Bitcoin ETF Capital Flows: The Future of Investments

Introduction

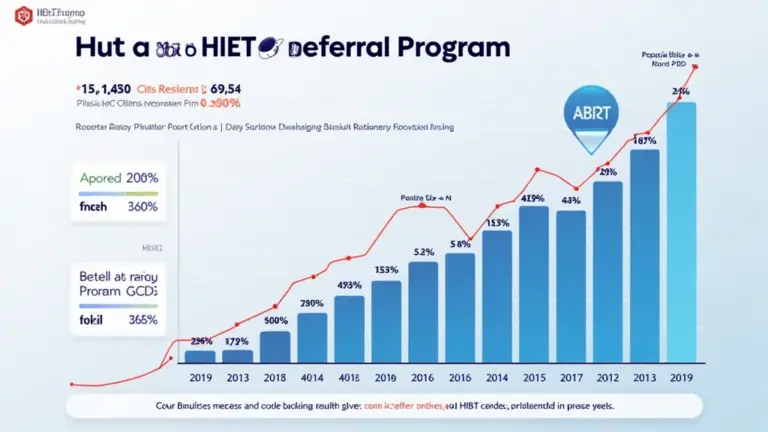

As the cryptocurrency sector captures the attention of mainstream investors, recent data shows that Bitcoin ETFs alone accounted for over $8 billion in capital flows last year, signaling a fundamental shift in investment strategies. In 2025, these trends are expected to intensify as more regulatory frameworks emerge. This article aims to provide valuable insights into Bitcoin ETF capital flows, especially for investors looking to navigate this new landscape in platforms like HIBT.

The Role of Bitcoin ETFs in Investment

Bitcoin ETFs function like traditional investment funds but allow investors to gain exposure to Bitcoin without the need to hold the underlying asset. In many ways, they are “like a bank vault for digital assets,” ensuring security and ease of access. This increasing interest is evident in Vietnam, where user growth in cryptocurrency investment reached 56% in 2023.

Understanding Capital Flow Dynamics

- Increased Institutional Participation: With institutional players entering the sphere, Bitcoin ETF capital inflows have received a significant boost.

- Market Sentiment: Positive regulatory news can influence capital flows dramatically, often seen before major announcements.

- Investor Education: Many cryptocurrencies lack basic understanding, which Bitcoin ETFs help simplify.

Challenges and Considerations

While Bitcoin ETFs offer numerous advantages, potential investors should consider the following:

- Regulatory Risks: Compliance structures vary, and it’s crucial to stay updated with local regulations.

- Market Volatility: Bitcoin remains highly volatile, and capital flows can change rapidly.

Future Trends in Bitcoin Capital Flows

Looking towards the latter half of 2025, we can expect to see:

- Innovative Crypto Products: Products tailored for the Asian market could emerge, further increasing Bitcoin ETF capital flows.

- Enhanced Security Measures: Platforms will need to adopt stringent “tiêu chuẩn an ninh blockchain” to gain investor trust.

- Broader Adoption: With more educational resources available, we anticipate a more extensive investor base willing to engage.

Conclusion

In summary, understanding Bitcoin ETF capital flows in 2025 will be crucial for both new and seasoned investors. By staying informed and utilizing platforms like HIBT, investors can navigate this evolving landscape efficiently. Remember, this is not financial advice. Always consult local regulators when making investment decisions.