Understanding Bitcoin Consensus Algorithm Risks

Understanding Bitcoin Consensus Algorithm Risks

With over $4.1 billion lost to DeFi hacks in 2024 alone, the integrity of blockchain consensus algorithms has never been more crucial. This article delves into the risks associated with Bitcoin’s consensus mechanism, providing a comprehensive overview tailored for both seasoned investors and newcomers.

What is a Consensus Algorithm?

A consensus algorithm in blockchain technology is a protocol that considers a transaction valid, ensuring all nodes in the network agree on the current state of the ledger. Bitcoin utilizes the Proof of Work (PoW) consensus to secure its network, but what are the inherent risks?

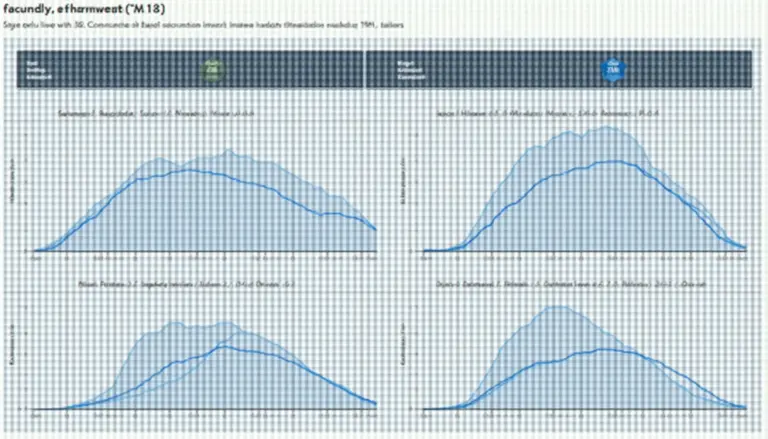

Consensus Mechanism Vulnerabilities

Bitcoin’s PoW might be secure, but it’s susceptible to specific vulnerabilities:

- 51% Attack: If a single entity controls over 50% of the network’s hashing power, it can manipulate the blockchain.

- Sybil Attacks: An attacker creates multiple pseudonymous identities to gain influence over the network.

- Forking Risks: Changes to the protocol can lead to forks, creating duplicate versions of the blockchain.

Similar to how a bank vault protects cash, these mechanisms aim to safeguard digital assets against malicious activities.

Energy Consumption and Centralization Concerns

Bitcoin mining processes consume vast amounts of energy, raising concerns about environmental impact. A significant portion of Bitcoin mining occurs in regions with cheap electricity, leading to geographic centralization.

According to recent data, approximately 65% of Bitcoin miners are located in just five countries. This concentration can increase risks regarding regulatory scrutiny.

Compliance Challenges in Vietnam

The Vietnam cryptocurrency market is experiencing a growth rate of over 58% annually, but with this growth comes the challenge of compliance with evolving regulations. Local users are often left in the dark about legal ramifications, which complicates their investment choices.

As the Vietnamese market continues to mature, understanding the risks associated with Bitcoin’s consensus algorithm becomes increasingly important. Knowledge is power, and being informed can help mitigate risks.

Mitigating Risks Associated with the Bitcoin Consensus Algorithm

To effectively navigate the risks associated with Bitcoin’s consensus algorithm, consider the following strategies:

- Hardware Wallets: Utilize secure hardware wallets, like the Ledger Nano X, which can reduce the risk of hacks by up to 70%.

- Stay Updated: Regularly monitor industry updates and emerging threats.

- Peer Reviews: Engage with community audits to enhance transparency.

These practices can enhance security and instill confidence in users navigating the cryptocurrency landscape.

Conclusion

Understanding the risks associated with Bitcoin’s consensus algorithm is essential not just for survival in the crypto space but also for making informed decisions. Keeping abreast of these risks and employing robust strategies will empower users in this ever-evolving environment.

For further insights, download our security checklist and ensure you’re prepared for any eventuality in the blockchain world.

Remember, while Bitcoin offers tremendous potential, it comes with its share of risks—as always, not financial advice. Consult local regulators for personalized guidance.

This article was authored by David Nguyen, a blockchain researcher with over 15 published papers in the field and a leading expert in security audits for prominent projects.