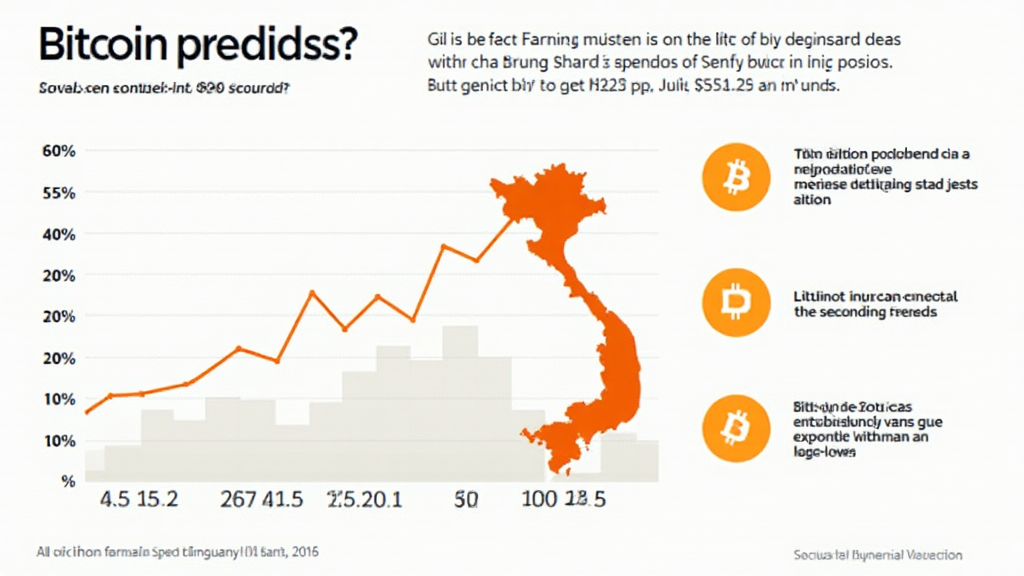

Bitcoin Expense Ratio Vietnam Analysis: Understanding Its Impact

Introduction

According to Chainalysis 2025 data, Vietnam ranks among the highest in cryptocurrency adoption, making it essential to understand the Bitcoin expense ratio Vietnam analysis. With over 73% of Vietnamese investors facing challenges related to expense visibility, grasping the implications of this metric is crucial.

What is Bitcoin Expense Ratio?

Let’s break it down simply: think of the Bitcoin expense ratio as the management fee you might pay when you invest in a mutual fund. It reflects how much it costs you to maintain your Bitcoin investment over time. A lower ratio means you’re paying less for ownership, allowing you to keep more of your profits.

Why is it Important for Vietnamese Investors?

For those in Vietnam, the Bitcoin expense ratio can significantly influence your net gains. Imagine going to a market to shop. If you notice every stall charges different fees for goods, you’d want to choose the stall that offers the best value for your money. Similarly, understanding this ratio helps you maximize your returns in the rapidly growing Vietnamese crypto landscape.

Common Issues and Misconceptions

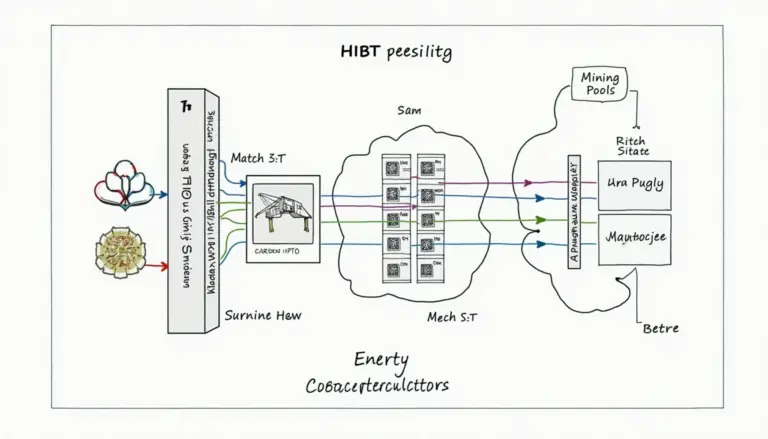

You might think that all cryptocurrencies carry the same expenses, but that’s not the case. While Bitcoin may be popular, its expense ratio can vary widely across exchanges and wallets. It’s like comparing apples to oranges—each has its price tag. Knowing these differences will help you choose the right platform for trading.

Understanding Local Regulations

In Vietnam, the legal framework surrounding cryptocurrencies is evolving. Staying updated with local regulations helps in avoiding pitfalls. As cryptocurrencies become more integrated into public life, understanding the implications of the Bitcoin expense ratio can aid in compliant trading, much like knowing the local tax laws before opening a business.

Conclusion

In summary, analyzing the Bitcoin expense ratio Vietnam analysis is an essential step for investors looking to optimize their cryptocurrency investments. Ready to dive deeper? Download our comprehensive toolkit to gain insights into managing your Bitcoin expenses effectively.