Bitcoin Dominance Index Tracking

Is Bitcoin Dominance Index Tracking Important?

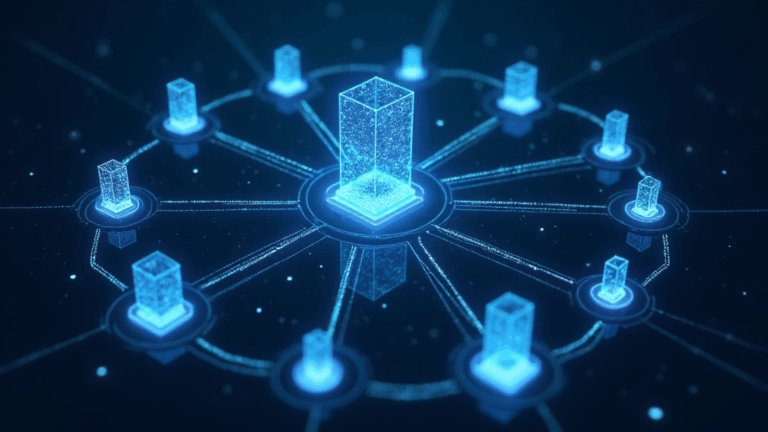

As of 2024, with Bitcoin accounting for over 45% of the total cryptocurrency market capitalization, understanding Bitcoin dominance index tracking is more crucial than ever. Why does it matter? This metric helps investors gauge Bitcoin’s performance against other cryptocurrencies and make informed decisions in a volatile market. Just like a compass guides a lost traveler, the dominance index can steer your investment strategy towards stability.

What is Bitcoin Dominance?

Bitcoin dominance refers to Bitcoin’s market share compared to the total market capitalization of all cryptocurrencies. It is an indicator of Bitcoin’s relative strength and market influence. A rising dominance suggests investor confidence in Bitcoin, while a declining index may indicate interest shifting to altcoins. Users in Vietnam have seen a 30% increase in Bitcoin holdings, reflecting a growing trust in this leading cryptocurrency. Tiêu chuẩn an ninh blockchain plays a pivotal role in this growth, ensuring confidence in securing digital assets.

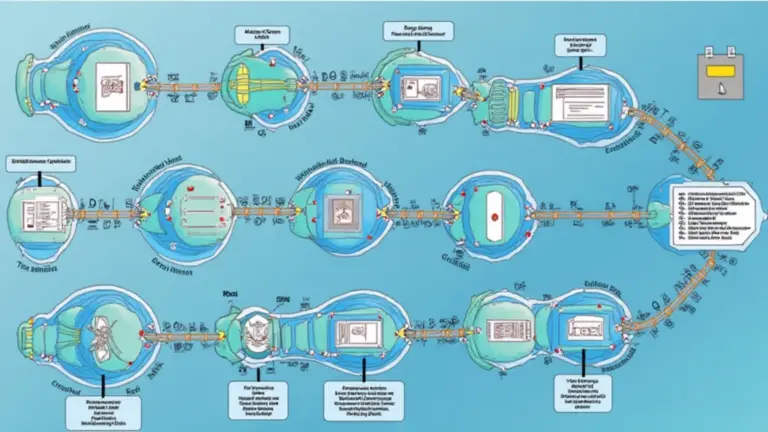

How to Track Bitcoin Dominance Effectively?

Tracking Bitcoin dominance involves monitoring various data points. Here are some practical approaches to do this:

- Use reliable cryptocurrency data platforms like CoinMarketCap or CoinGecko.

- Follow trends over time, noting correlation with major market events.

- Examine sentiment indicators alongside dominance trends for a holistic view.

The Role of Bitcoin Dominance in Crypto Portfolio Management

When managing your investment portfolio, Bitcoin dominance tracking can influence asset allocation decisions. For instance, a rising dominance may prompt investors to favor Bitcoin over altcoins, due to perceived security and stability. Think of it as a floodgate: when Bitcoin dominance rises, it can safeguard your investment from the unpredictable tides of the altcoin market.

Future Trends in Bitcoin Dominance

As we look towards 2025, the dynamics of Bitcoin dominance may shift due to technological advancements and regulatory changes. Some analysts predict that up-and-coming altcoins may challenge Bitcoin’s supremacy, while others believe Bitcoin will continue to hold strong.

According to recent reports, the Vietnam crypto market has seen a radical surge in user participation, with a 50% increase in investors over the last year.

Conclusion

In conclusion, Bitcoin dominance index tracking is vital for understanding market trends and making informed decisions. As a tool, it equips investors in Vietnam and globally to navigate the complexities of the cryptocurrency landscape effectively. Remember, while altcoins provide exciting opportunities like 2025’s promising altcoins, Bitcoin remains a stronghold for many. Stay informed and adapt your strategies accordingly!

For more insights and updates, visit bitcoinstair.com”>bitcoinstair.