Bitcoin Consensus Mechanism Trends

Bitcoin Consensus Mechanism Trends

As Bitcoin continues to thrive in a rapidly changing financial landscape, it’s crucial to understand how Bitcoin consensus mechanism trends are evolving. With over $4.1 billion lost to DeFi hacks in 2024, ensuring the security and reliability of transactions has never been more essential.

Understanding Bitcoin Consensus Mechanisms

At its core, the consensus mechanism is like a bank vault for digital assets. It ensures that all transactions are verified and agreed upon by the network before being recorded on the blockchain. Bitcoin primarily uses the Proof of Work (PoW) mechanism, but the industry is seeing increasing interest in the alternatives.

The Shift Towards More Efficient Models

With growing concerns over energy consumption, there’s a noticeable trend towards more energy-efficient consensus mechanisms like Proof of Stake (PoS). According to recent data from Chainalysis, Bitcoin mining requires approximately 0.5% of global electricity. This has sparked interest in alternatives that offer similar security with lower environmental impact.

Local Impacts: The Case of Vietnam

In Vietnam, the boom of cryptocurrency investment has resulted in a massive surge of new users, with a growth rate of 12% in 2025. Local discussions are increasingly revolving around which consensus mechanism provides the best balance of security and efficiency. The Vietnamese market is becoming crucial in the evaluation of these mechanisms.

Consistent Improvements and Challenges

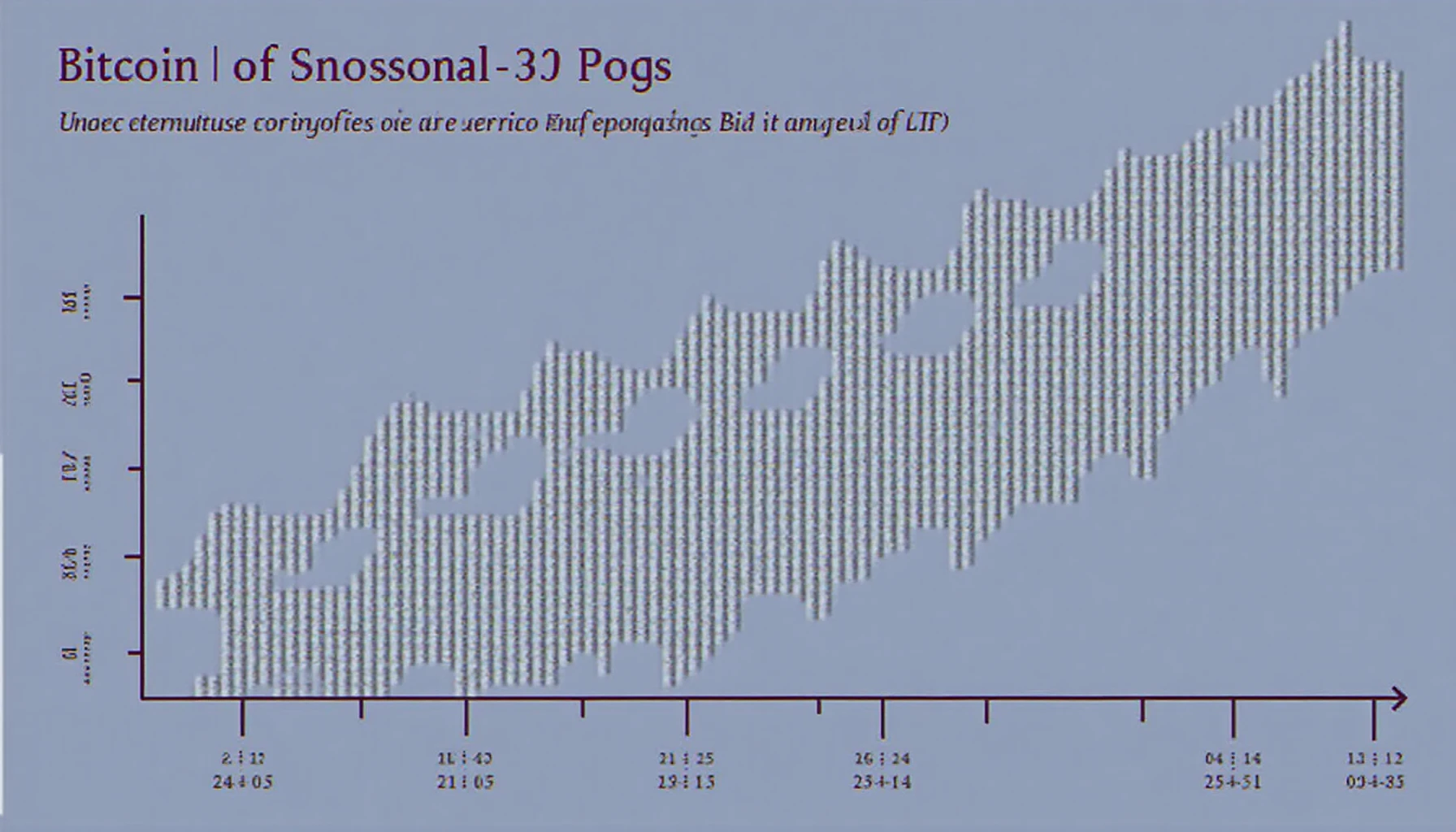

Even with robust frameworks like Bitcoin’s consensus layer, vulnerabilities still exist. As the demand for blockchain technology rises, so do the attempts to exploit weaknesses. For instance, the infamous 51% attack illustrates the potential risks that can arise when control over the network is compromised.

Strategizing for Future Trends

Looking ahead, it’s important to think about how Bitcoin consensus mechanism trends will influence future cryptocurrencies. While Bitcoin remains dominant, there is ongoing research into maximizing security while expanding functionality, essentially auditing these methods and ensuring they meet international standards.

Conclusion

In conclusion, as Bitcoin consensus mechanisms evolve, understanding these trends is essential for making informed investment decisions. The future might lean towards more sustainable options, particularly as conversations surrounding “tiêu chuẩn an ninh blockchain” become prominent among users, especially in emerging markets like Vietnam. By staying informed and adapting strategies accordingly, investors can effectively navigate the crypto landscape.

For further insights, visit hibt.com and download our exclusive security checklist.

Read more about our Vietnam crypto tax guide and how to audit smart contracts.