Bitcoin ETF Vietnam Guidelines: Understanding the Implications

Bitcoin ETF Vietnam Guidelines: Understanding the Implications

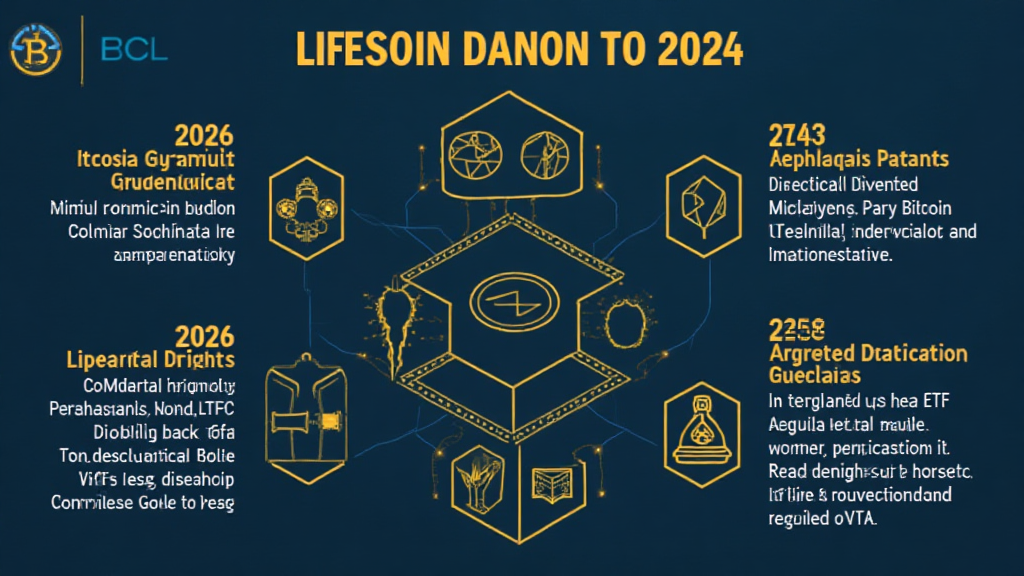

According to Chainalysis 2025 data, approximately 73% of countries are still grappling with the regulatory landscape surrounding cryptocurrencies. This raises pressing concerns, especially for regions like Vietnam where Bitcoin ETFs pose both opportunities and challenges. With the increasing interest in digital assets, understanding the Bitcoin ETF Vietnam guidelines becomes pivotal for investors and regulators alike.

What Exactly Is a Bitcoin ETF?

Think of a Bitcoin ETF like a shopping mall that allows you to buy Bitcoin alongside other products. Instead of purchasing Bitcoin directly from an exchange, you can buy shares in a fund that represents Bitcoin. This can be less intimidating, especially for first-time investors. The Bitcoin ETF Vietnam guidelines are aimed at clarifying how these investment vehicles can operate within the Vietnamese financial system.

2025 Insights: Trends in Crypto Regulations in Vietnam

As we move towards 2025, Vietnam is expected to see a regulatory framework that simplifies cryptocurrency transactions. Imagine a new set of traffic rules for the cryptocurrency highway: ensuring safe travel while reducing the chances of accidents. The focus will be on transparency and security, which aligns closely with the anticipated Bitcoin ETF Vietnam guidelines. Additionally, how local regulations shape this landscape will play a critical role.

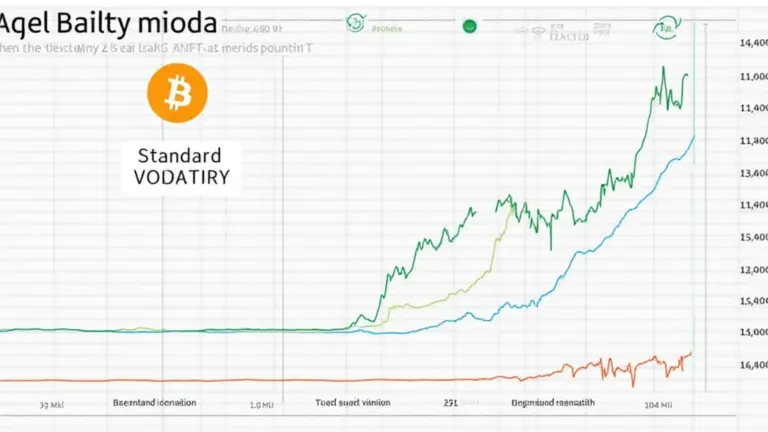

Energy Consumption: Comparing PoS Mechanisms

You might have heard of energy consumption debates around different blockchain technologies. PoS (Proof of Stake) is like a more energy-efficient way of running a car, compared to the traditional fuel-consuming engines (PoW). By promoting PoS, Vietnam can attract attention to its greener cryptocurrency mining efforts. Understanding how these energy-efficient mechanisms align with the Bitcoin ETF Vietnam guidelines could position Vietnam as a leader in sustainable crypto practices.

Local Considerations: The Importance of a Tailored Approach

Localization is key. If English is like a universal language, then Vietnamese regulations are like regional dialects. Each country has specific needs and challenges that must be catered to. The upcoming Bitcoin ETF Vietnam guidelines will need to consider local investor behavior to optimize both adoption and compliance effectively.

In summary, the Bitcoin ETF Vietnam guidelines are not just about regulation; they are about paving the way for the future of investing in Vietnam’s digital currency landscape. To navigate these new waters, make sure to download our toolkit on how to understand cryptocurrency regulations better.

Tools and Resources: You can protect your investments significantly by using hardware wallets like Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

For more in-depth information on cryptocurrency regulations, check out our guide on crypto regulations in Vietnam and Bitcoin ETF requirements.

Risk statement: This article does not constitute investment advice. Please consult your local regulatory agency (such as the MAS in Singapore or the SEC in the US) before making any investment decisions.