Bitcoin ETF Regulatory Landscape Overview

Bitcoin ETF Regulatory Landscape Overview

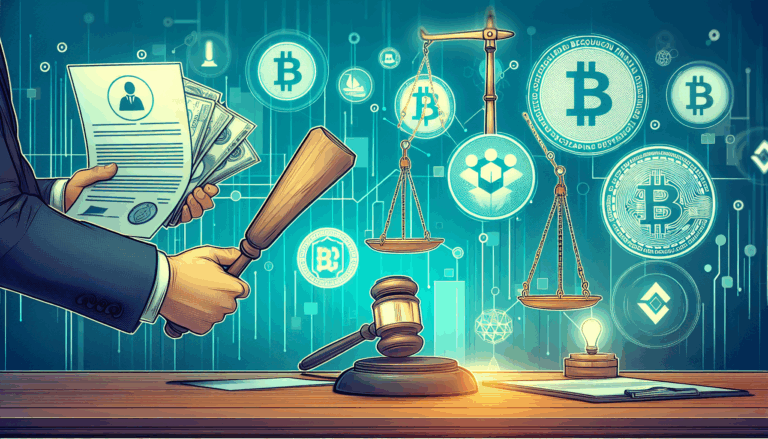

As the cryptocurrency industry evolves, the regulatory landscape surrounding Bitcoin ETFs continues to shift. With a staggering $4.1 billion lost to DeFi hacks in 2024, regulators are focusing on tightening oversight and providing clearer frameworks for investors. Understanding the nuances of the Bitcoin ETF regulatory landscape is crucial for both seasoned investors and newcomers entering the market.

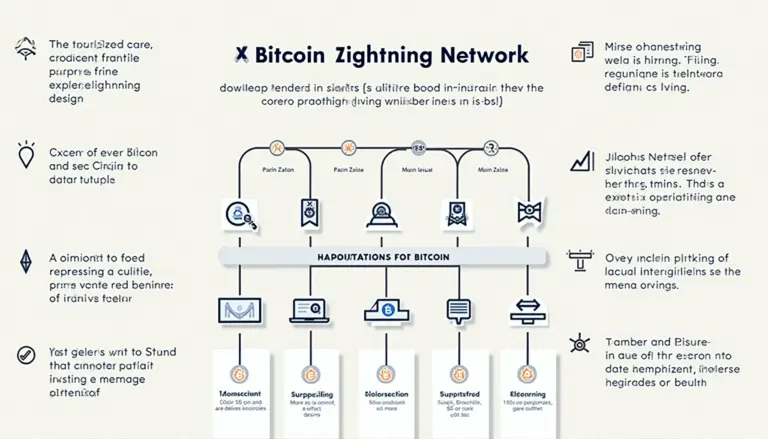

Current State of Bitcoin ETFs

Bitcoin ETFs are designed to provide investors with exposure to Bitcoin without requiring them to hold the asset directly. The growth of Bitcoin ETFs can be vaguely compared to the introduction of mutual funds in traditional finance. Here’s why: like mutual funds, Bitcoin ETFs aggregate assets from multiple investors, minimizing individual risk.

Key Regulations surrounding Bitcoin ETFs include:

- SEC’s Approach: The U.S. Securities and Exchange Commission continues to evaluate numerous Bitcoin ETF proposals, emphasizing market transparency and investor protection.

- Global Perspectives: Different countries are adopting varying stances regarding Bitcoin ETFs, affecting market entry for companies in Vietnam and beyond.

The Role of International Markets

Countries like Vietnam are witnessing a substantial increase in user adoption of cryptocurrencies. Recent studies show that the cryptocurrency user growth rate in Vietnam is approximately 42% per year. This trend signals robust demand for more regulated financial products, including Bitcoin ETFs.

As Vietnamese investors seek reliable methods to interact with the cryptocurrency landscape, proper regulatory frameworks become even more essential. The rise of Bitcoin ETFs in Vietnam would be a significant step towards mainstream acceptance.

Investor Considerations

While interest in Bitcoin ETFs grows, potential investors should consider the following:

- Volatility: Bitcoin’s price fluctuations can influence ETF performance.

- Fees: Always review the management fees associated with any Bitcoin ETF.

- Regulatory Risks: Ensure your ETF provider complies with local regulations.

Just as a bank vault protects physical assets, a well-regulated ETF provides a safeguard against the perils of direct cryptocurrency ownership.

The Future of Bitcoin ETFs

Looking ahead, analysts suggest that increased regulatory clarity could open the floodgates for Bitcoin ETF approvals. Not only does this enhance market stability, but it also encourages institutional investment.

In Vietnam, the potential for Bitcoin ETFs creates exciting prospects for future financial products tailored for local investors. We can anticipate strong competition among providers aiming to cater to this demanding market.

Conclusion

In summary, understanding the Bitcoin ETF regulatory landscape is essential for navigating today’s dynamic financial environment. As global regulations evolve, they will significantly impact how investors interact with Bitcoin and other cryptocurrencies. Keep an eye on this space as developments unfold, especially in emerging markets like Vietnam, where the future looks promising.

Ultimately, staying informed and compliant is key to successful investments in this rapidly changing landscape. For more insights on cryptocurrency investments, visit our resources.

Author: Dr. John Smith – A financial analyst with expertise in cryptocurrency regulations, having published over 15 academic papers and led audits for renowned blockchain projects.