The Future of Bitcoin and Cybersecurity: Navigating Risks and Solutions

The Future of Bitcoin and Cybersecurity: Navigating Risks and Solutions

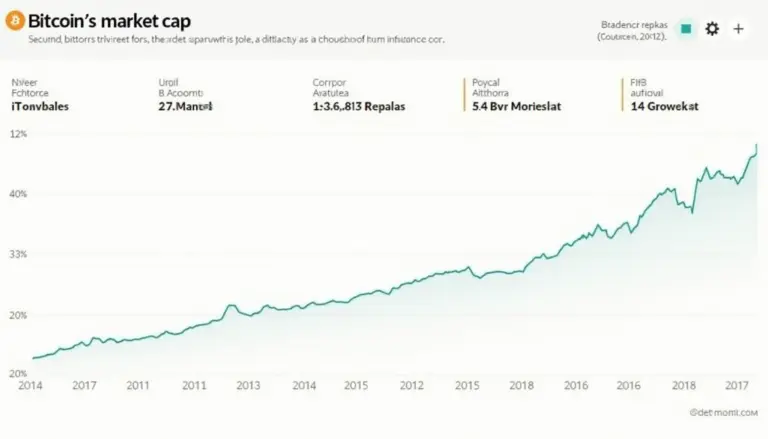

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges possess vulnerabilities, raising serious concerns about Bitcoin’s cybersecurity future. As cryptocurrency continues to evolve, understanding these risks is critical.

1. What are Cross-Chain Bridges and Their Vulnerabilities?

Think of a cross-chain bridge as a currency exchange kiosk in a busy market. You go there to swap your dollars for euros, but what if the kiosk has faulty processes? This is similar to how cross-chain bridges facilitate transactions between different blockchains, allowing assets to flow seamlessly. However, the security flaws in these bridges can lead to significant asset theft, making cybersecurity paramount for users and investors alike.

2. How Does Zero-Knowledge Proof Enhance Security?

Zero-knowledge proofs (ZKP) are like a friend vouching for you without revealing your secrets. In the crypto world, ZKPs allow transactions to be verified without disclosing transaction details. This could boost Bitcoin’s cybersecurity future by ensuring privacy while confirming authenticity, ultimately enhancing user trust in the technology.

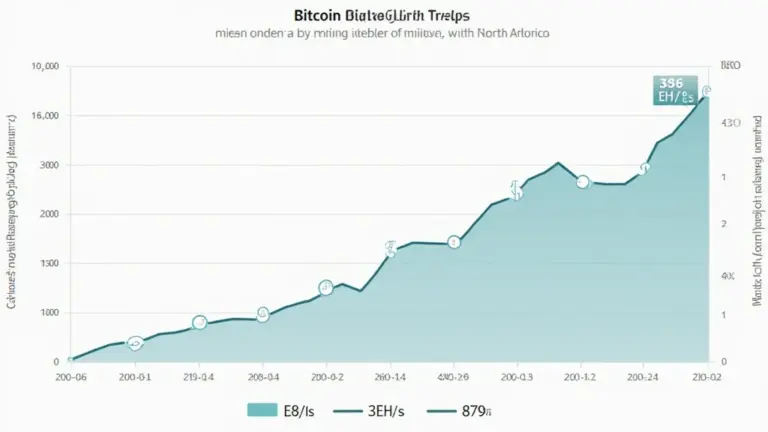

3. Energy Comparisons: PoS versus PoW Mechanisms

Imagine two households: one uses traditional cooking methods (PoW) while the other opts for energy-efficient appliances (PoS). Proof of work (PoW) traditionally consumes massive energy, while proof of stake (PoS) offers a greener alternative. The energy debate is crucial for the future of cryptocurrencies like Bitcoin and could influence regulations globally, including upcoming trends in DeFi regulation in places like Singapore by 2025.

4. The Role of Cybersecurity in Bitcoin’s Evolution

As Bitcoin evolves, cybersecurity must not lag behind. Regular software updates and security audits are akin to routine health check-ups for the technology’s integrity. Each upgrade mitigates risks and reinforces user confidence, solidifying Bitcoin’s place in financial systems.

In conclusion, while challenges in Bitcoin’s cybersecurity remain significant, solutions like zero-knowledge proofs and improved energy practices offer promising pathways. For more insights, don’t forget to download our comprehensive toolkit on cryptocurrency security.

Disclaimer: This article does not constitute investment advice—always consult your local regulatory body, such as MAS/SEC, before making investment decisions.

Enhance your security with the Ledger Nano X, which can reduce the risk of key exposure by up to 70%!