Understanding Bitcoin Exchange Uptime in Vietnam

Understanding Bitcoin Exchange Uptime in Vietnam

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency exchanges globally experience significant downtime. For traders in Vietnam, where the Bitcoin market is booming, this issue calls for urgent attention to ensure efficient trading activities.

What is Bitcoin Exchange Uptime?

To put it simply, Bitcoin exchange uptime refers to the period during which a cryptocurrency exchange is operational and able to facilitate trades. Imagine a local market that opens and closes at certain hours. If the market is shut when you want to buy or sell, you’ll miss your opportunities. In Vietnam, where enthusiasts are active, the reliability of a Bitcoin exchange directly affects their trading results.

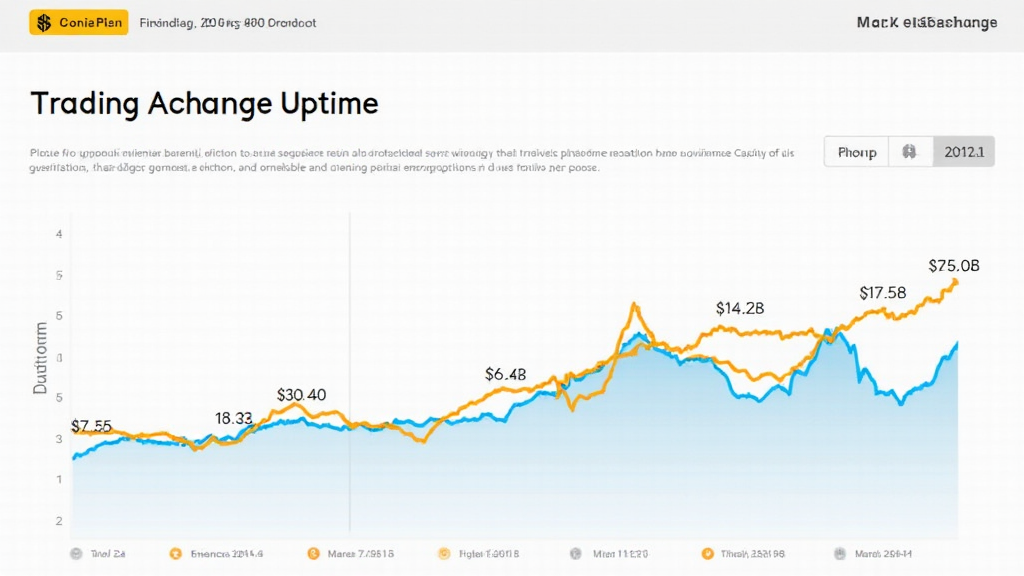

Why is Uptime Important for Vietnamese Traders?

Consider the situation where a Vietnamese trader wants to capitalize on a price dip. If their chosen exchange is down, they can’t make the trades necessary to seize the moment. This is similar to having a fruit shop that runs out of stocks; customers go elsewhere. According to CoinGecko, exchanges with over 99% uptime have a significant advantage, especially in a volatile market like Bitcoin.

How to Choose a Reliable Bitcoin Exchange in Vietnam?

When selecting an exchange, Vietnam traders should check for uptime statistics. Opt for exchanges that operate like a well-organized 24-hour food market, always ready for customers. Resources like user reviews and uptime tracking websites can offer insights into the reliability of these platforms. Ensure that the exchange is compliant with local regulations to avoid potential scams.

The Role of Technology in Improving Uptime

Modern technology is akin to upgrading the infrastructure of a busy market. Just like better roads reduce traffic, blockchain innovations can enhance exchange uptime. Implementing features such as multi-layered servers and failover systems can significantly reduce instances of downtime. Vietnamese crypto exchanges are beginning to take note of these technological advances, leading to improved service quality.

In conclusion, understanding Bitcoin exchange uptime in Vietnam is crucial for efficient trading. Keep an eye on the uptime stats before you start trading to maximize your profitability. Download our comprehensive toolkit for further guidance on selecting the right crypto exchange for your needs.

Check out our white paper on exchange security and enhance your trading strategy today.

**Disclaimer:** This article is not investment advice. Always consult with local regulatory bodies like MAS or SEC before making any trades. Use a secure wallet like Ledger Nano X to reduce private key leakage risks by up to 70%.