Understanding Bitcoin Difficulty Adjustment Models

Understanding Bitcoin Difficulty Adjustment Models

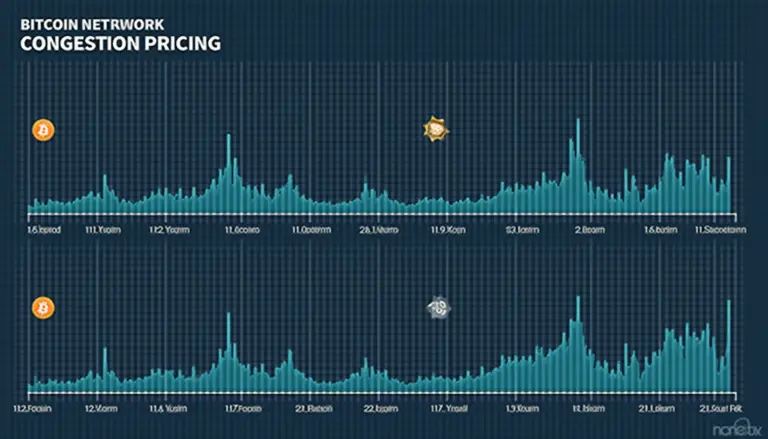

The Bitcoin network employs sophisticated difficult adjustment models to regulate the pace of new Bitcoin creation and ensure transaction integrity. As miners contribute computational power, fluctuations in Bitcoin’s mining difficulty can significantly impact profitability and mining efficiency. In this article, we will analyze various models, their implications, and how they can address common concerns for miners.

Pain Point Scenario

Imagine a scenario where a miner faces a sudden surge in competition, leading to higher difficulty levels. This scenario leads to increased operational costs while decreasing the mining rewards, directly impacting profitability. Miners often experience frustration as they see their investment shrink while adjusting to the new realities of the mining landscape. Understanding Bitcoin difficulty adjustment models can help mitigate these issues.

Solutions Deep Dive

To tackle the challenges associated with Bitcoin difficulty changes, miners can implement several strategies:

- Multiple Signature Verification – This method enhances security by requiring multiple private keys for Bitcoin transactions, ensuring that funds are safeguarded against theft.

- Mining Pool Participation – Joining a mining pool can distribute risk and increase the chance of earning consistent payouts, even in volatile difficulty environments.

- Efficiency Optimization – Miners should invest in energy-efficient hardware and adopt improved cooling techniques to lower operational costs.

Comparison Table: Solution A vs. Solution B

| Parameter | Solution A – Multiple Signature Verification | Solution B – Mining Pool Participation |

|---|---|---|

| Security | High | Moderate |

| Cost | High Initial Investment | Fees for Pool Services |

| Typical Application Scenario | High-value transactions | Home miners or artists |

According to a 2025 Chainalysis report, miners employing efficient strategies related to difficulty adjustment exhibit a potential increase in profitability by up to 30%. This data underscores how understanding Bitcoin difficulty adjustment models can lead to smarter financial decisions.

Risk Warning

Despite the various advantages, miners must remain aware of specific risks associated with difficulty adjustment models. Be cautious with high initial investments in mining hardware; market volatility can lead to losses. Always conduct thorough research before committing to any mining plan.

At bitcoinstair, we prioritize transparency and education in the cryptocurrency world. Understanding the complexity behind Bitcoin difficulty adjustment models is crucial for optimizing your mining operations.

In conclusion, grasping Bitcoin difficulty adjustment models is vital for any miner looking to remain competitive in the ever-evolving landscape of cryptocurrency mining. At bitcoinstair, we strive to equip miners with the knowledge needed to navigate these challenges effectively.

FAQ

Q: What are Bitcoin difficulty adjustment models?

A: Bitcoin difficulty adjustment models regulate the pace of new Bitcoin creation, impacting mining efficiency and profitability.

Q: How do these models affect miners?

A: Miners may face varying operational costs and rewards based on the difficulty levels, making an understanding of these models essential.

Q: Can strategies mitigate the impact of difficulty changes?

A: Yes, strategies like multiple signature verification and mining pools can help miners optimize their operations against difficulty fluctuations.