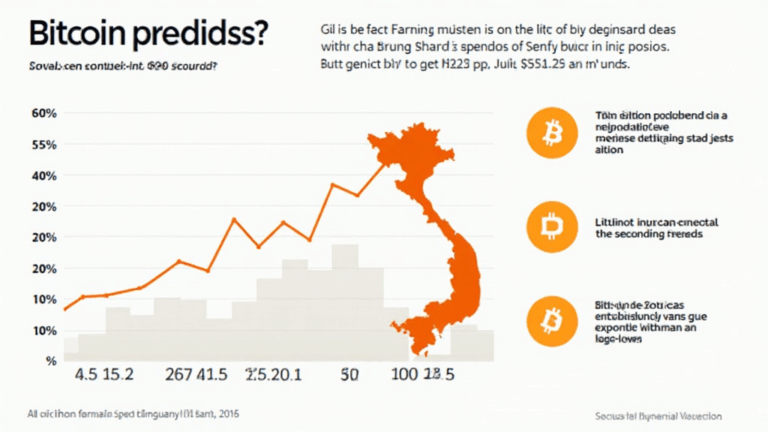

Bitcoin Community Impact in Vietnam: A 2025 Outlook

Understanding Bitcoin’s Growing Influence in Vietnam According to Chainalysis, Vietnam ranks high in cryptocurrency adoption, with over 20% of the population participating in trading and investment. As the Bitcoin community expands its reach, the social and economic implications are profound. For instance, think of it like a bustling market where everyone is trading goods and…