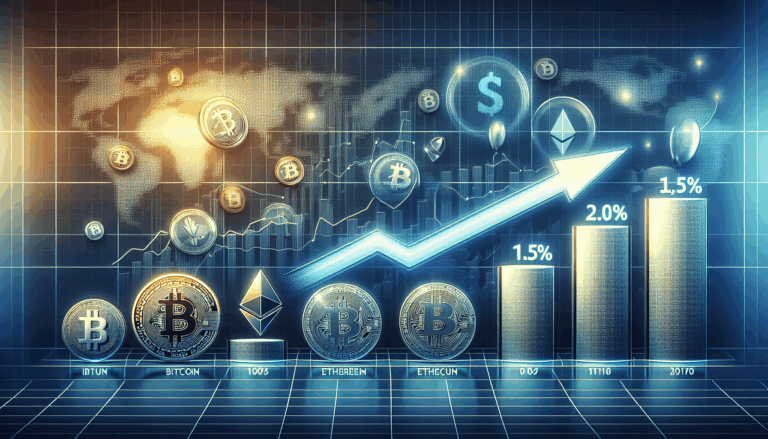

Bitcoin Crypto ETF Vietnam Applications: Trends and Insights

Unpacking Bitcoin Crypto ETFs in Vietnam

According to Chainalysis 2025 data, an astonishing percentage of Vietnamese investors are eager to explore Bitcoin crypto ETF applications. These financial products allow investors to tap into the booming cryptocurrency market without directly handling the assets themselves. Think of it like shopping at a store instead of the farmer’s market. When you purchase ETFs, you are essentially buying a basket of cryptocurrencies managed professionally, which is a lot less stressful than dealing with the volatility of individual coins.

Understanding the Regulatory Landscape

You might be wondering, what does Vietnam’s regulatory environment look like for these ETFs? The Vietnamese government is taking cautious steps. Regulatory measures are expected to evolve, aiming to address investor protection similar to how a traffic signal guides cars safely. Just as you wouldn’t cross the street without checking for cars, investors must ensure they are compliant with local regulations when diving into Bitcoin crypto ETFs.

Market Trends to Watch

Looking at trends, many are curious about how Bitcoin will perform as the ETF applications increase. With insights from CoinGecko’s 2025 data, it seems there’s a growing confidence among investors. An ETF could simplify access to Bitcoin, much like using your smartphone for online shopping – it’s accessible, straightforward, and often more convenient.

The Future of Bitcoin Crypto ETFs in Vietnam

The future appears bright for Bitcoin crypto ETF Vietnam applications. With advancements in technology and investor education, the market is poised to grow, much like how the internet transformed retail. Vietnamese investors can expect more products tailored to their needs, making the investment journey smoother and less daunting.

In summary, the introduction of Bitcoin crypto ETFs in Vietnam presents exciting opportunities for investors. However, as you consider investing, it’s crucial to stay informed and compliant. To guide you further, download our essential toolkit on navigating crypto investments safely and effectively.