Understanding Bitcoin ETF Creation/Redemption Flows

Introduction

In 2024, the cryptocurrency landscape witnessed a surge of interest, with Bitcoin ETFs becoming a hot topic. With over 200 million globally embracing cryptocurrency, the creation and redemption flows of Bitcoin ETFs play a crucial role in this market’s liquidity and accessibility.

What are Bitcoin ETFs?

Bitcoin Exchange-Traded Funds (ETFs) are investment funds that track the price of Bitcoin and are traded on traditional stock exchanges. They allow investors to gain exposure to Bitcoin without the need for a digital wallet, bridging the gap between traditional finance and the crypto world.

Creating and Redeeming Bitcoin ETFs

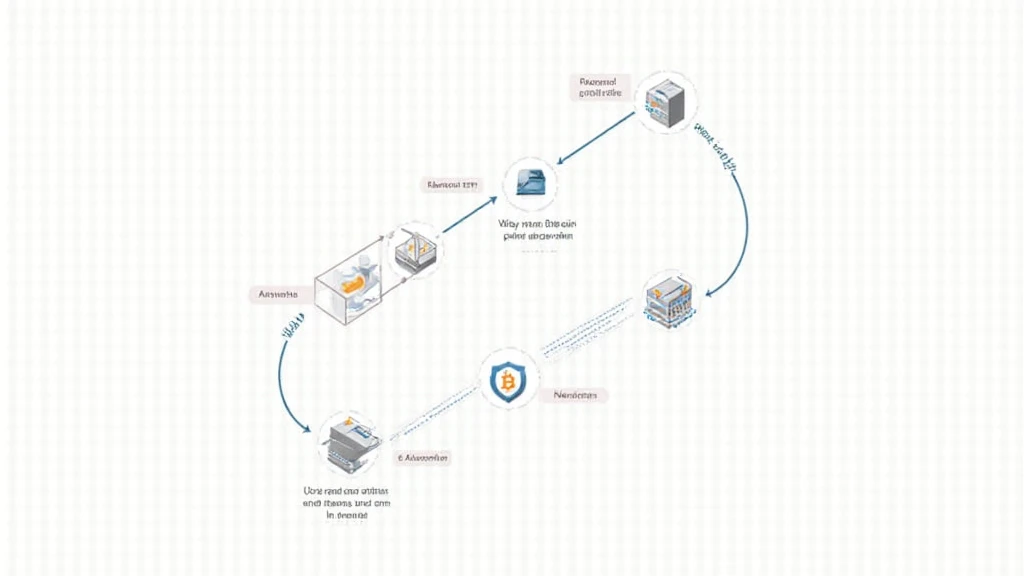

The creation and redemption process of Bitcoin ETFs is likened to a two-way street. Here’s how it works:

- Creation: Authorized participants (APs) buy Bitcoin and deliver it to the ETF provider in exchange for ETF shares.

- Redemption: APs return ETF shares to the fund and receive Bitcoin in return.

This mechanism helps maintain the ETF’s price close to the actual Bitcoin price, minimizing discrepancies.

Impact on Market Liquidity

Understanding the Bitcoin ETF creation/redemption flows reveals their impact on market liquidity. When inflows surge, Bitcoin’s price may benefit as demand increases. Conversely, significant redemptions can lead to downward pressure on prices. For example, in the past year, fluctuations in ETF holdings correlated closely with Bitcoin’s market cap, emphasizing their role in price stability.

Vietnam’s Growing Market

In Vietnam, highlighting this trend is crucial. The country’s crypto adoption rate has increased by 40% in 2024, with many investors looking towards Bitcoin ETFs as a means to diversify their portfolios. Utilizing ETFs could introduce new retail investors into the market, ultimately strengthening the liquidity and stability of the Vietnamese crypto scene.

Conclusion

Bitcoin ETF creation/redemption flows are essential for understanding overall market dynamics. They offer a simplified way for new investors to gain exposure to Bitcoin while also influencing price stability. As Vietnam continues to grow as a key player in the crypto space, the reliance on Bitcoin ETFs might reshape the local market landscape, fostering greater participation.

For more insights on cryptocurrency and ETF dynamics, visit hibt.com.